Inside this issue

2021 FSAC Announcement ......... 1

Payment and Print Soluons Division

(PPSD) News............................... 2

Economic Impact Payments ........ 2

ITS.gov News ............................... 4

ASAP.gov News ........................... 4

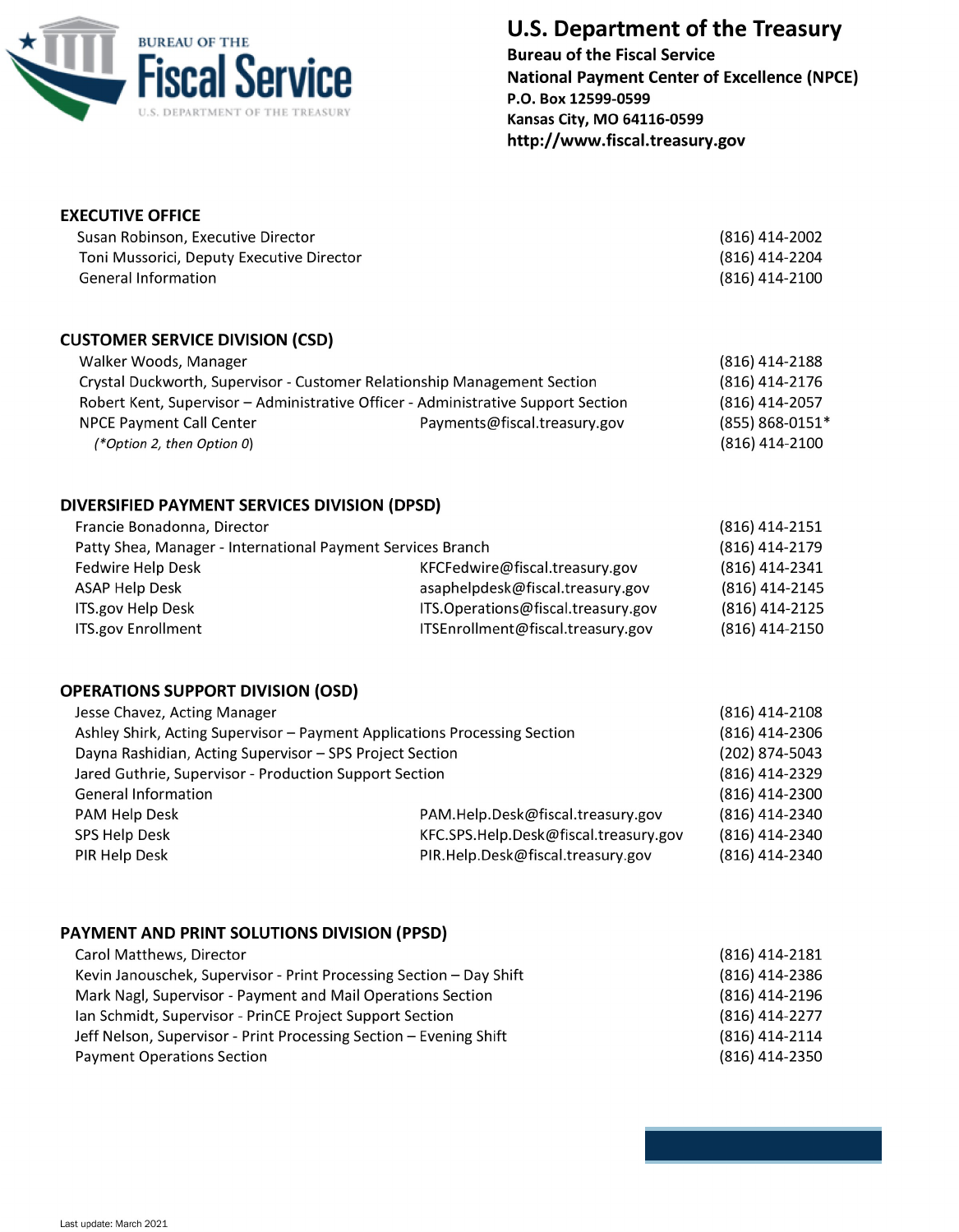

NPCE Contacts ............................ 5

Special points of interest

FSAC News

Historic Payment Processing

News on ITS.gov & ASAP.gov

Contacts

New Names, Same Great Service!

