15968

A STUDY ON FOREIGN DIRECT INVESTMENT IN INDIA

PJAEE, 17 (7) 2020

A STUDY ON FOREIGN DIRECT INVESTMENT IN INDIA

Dr. P. Sai Rani

1

and Sourav Kumar Ghosh

2

1

Head-Department of Finance, ICBM-SBE, Hyderabad

2

Student, ICBM-SBE, Hyderabad

Dr. P. Sai Rani and Sourav Kumar Ghosh: A Study on Foreign Direct Investment in India

-- Palarch’s Journal of Archaeology of Egypt/Egyptology, ISSN 1567-214x

Keywords: Indian economy, Foreign direct investment inflows, Trend

ABSTRACT

Indian economy is one of the fastest emerging economies of the world which attracts a remarkable

amount of foreign direct investments every year. However, there have been reports for the past few years

showing inconsistency in inflows of foreign direct investment in India and also the GDP of India is

observed to be in decreasing trend. This gives rise to the need of studying multiple facets of such

investments. This paper aims at studying the trends of FDI inflows in India and ascertaining the country-

wise FDI inflows and sector-wise distribution of such investments in the country. This study is based on

secondary data collected from various reliable sources. Simple statistical tools like CAGR (Compound

Annual Growth Rate), and Percentage have been used for purpose of study. The study reveals varying

trends of FDI inflows in India in the recent years which is in line with the world economy but it is

generally on a rising side. The study also reveals that Mauritius has been the top investing nation in India

and among all the sectors the service sector attracts the maximum FDI from various nations over the

period of study. The data collected for the purpose of study is limited to almost last two decades and is

entirely based on Indian economy only.

INTRODUCTION

Investment, which is also called creation of capital, is a vital determinant of a

country’s economic growth. It is required to a great extent for the economy to grow.

An appropriate level of capital together with labour, natural resources and advanced

technology can bring about optimum growth levels in the economy by way of creation

of capital goods which may be in physical, financial or human form. The other name

of this capital is investment which comprises not only domestic but also foreign

investments. Foreign investment inflows can reduce the domestic savings gap. On a

general basis, these inflows foster growth in a developing economy. Multinational

Corporation (MNC) is a proper tool to bring all the economies together on the global

platform. There is a direct proportion between the expansion of these inflows and that

of the MNCs. Backward and underdeveloped countries interested in speedy economic

development are required to import world-class machinery, technical know-how,

entrepreneurial skills, and foreign investments. Most of the world economies seeking

growth, both short-term and long-term, has to some extent depend on foreign capital

15969

A STUDY ON FOREIGN DIRECT INVESTMENT IN INDIA

PJAEE, 17 (7) 2020

inflows. It cannot be denied that this capital infusion from foreign countries contribute

to the ongoing phenomenon of economic growth, industrialization and modernization

in numerous ways.

As a matter of fact, foreign direct investment is a significant component of total

foreign investments. In such investments, the investor (an individual, a firm, a

company, etc) from a different (foreign) nation invests in a business situated in host

nation. Usually, the foreign investor acquires assets of the business or establishes

business operations to get a controlling interest in the business established in host

nation and is directly involved in its management when he invests either directly or via

other affiliates.

Furthermore, there are three components of FDI. These are: equity capital, reinvested

earnings and other capital or intracompany loans. FDI flows are recorded as a net of

capital account credits less debits between direct investors as well as their foreign

affiliates in a given financial year.

Basically, there are two routes for foreign investors to invest in India. These are:

(i) Automatic Route: On this route, no approval of authority is required by the

foreign investor. He can invest in any company without the need for

Government approval.

For example: Agriculture, Plantation, Construction Development, Industrial Parks,

Railway Infrastructure, Financial Services, Insurance, Pension Sector, etc.

(ii) Government Route: No investment can be made on this route without prior

approval of the Indian Government.

For example: Print media, Satellites-establishment and operations, Banking-public

sector, etc.

There is no uniform rate of FDI in India. This rate can be 26% or 49% or 51% or 74%.

