Legal Compliance

& Online Resources

An Addendum to Guiding Principles & Best Practices

1

This document provides SC-specific links and resources for

determining regulatory compliance.

All nonprofit organizations operating in the state of South Carolina should be aware of and in compliance with all legal

requirements pertaining to nonprofit management, reporting, and governance.

Nonprofits should use this checklist as a starting basis for determining their compliance with legal requirements on both the state

and the federal level. Under each major topic area is a list of requirements that can apply to any nonprofit in a given situation.

These requirements are not specific to any type of industry. Not every nonprofit will be responsible for completing each item and

the “status” column should be used as a quick reference to the status

of the document or action.

The addendum is sorted by when a certain document or event

should occur – annually, quarterly, or periodically in a nonprofit’s

lifecycle. At the beginning of this addendum, a checklist of all the

legal requirements for starting a nonprofit organization is included.

Many of the items seen in the rest of the addendum are under the

assumption that a new nonprofit has completed this checklist in

fulfillment of their needs.

This Addendum is not meant to be construed as legal advice, nor

is it a substitute for individualized consultation with an attorney.

Items are coded as “US” for federal requirements and “SC” if

specific to South Carolina. Hyperlinks are directed to regulations

and resources.

Suggested Key for “Status” Column:

M

Missing

IP

In Progress

C

Completed

N/A

Not Applicable

NS

Not Sure

Legal Compliance

& Online Resources

An Addendum to Guiding Principles & Best Practices

2