Bureau of the Fiscal Service has renamed its Financial Centers. The Kansas

City Financial Center (KFC) name has changed to the National Payment

Center of Excellence (NPCE), and the Philadelphia Financial Center (PFC)

name has changed to the National Payment Integrity and Resolution Center

(NPIRC). These changes are the result of an internal reorganization and will

have no impact on the service you receive.

2021 Fiscal Service Advisory Council (FSAC)

Payments Forum

Date: June 22-24, 2021

Locaon: Teams Live Event

This year, for the first time, Fiscal Service will host the Fiscal Service Advisory

Council (FSAC) Payments Forum as a virtual, online event. The FSAC is a great

opportunity for agencies to hear about new and updated federal

government payment products, services, and initiatives. We hope you will be

able to join us to learn more about the future of payments.

Participation is open to all Federal Agencies. Multiple representatives from

each Federal Program Agency are welcome to attend. However, voting on

Council initiatives will be limited to one vote for each agency processing site.

Stay tuned for registraon details.

For more informaon about FSAC, visit the event page:

hps://scal.treasury.gov/events/fsac_forum.html

Spring Edion | April 2021

National Payment Center of

Excellence Dispatch

Keeping Customers Connected and Informed!

The Payment and Print Solutions Division (PPSD) – formerly the Payment and

Mail Operations Branch (PMOB) – is the group within the National Payment

Center of Excellence (NPCE) that supports all payment and print operations.

PPSD assists Federal Agencies both with processing payments – on time, every

time! – as well as providing custom print solutions.

2020 was a historic and busy year for PPSD. With many employees and

customers working remotely, providing print solutions proved particularly

challenging. PPSD has worked hard throughout the pandemic to continue to

deliver the seamless services our customers expect, and we are committed to

continuing to meet all of your payment and print solution needs. We look

forward to continuing this work with you in 2021.

To get more information or assistance with payment questions, payment

processing timelines, or printing capabilities for letters or documents, please

contact one of our payment analysts at

KFC.Control.Paym[email protected]ov or 816-414-2350. For assistance

with special mail handling requests, please email the team at

addresses to reflect our new name so be on the lookout for that new

information.

Payment and Print Soluons Division (PPSD) News

2

Historic Payments Processed for the Economic Impact Payments (EIP)

If you have General Payment

related quesons, please send an

email to:

Payments@scal.treasury.gov

Round One of the COVID Smulus Payments in 2020

The Coronavirus Aid, Relief, and Economic Security Act, or the CARES Act, has been the government's largest

intervention in the U.S. economy since the Great Depression. The two trillion-dollar response to the COVID-19 pandemic

provided financial relief to individuals, businesses, and state & local governments. The Fiscal Service was critical to the

implementation of four of the major relief programs established by the CARES Act.

In April 2020, more than 23 million Americans filed for unemployment benefits. The CARES Act provided $300 billion for

payments to individuals, including $1200 for each eligible recipient and $500 payments for each dependent child.

Working with the Internal Revenue Service (IRS), the Fiscal Service's Kansas City and Philadelphia Financial Centers

issued 81 million payments within three weeks of the passage of the CARES Act – disbursing direct deposit and check

payments to Americans in need. By June 3, 2020, the Fiscal Service had disbursed $267 billion to 159 million Americans,

delivering 75% of the payments electronically.