Some industries even allow 100% FDI, that is, entire resources of these industries may

come from foreign entities. Moreover, different rates as well as routes can be observed

in a particular sector. For example: Defence and Telecom services (Automatic- up to

49% and Government- beyond 49%), etc.

There are some industries where FDI is strictly prohibited under any route. For

example: Cigars, cigarettes or any related tobacco industry, lottery, betting or

gambling businesses, Investments in chit funds, Nidhi company, Trading in

Transferable Development Rights (TDRs), etc.

In some sensitive sectors like defence, insurance and media, there have always been

conflicting views on FDI, as the integrity and security of our nation are at stake. So,

FDI caps apply for many of such industries. For example, the defence industry only

allows 49% foreign direct investment (automatic route) beyond which government

approval must be obtained.

REVIEW OF LITERATURE

Many published articles are available on foreign direct investment. A review of

relevant literature has been done. Bajpai and Dasgupta (2004) in their study

Multinational Companies and Foreign Direct Investment in China and India have

inspected the FDI patterns over the years by the MNCs into these two developing

nations and tried to find out the possibilities of attracting higher FDI inflows for India

with the framing of suitable policies. Goswamia and Saikiab (2012) in their study FDI

and its relation with exports in India, status and prospect in north-east region have

15970

A STUDY ON FOREIGN DIRECT INVESTMENT IN INDIA

PJAEE, 17 (7) 2020

explored the trends of FDI in India and determined the association between FDI and

exports during 1991 to 2011. Patil and Kadam (2014) in their research paper titled

Effects of FDI on Indian economy: A Critical Appraisal have made an attempt to

ascertain the relevance of FDI in our country by observing its inflows as well as its

effect on its economic development over the years 2000-2010. Azhar and Marimuthu

(2012) in their study An Overview of Foreign Direct Investment in India have focused

on the need, sources and determinants of FDI, its year-wise and sector-wise

examination and causes thereof. Anitha (2012) in Foreign Direct Investment and

Economic Growth in India has explained the importance of FDI for developing and

underdeveloped nations by stating that FDI plays a vital role in reducing the gap

evident between present and needed funds and resources.

NEED OF THE STUDY

There have been reports for the past few years showing inconsistency in inflows of

foreign direct investment in India. So, the need is felt to study the trends of FDI

inflows in India, identification of country-wise inflows and ascertaining their sector-

wise distribution in India.

OBJECTIVES OF THE STUDY

(i) To study the trends of FDI inflows in India.

(ii) To identify the country-wise flow of FDI into India.

(iii)To ascertain the sector-wise distribution of FDI inflows in India.

LIMITATIONS OF THE STUDY

(i) The present study is entirely based on Indian economy only.

(ii) The study is limited to only last nineteen financial years. So, the findings of this

study reflect this period only.

SCOPE OF THE STUDY

(i) To evaluate the trends of FDI inflows into India, data have been collected for the

period 2000-01 to 2018-19.

(ii) To study the country-wise flow of FDI and its sector-wise distribution in India,

data have been collected for the period 2000-01 to 2018-19.

RESEARCH METHODOLOGY

Data Collection

This study is based on secondary data. This database is constructed by pooling

information and data from various reliable sources like National Statistical Office,

Department of Industrial Policy and Promotion (DIPP), Reserve Bank of India,

statisticstimes.com amongst many other. Online database of Indian economy, articles,

journals, newspapers, etc. have also been referred.

Statistical Tool

To evaluate the trend of FDI inflows into India, CAGR (Compound Annual Growth

Rate) and percentage have been used. To study the country-wise flow of FDI and its

sector-wise distribution in India, simple calculation using Percentage has been done

for easy understanding.