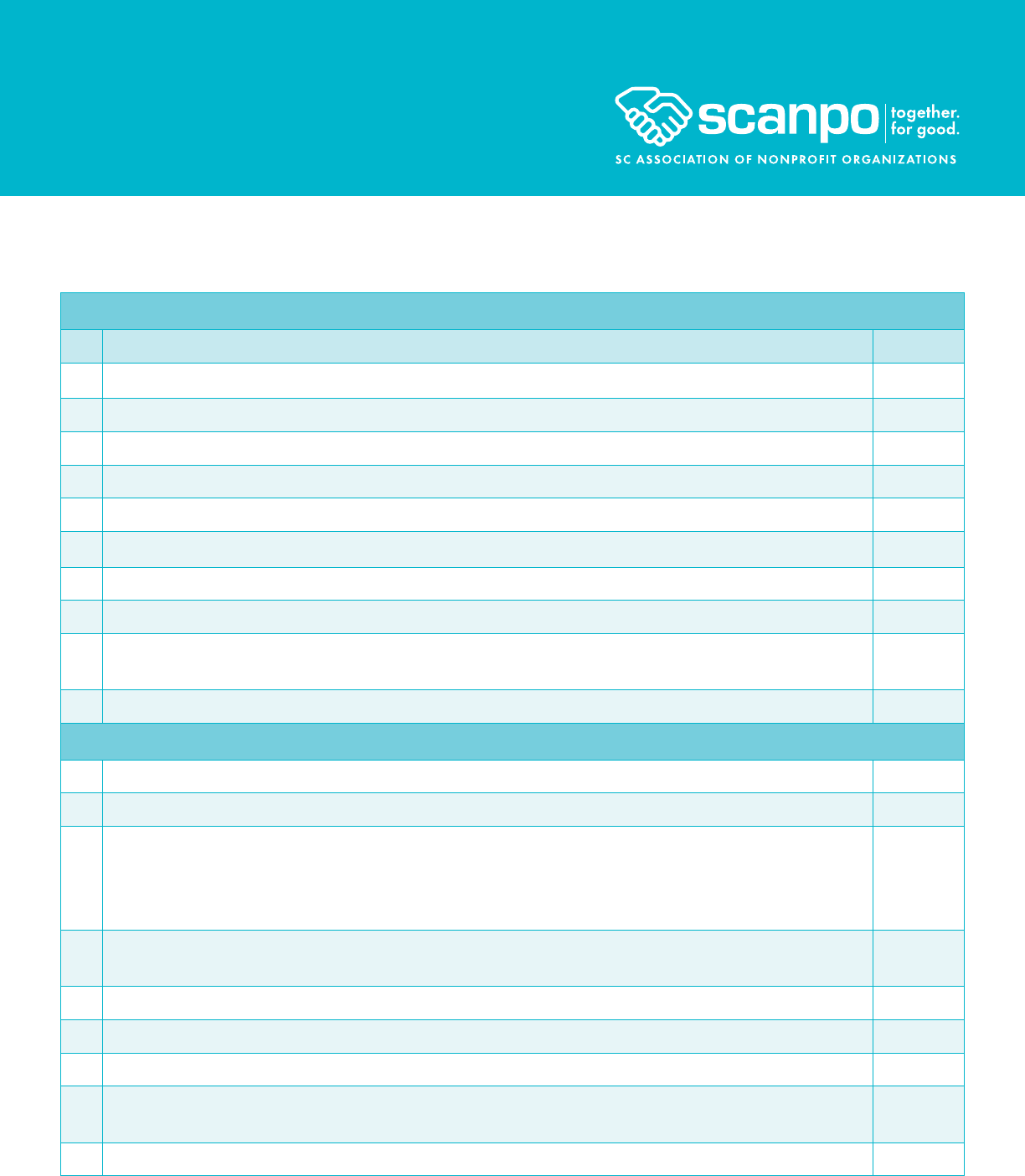

Checklist for Nonprofit Startups:

Draft and File Articles of incorporation (S.C. Code 33-31-202) SC

File a CL-1 form with articles of incorporation if organization is a Political Association SC

Continuously maintain a registered office and registered agent (SC Code § 33-31-501) SC

Hold an organizational meeting after incorporation to elect directors (if not named in the articles) appoint officers, adopt bylaws, and

carry on other business (SC Code § 33-31-205(a)) SC

Elect required officers—president, secretary and treasurer, or as otherwise indicated in the articles or bylaws (SC Code Ann §

33-31-840) SC

Install a minimum of three board members (SC Code. § 33-31-803) SC

Include provisions in the articles of incorporation that are not inconsistent with law for how assets will be distributed in case of

corporate dissolution (SC Code § 33-31-202(a)(6)) SC

Attach the 501(c)(3) status to Articles of incorporation and IRS Form 1023 SC

Submit the applicable IRS 990 Form US

• Additional Resources: IRS Form 990 and variants US

Write a personal use of assets/funds policy (Internal Revenue Code §501(c) (3), §4958) US

• Legal Information Institute: 26 USC § 4958 - Taxes on excess benefit transactions

Qualify as a public charity under “Public Support Test” or “Facts & Circumstances Test” (Revenue Code §170(b) (1) (A) (VI), §5

09(a) (1);990) US

Prohibit loans to board members/officers (SC Code Ann 33-31-832) SC

Apply for Tax Exemption (IRS Form 1023, IRS Form 1023-EZ) US

Obtain Employer Identification Number (EIN) from the IRS. US

Determine use of Municipal Business License Tax, if applicable SC

Develop the mission statement (990) US

Elect your organization to have a 501(h) status, if conducting any lobbying (Internal Revenue Code §501(c)(3), §501(h)) US