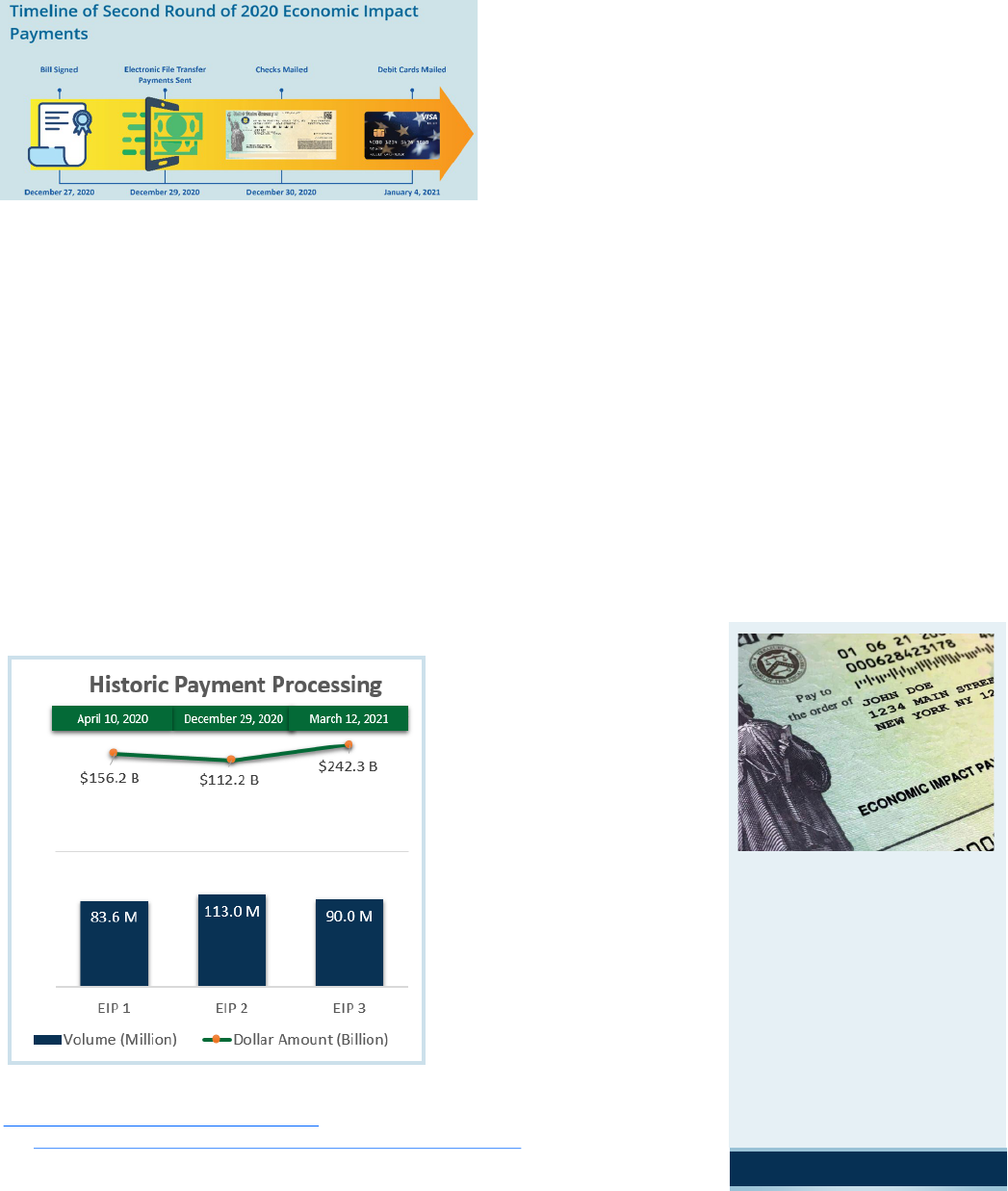

Round Two of the COVID Smulus Payments in 2020

On December 29, 2020, only two days after the Coronavirus Response and Relief Supplemental Appropriations Act

was signed into law, Fiscal Service disbursed more than 113 million electronic Economic Impact Payments (EIP) in

only seven hours! This coordinated response required tremendous teamwork between the IRS, Fiscal Service, and

Federal Reserve Bank (FRB). The EFT payments – valued at over $112 billion – were delivered to financial institutions

by 11:00 a.m. Eastern time on December 30, to give

Americans access to the money they needed!