15971

A STUDY ON FOREIGN DIRECT INVESTMENT IN INDIA

PJAEE, 17 (7) 2020

Data On Fdi (April, 2000 To March, 2019)

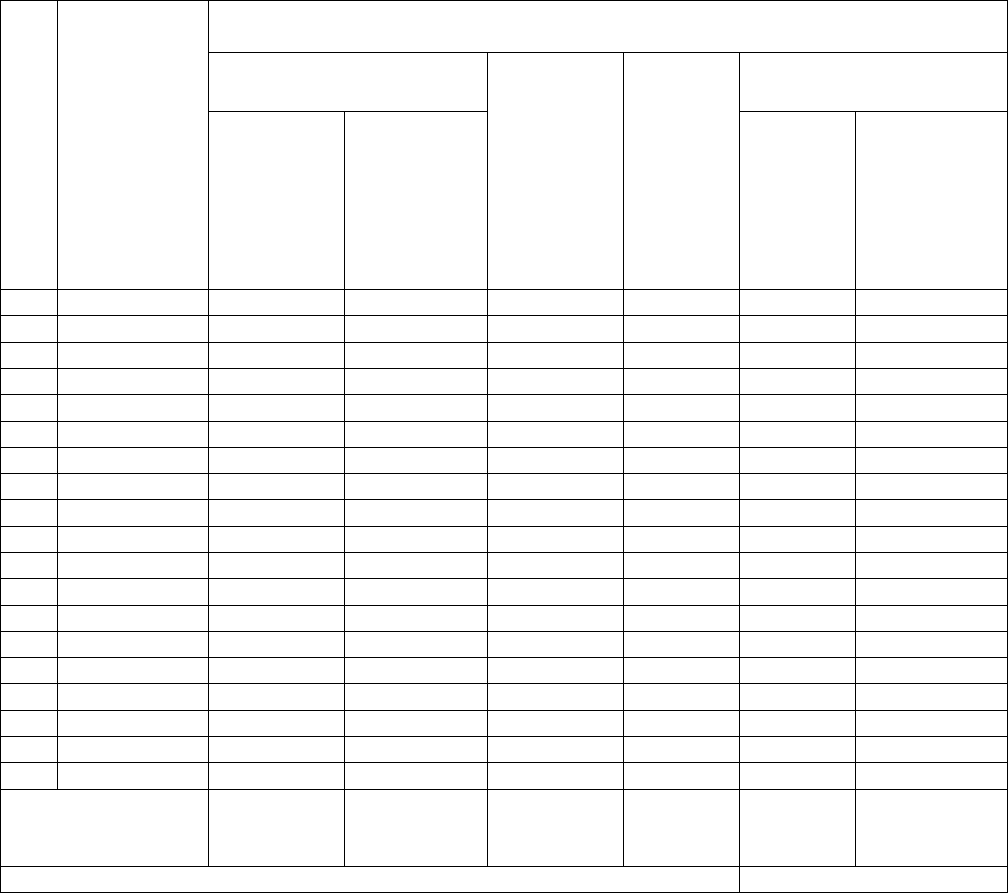

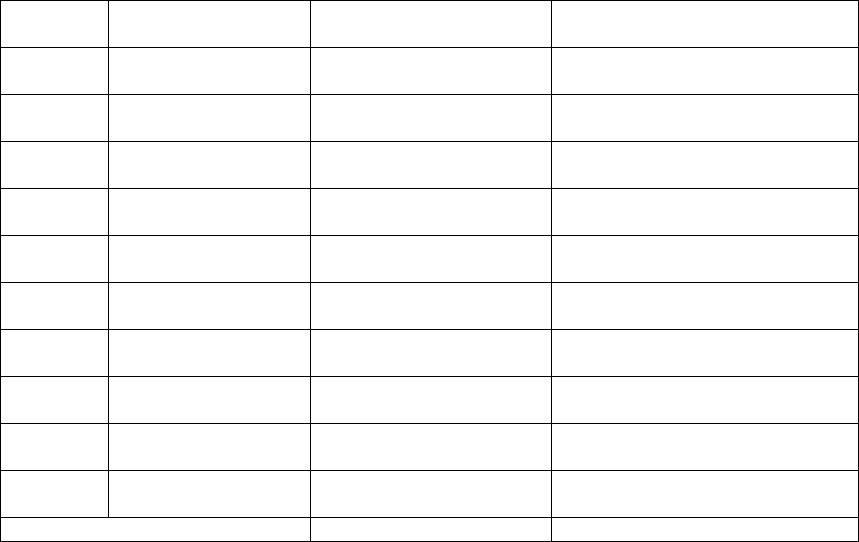

Table-I. Financial Year-Wise Fdi Inflows (Trends)

(A). TOTAL FDI INFLOWS (Equity inflows + Reinvested earnings + Other

capital) Amount: US$ in Millions

S.