Legal Compliance

& Online Resources

An Addendum to Guiding Principles & Best Practices

3

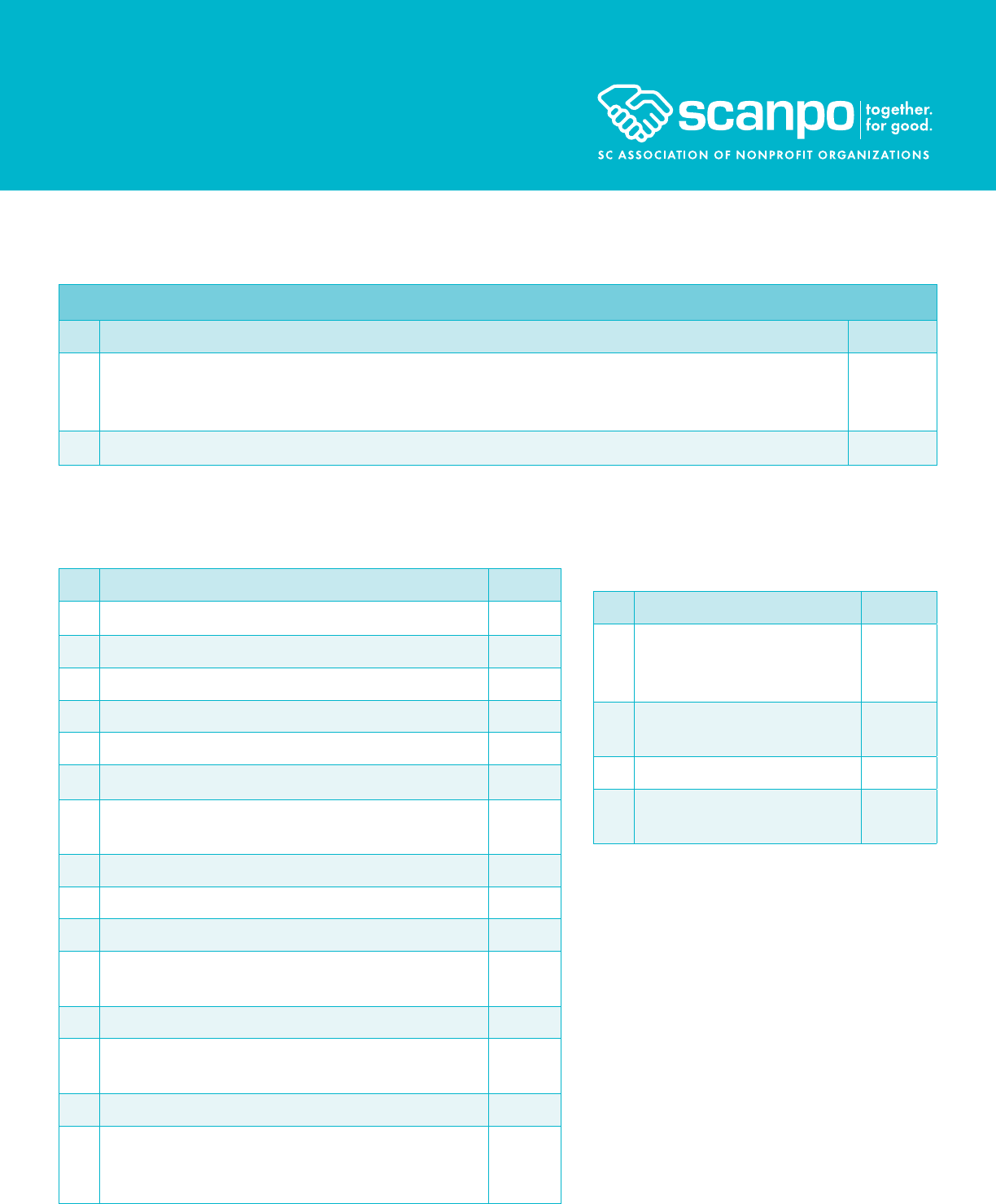

Governance

Annual Requirements

Status

1.

Update the Conflict of interest policy, procedures & signed forms for board, staff, & volunteers—updated annually (Sarbanes-

Oxley Act of 2002; 990; S.C. Code Ann. § 33-31-831) US, SC

Periodic Requirements

1.

Have available to the public IRS Form 1023 & IRS determination letter—publicly accessible for accountability purposes US

• Additional Information: Public Disclosure and Availability Requirements

2.

Notify SC Secretary of State if principal office has been changed within 30 days (SC Code § 33-31-505) SC

3.