On December 30, 2020, Fiscal Service began issuing

checks and distributing Direct Express payments and

cards. The Payment and Mail Operations Branches in

Kansas City and Philadelphia began printing and mailing

nearly 26 million checks totaling $22.7 billion.

Additionally, more than two million payments were

made to existing Direct Express card recipients – totaling $1.25 billion – and on January 4, 2021, eight million new

EIP Cards valued at $7.1 billion were sent to eligible recipients.

The lessons learned in round one allowed Fiscal Service, IRS, and FRB to be ready for the more recent rounds of

stimulus payments. The preparation and testing – including the development of streamlined workflow tools by Fiscal

Service’s Information and Security Services (ISS) – allowed subsequent stimulus programs to be processed even

faster. During round one Fiscal Service processed 163 million payments within two months with 84 million of those

payments delivered as EFTs within two weeks. With round two, the National Payment Center of Excellence (NPCE)

set a single day processing record processing 113 million transactions in one day!

Round Three of the COVID Smulus Payments in 2021

Continuing the success of rounds one and two, on Friday, March 12, 2021 – less than 24 hours after the American

Rescue Plan of 2021 was signed into law – Fiscal Service disbursed more than 90 million electronic economic impact

stimulus payments totaling $242.3 billion dollars.

We want to extend a

special thanks to the IRS

for partnering with

Bureau of the Fiscal

Service to deliver this

much needed relief

quickly and seamlessly to

the American people!

For more information on the

Economic Impact Stimulus work, please see:

https://fmvision.fiscal.treasury.gov/cares-act.html

and https://fmvision.fiscal.treasury.gov/round-two-covid-stimulus-payments.html

3

Fun Fact:

Only 10 Financial

Instuons

disbursed more than

113M ACH Credits

for the enre year in

2019

International Treasury Services (ITS.gov) is the Bureau of the Fiscal Service payment system that gives Federal

Agencies the ability to issue payments to more than 200 countries world-wide. ITS.gov provides many payment and

delivery options, including: payments in any of 140 different foreign currencies (FX) – including supporting electronic

U.S. dollar payments, one-time or recurring payment capabilities, and the ability to send benefit, payroll, and vendor

payments directly to recipients outside the United States.