No.

Financial

Years

2000-01 to

2018-

19(April-

March)

Foreign Direct Investment (FDI)

Equity

Re-invested

Earnings

Other

Capital

FDI flows into India

FIPB

Route/RBI

Automatic/

Acquisition

Route

Equity

Capital of

unincorp-

orated

bodies#

Total

FDI

Flows

Percentage

growth

over previous

year (in

terms of US$)

1.

2000-01

2,339

61

1,350

279

4,029

-

2.

2001-02

3,904

191

1,645

390

6,130

(+)52%

3.

2002-03

2,574

190

1,833

438

5,035

(-)18%

4.

2003-04

2,197

32

1,460

633

4,322

(-)14%

5.

2004-05

3,250

528

1,904

369

6,051

(+)40%

6.

2005-06

5,540

435

2,760

226

8,961

(+)48%

7.

2006-07

15,585

896

5,828

517

22,826

(+)155%

8.

2007-08

24,573

2,291

7,679

300

34,843

(+)53%

9.

2008-09

31,364

702

9,030

777

41,873

(+)20%

10.

2009-10

25,606

1,540

8,668

1,931

37,745

(-)10%

11.

2010-11

21,376

874

11,939

658

34,847

(-)08%

12.

2011-12

34,833

1,022

8,206

2,495

46,556

(+)34%

13.

2012-13

21,825

1,059

9,880

1,534

34,298

(-)26%

14.

2013-14

24,299

975

8,978

1,794

36,046

(+)5%

15.

2014-15

30,933

978

9,988

3,249

45,148

(+)25%

16.

2015-16

40,001

1,111

10,413

4,034

55,559

(+)23%

17.

2016-17

43,478

1,223

12,343

3,176

60,220

(+)8%

18.

2017-18

44,857

664

12,542

2,911

60,974

(+)1%

19.

2018-19

44,366

693

13,570

5,746

64,375

(+)6%

Cumulative Total

(from April,2000 to

March,2019)

4,22,900

15,465

140,016

31,457

609,838

-

CAGR

(+)15.7%

Source: RBI’s Bulletin March, 2019 dt.11.05.2019; (Table No.34- FOREIGN

INVESTMENT INFLOWS)

Note: All figures for financial years 2016-17 to 2018-19 are provisional.

15972

A STUDY ON FOREIGN DIRECT INVESTMENT IN INDIA

PJAEE, 17 (7) 2020

PLOTTING THE TRENDS OF FDI INFLOWS IN INDIA DURING 2000-01 TO

2018-19 ON A CHART

Chart- (a)