Notify SC Secretary of State if registered agent or registered office has been changed or discontinued (SC Code § 33-

31-502(a); SC Code § 33-31-503(a)) SC

4.

File Articles of Amendment for significant errors or errors discovered after 90 days (SC Code § 33-31-1005) SC

5.

File Articles of Dissolution and written notice to Secretary of State of intention to dissolve (SC Code § 33-31-1403, SC

Code § 33-31-1404) SC

Additional Requirements

1.

South Carolina Freedom of Information Act (SC Code § 30-4-10 et seq.)

• Guide to SC FOIA

• How to File a FOIA request

Legal Compliance

& Online Resources

An Addendum to Guiding Principles & Best Practices

4

Financial Management & Stewardship

1

Annual Requirements

Status

1.

Complete an audit, if organization spends over $500,000 of federal money/grants (Office of Management & Budget

Circular A-133; 990) US

2.

Comply with conditions placed upon donations (990) US

3.

Submit IRS Form 1099-MISC, if applicable (Internal Revenue Code §501(c)(3)) US

• Houston Chronicle: Do Nonprofits Need to Issue 1099s?

• NPO Accounting Blog: 1099 Tips

4.

Report unrelated business income tax (UBIT) reporting, if applicable (Internal Revenue Code §501(c) (3)) US

Quarterly Requirements

1.

Finalize payroll and applicable taxes

• Prepare Withholding Tax Return, quarterly or annual (WH-1605; WH-1606) SC

• File Form 941 – Quarterly Payroll Taxes US

• Additional Information: Payroll – Federal Withholdings/Filings US

• Additional Information: Payroll—State & local quarterly withholding/filings SC

Periodic Requirements

1.

Determine the need for a bulk-rate postage permit, if applicable US

2.

Categorize donated funds into appropriate categories—unrestricted, temporarily restricted or permanently restricted

(990) US

3.

Maintain a financial records & destruction policy (Sarbanes-Oxley Act of 2002; 990) US

4.

Store financial supporting documentation for the appropriate length of time—i.e., grant applications, sales slips, paid

bills, invoices, receipts, deposit slips, cancelled checks (Internal Revenue Code §501(c)(3)) US

5.

Categorize Expended Funds US, SC

• IRS Form 990

• Charity Search – Information includes program expenses

• SC Secretary of State Angels and Scrooges List (2013 List)

6.

Have available to the public IRS Form 1023 & IRS determination letter—for accountability purposes US

Additional Requirements

1.

Draft a whistleblower policy (Sarbanes-Oxley Act of 2002; 990) US

2.

Develop lobbying expense policy & procedures, if applicable (Lobbying Disclosure Act of 1995; 990) US

1

A good website for general information regarding tax information for nonprofits can be found at the following link:

www.irs.gov/Charities-&-Non-Profits

Legal Compliance

& Online Resources

An Addendum to Guiding Principles & Best Practices

5

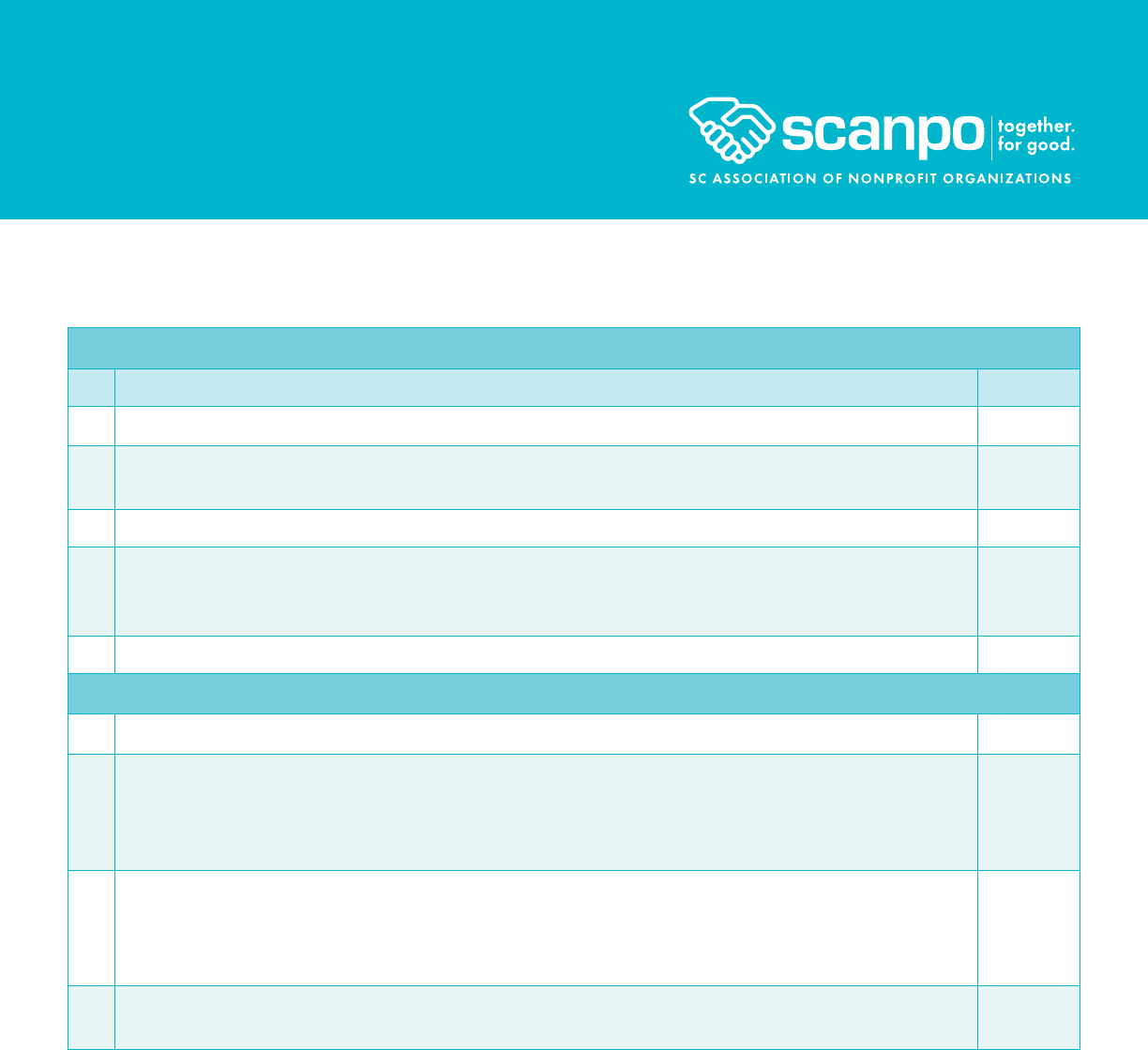

Operations & Evaluation

Annual Requirements

Status

1.

Obtain and review all necessary/appropriate insurance (i.e., D&O, general liability, etc.) US, SC

2.

Additional Resources: Workers’ compensation insurance SC

• SC law expressly exempts certain employers (SC Code § 42-1-360)

• File proof of financial responsibility and evidence of compliance with Workers’ Compensation Commission (SC Code

Regs 67-405)

3.

File Employer Status Report (Form UCE-151) with SC Employment Security Commission

Quarterly Requirements

1.

SC Employment Security Commission (SC Code § 41-27-230) SC

• File Contribution Reports (due April 30th, July 31st, October 31st, and January 31st) – Form UCE-101

• File Quarterly Wage Reports (due with Contribution Reports) – Form UCE-120

• Additional Resources: Non-profit Opt Out Method – in lieu of contributions – Form UCE-155 (SC Code § 41-31-620)

• Additional Resources: Bonding Requirement (SC Code § 41-31-640)

Periodic Requirements

1.