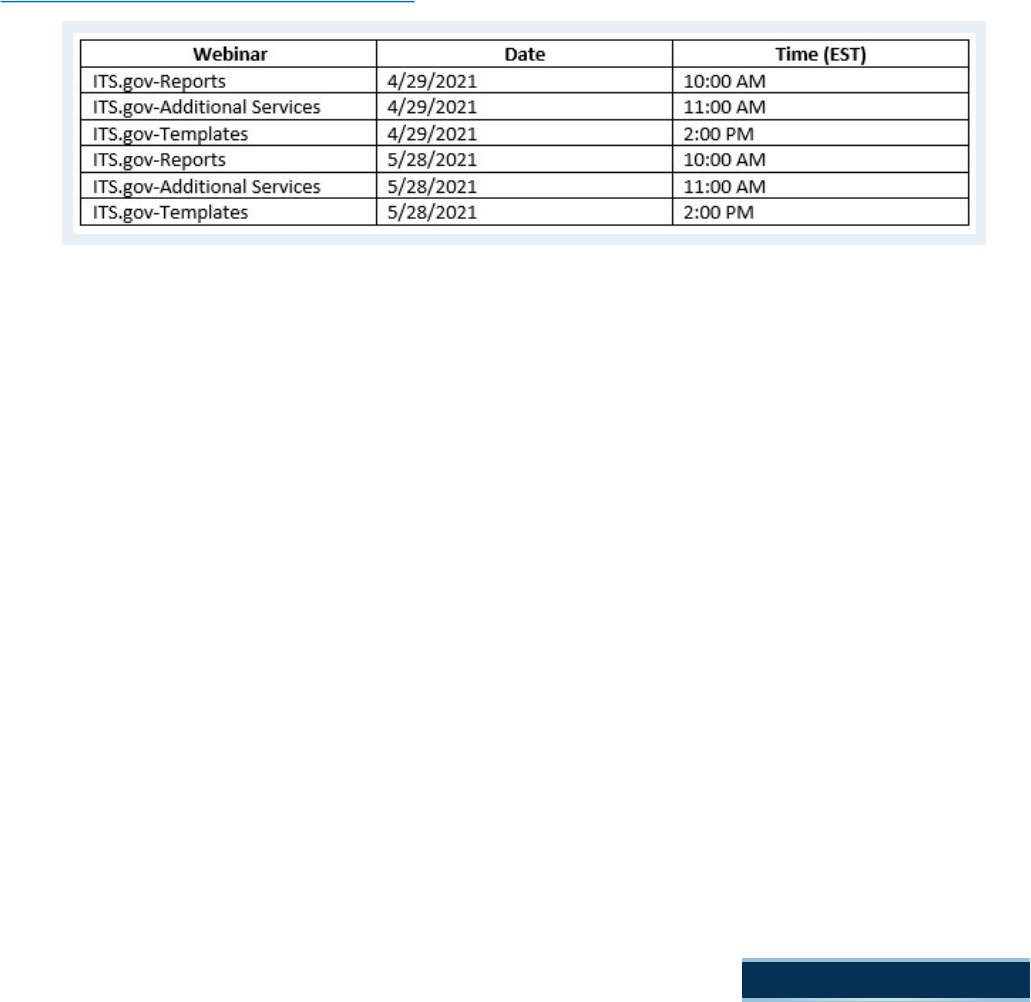

Throughout 2021, ITS.gov will be offering training seminars during the last week of every month. The courses will

cover different features of the ITS.gov application, including: how to create reports, how to create templates, and

how to stop, trace, or recall a payment. The training is free of charge and open to all enrolled ITS.gov users. Each hour

-long class will include a training manual that can be used as a reference guide to help users get the most out of the

ITS.gov system. Please see the training schedule below and register for courses at:

https://fiscal.treasury.gov/training/index.html

Automated Standard Application for Payments (ASAP.gov) has been busy working with the Department of Justice

(DOJ) to enroll several large Justice programs. In October 2020, the DOJ launched a new grants management system

– the Justice Grants System (JustGrants) – which allowed the Department to convert grants management for the

Office of Community Oriented Policing Services (COPS Office), the Office of Justice Programs (OJP), and the Office on

Violence Against Women (OVW) to the Department of Treasury’s ASAP.gov system. ASAP.gov offers DOJ and their

grantees several key benefits. ASAP.gov:

Simplifies the user experience by allowing grantees to draw funds securely from Agency controlled and

pre-authorized accounts

Reduces the amount of time grantees wait for funds by offering both same-day and next day payment

settlement options

Allows grantees and Recipient Organizations (ROs) to leverage existing ASAP profiles to access funds from

multiple agencies to simplify account management and save time

This has been a major effort for the DOJ – which has approximately 20,000 grant ROs. DOJ plans to migrate 5,000 ROs

this fiscal year and anticipates processing 65,000 grant payments through ASAP.gov in the first year — totaling $4

billion dollars. They are off to a great start. On October 15th, their first day using ASAP.gov, DOJ programs authorized

$2.9 Billion in grants through ASAP.

4

Internaonal Treasury Services (ITS.gov) Training News

Automated Standard Applicaon for Payments (ASAP.gov)

Agency Conversion News

5