Nonprofit Postage Rates (USPS Publication 417) SC

• Apply to Mail at Nonprofit Standard Mail Rates (Postal Service Form 3624), submitted to post office from which the

organization intends to mail

• Determine Standard Mail Nonprofit Eligibility (Quick Service Guide 670)

• Additional Resources: Nonprofit Postage Rates (Quick Service Guide 703)

2.

Develop document retention & destruction policy (Sarbanes-Oxley Act of 2002; 990) US

Legal Compliance

& Online Resources

An Addendum to Guiding Principles & Best Practices

6

Human Resources Required Compliance with Employment Laws

For organizations with less than 15 employees

Status

1.

Gather 403b plan documentation US

2.

Comply with all state and federal employment laws US, SC

3.

Be familiar with Child Labor Regulations (SC Code Section. 41-13-20) SC

4.

Make sure compensation paid is reasonable & substantiated (Internal Revenue Code §501(c)(3); 990) US

5.

Comply with Equal Employment Opportunity Act of 1972 US

6.

Research Fair Credit Reporting Act of 2010 US

7.

Determine eligibility and classifications as it relates to Fair Labor Standards Act of 1938 US

8.

Follow National Labor Relations Act of 1935—with 2+ employees US

9.

Train employees on privacy of Health Information—HIPAA (Health Insurance Portability & Accountability Act of 1996),

if necessary US

10.

Educate employees on whistleblower protection policy US

For Organizations with more than 15 employees

2

All of the above requirements PLUS the following:

1.

Follow Age Discrimination in Employment Act of 1967 (20 or more employees) US

2.

Follow Americans with Disabilities Act of 1990 US

3.

Determine how Nursing Mothers information applies to your organization

• Additional Information: Break Time for Nursing Mothers under the FLMA (50 or more employees) (Patient Protection

and Affordable Care Act of 2010) US

• Additional Information: Nursing mothers (S.C. Code Ann. Section 63-5-40) SC

4.

Determine how Children’s Health Insurance Program Reauthorization Act of 2009 applies to your organization

(employers with group health plans) US

5.

Follow Civil Rights Act of 1964 US

6.

Comply with Drug Free Workplace Act of 1988 (federal contractors & grantees) US

7.

Follow Employee Retirement Income Security Act of 1974 (20 or more employees) US

8.

Determine applicability of Federal WARN Act of 1988 (100 or more employees and involving facilities/plant closings

and mass layoffs) US

9.

Deliver sexual harassment training US

2

When additional criteria should be met before requirement is triggered, those criteria will be listed in parenthesis next to the requirement.

Legal Compliance

& Online Resources

An Addendum to Guiding Principles & Best Practices

7

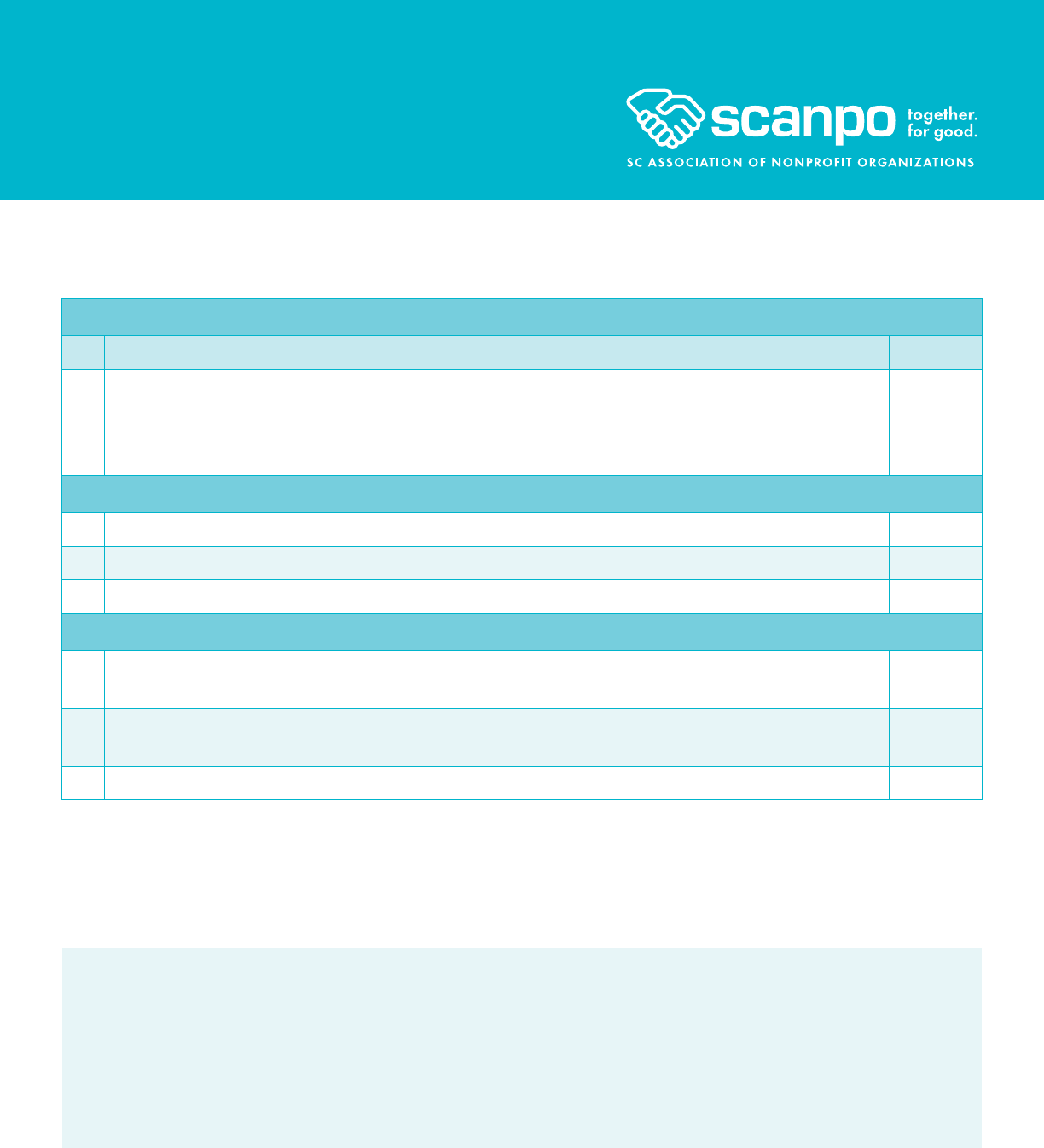

Additional Requirements

Status

1.

Finalize Payroll withholdings

• Additional Information: Payroll – Federal Withholdings/Filings US

• Additional Information: Payroll – State & local quarterly withholding/filings SC

2.

Recover overcompensation US

Human Resources (contd.’) Required Compliance with Employment Laws

Required Employment Postings

Post the following posters in easy-to-see locations in your office, as appropriate:

Status

1.

Labor, Licensing, and Regulation Work Place Poster SC

2.

Employee Polygraph Protection Act Poster US

3.

E-Verify poster (Participation and Right to Work) US

4.

Fair Labor Standards Act poster US, SC

5.

Family Medical Leave Act poster (only if 50+ employees) US

6.

OSHA poster US

7.

Labor, Licensing, and Regulation OSHA Poster and

OSHA Log US

8.

Equal Opportunity is the Law US

9.

South Carolina Human Affairs Commission poster SC

10.

SC Department of Employment and Workforce poster SC

11.

Uniformed Services Employment & Reemployment Rights Act

poster US

12.

South Carolina Workers’ Compensation poster SC

13.

Summary of Work-Related Injuries and Illnesses (only if more

than 10 employees) SC

14.

Whistleblower’s Protection Act poster US

15.

All - In - One poster (containing SC labor law, SC OSHA,

SC Workers Compensation, SC Employment Security

Commission, and SC Human Affairs Commission postings) SC

Personnel Files (for each employee)

Gather each of the following documents for placement

in the employee’s personnel file:

Status

1.

Form I-9 (required), filed separately

from other HR documentation

(recommended practice) US

2.

Immigration & Naturalization

Services (INS) documentation US

3.

Tax forms W-4, annual W-2 US, SC

4.

E-Verify – Within 3 days of hire

date US, SC

Legal Compliance

& Online Resources

An Addendum to Guiding Principles & Best Practices

8

Fundraising

Annual Requirements

Status

1.

Register Professional fundraisers with the SC Secretary of State on an annual basis. (S.C. Code Ann. 33-56-10, et seq.) SC

2.

File Charitable Organization Registration Statement with Secretary of State. (by July 1 of each year prior to beginning

solicitation), if applicable (S.C. Code Ann 33-56-30) SC

3.

Apply for Registration Exemption with the Secretary of State SC

4.

Comply with fundraising rules & regulations (990) US, SC

• Additional Information: Fundraising Events for Nonprofit Organizations - SC DOR Rev Rule 12-3 (sales tax,

admissions tax, ADL)

5.

File Annual Report of Financial Activities for non-exempted charitable organizations (SC Code § 33-56-60(A)) SC

Periodic Requirements

1.

Provide appropriate acknowledgement/receipts to donors (Internal Revenue Code §170(f) (17); 990) US

2.

Obtain bingo license to conduct bingo in the State of South Carolina under one of six classes of licenses. SC

• Additional Information: The Bingo Tax Act of 1996, SC Code Ann 12-21-3910 et seq.

• Additional Information: Overview of SC bingo licensing and enforcement

• Additional Information: IRS Publication 3079: Tax Exempt Organizations & Gaming

3.

Additional Information: Alcoholic Beverage Laws SC

• Unlicensed social functions

• Temporary License for sale of liquor (ABL-900)

• Nonprofit Private Clubs Application for biennial liquor license (ABL-901)

4.

Obtain Amusement License (L-514) or Admission tax exemption (L-2068) SC

• Additional Information: Amusement/Admissions Tax Guide

Legal Compliance

& Online Resources

An Addendum to Guiding Principles & Best Practices

9

© 2014 SC Association of Nonprofit Organizations. This work is adapted with permission from Principles and Practices for Nonprofit

Excellence © 2010 Minnesota Council of Nonprofits, Michigan Nonprofit Association © 2008, and Nonprofit Association of the Midlands

© 2014. Research for this project used, in part, the following publication: Maybank, Burkhard, Born, Rashley and Pearson, South Carolina

Nonprofit Corporate Practice Manual (2007). All rights reserved by their respective copyright holders.

DISCLAIMER: The information contained in this document is for educational purposes only. Links listed may not have the most current

information available. Please consult legal counsel or tax advisers before relying on any information contained herein.

Marketing Communications (Public Policy & Advocacy)

Quarterly Requirements

Status

1.

Comply with lobbying reporting requirements (Lobbying Disclosure Act of 1995 guide; SC Code § 2-17-5 et seq.; 990)

US, SC

• Disclose Lobbying US

• File Quarterly LD-2 Reports US

Periodic Requirements

1.

File semi-annual LD-203 Reports for individual lobbyists (January 30 and July 30) US

2.

Submit Disclosure Statements twice a year (prior to January 31 and June 30) SC

3.

File a written statement with State Ethics Commission when Cease to Engage in Lobbying SC

Additional Requirements

1.

Research limitations to nonprofits supporting or opposing legislation (Internal Revenue Code §501(c) (3), §501(h); 990) US

• Additional Information: Center for Association Leadership: Top Ten Myths about 501(c)(3) lobbying and Political Activity

2.

Comply with prohibition on supporting/opposing candidates or elected officials (Internal Revenue Code §501(c) (3);

990) US

3.

Comply with prohibition on using federal funds to lobby (Office of Management & Budget Circular A-122; 990) US