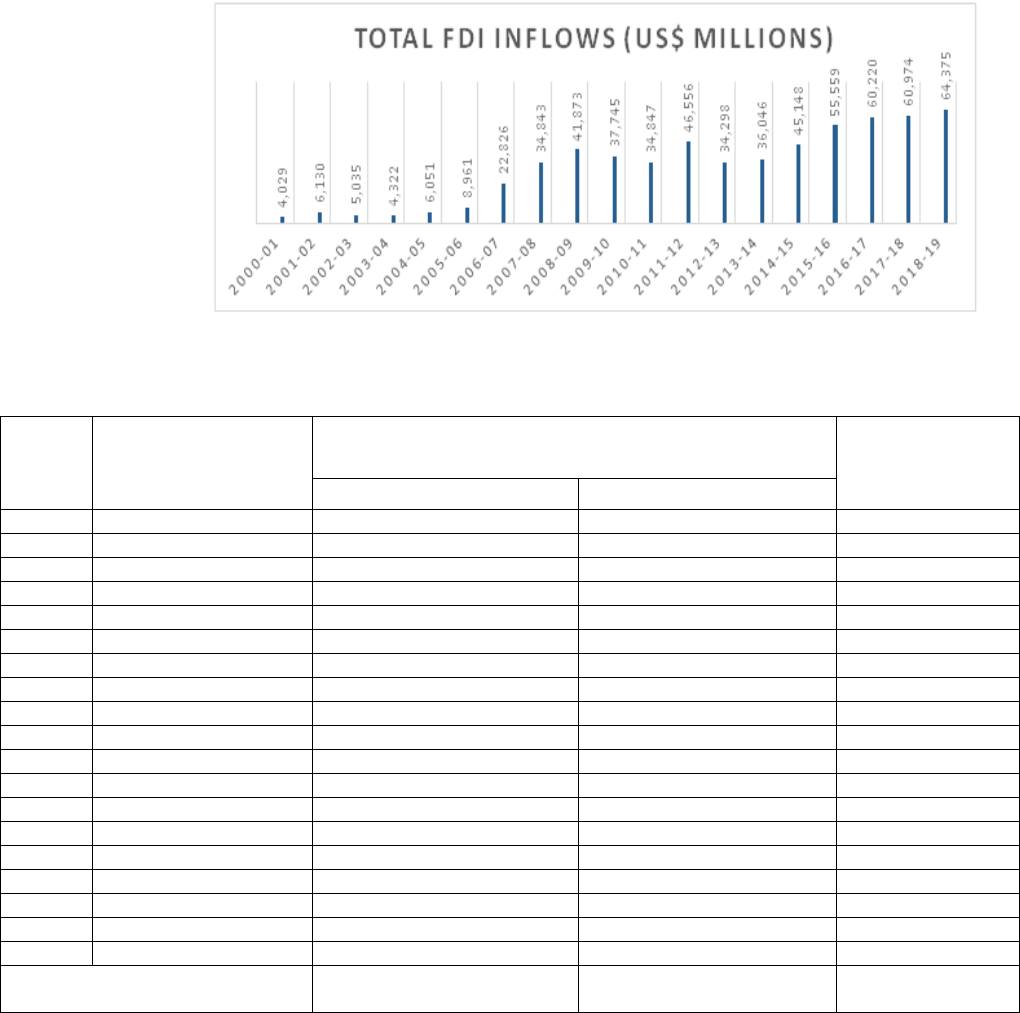

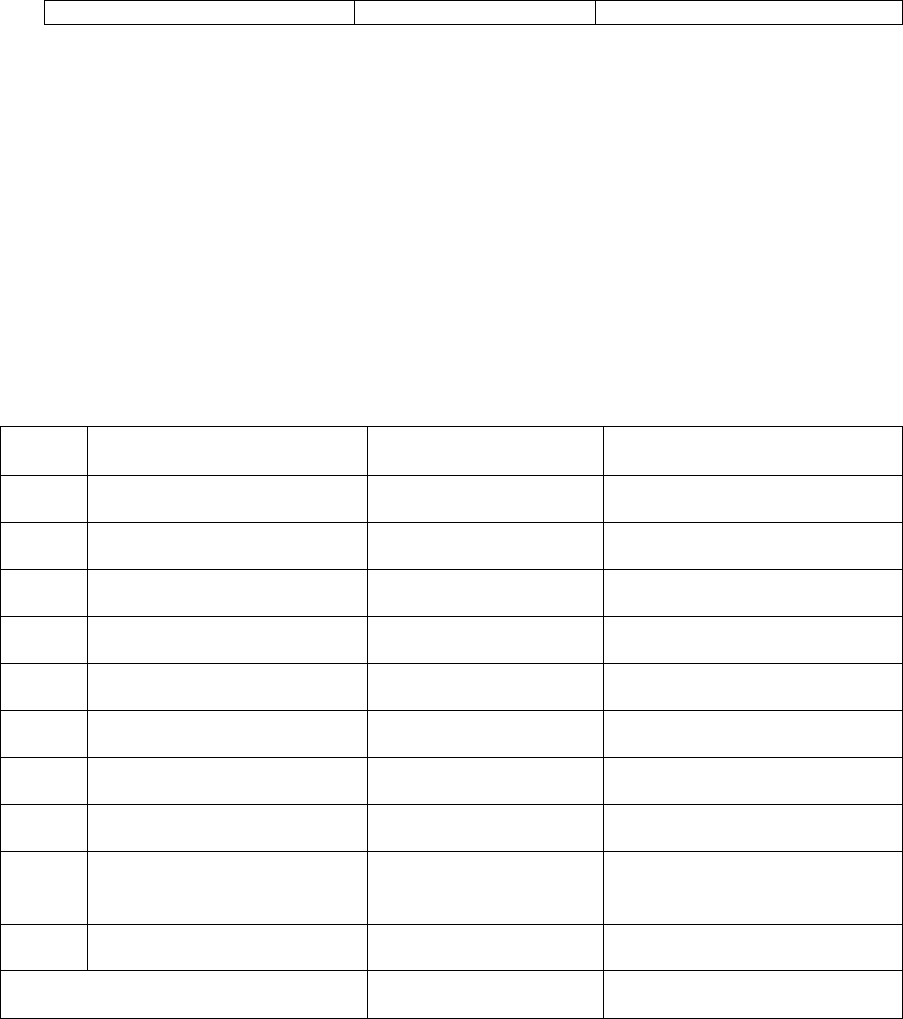

(B). TOTAL FDI EQUITY INFLOWS (excluding amount remitted through

RBI’s NRI Schemes)

S. No.

Financial Years

2000-01 To 2018-19

(April-March)

Amount of FDI Inflows

Percentage

Growth Over

Previous Year (in

terms of US $)

In Rs. Crores

In US $ Million

1.

2000-01

10,733

2,463

-

2.

2001-02

18,654

4,065

(+)65%

3.

2002-03

12,871

2,705

(-)33%

4.

2003-04

10,064

2,188

(-)19%

5.

2004-05

14,653

3,219

(+)47%

6.

2005-06

24,584

5,540

(+)72%

7.

2006-07

56,390

12,492

(+)125%

8.

2007-08

98,642

24,575

(+)97%

9.

2008-09

142,829

31,396

(+)28%

10.

2009-10

123,120

25,834

(-)18%

11.

2010-11

97,320

21,383

(-)17%

12.

2011-12

165,146

35,121

(+)64%

13.

2012-13

121,907

22,423

(-)36%

14.

2013-14

147,518

24,299

(+)8%

15.

2014-15

181,682

29,737

(+)22%

16.

2015-16

262,322

40,001

(+)35%

17.

2016-17

291,696

43,478

(+)9%

18.

2017-18

288,889

44,857

(+)3%

19.

2018-19

309,867

44,366

(-)1%

Cumulative Total (from

April,2000 to March,2019)

2,378,887

420,142

Source: dipp.nic.in

Note: All figures for financial years 2014-15 to 2018-19 are provisional subject to

reconciliation with RBI.

15973

A STUDY ON FOREIGN DIRECT INVESTMENT IN INDIA

PJAEE, 17 (7) 2020

PLOTTING THE TRENDS OF FDI EQUITY INFLOWS IN INDIA DURING

2000-01 TO 2018-19 ON A CHART

Chart- (b)

Interpretation (1)

Table I (A) and I (B) demonstrate cumulative amount of foreign direct investment

inflows in India from 2000-01 to 2018-19. Since 2000, the Indian government has

brought about vital amendments to FDI policies to ensure that the nation is

transforming into an immensely attractive destination for investing capital. The

inflows of FDI into India has increased dramatically following the 1991 reforms.

However, ever since these reforms took place, India has witnessed ups and downs in

the FDI inflows over the years, especially during the period of study, that is, 2000-01

to 2018-19. Many a times it has been evident that India has seen sudden or gradual

decrease in the percentage of FDI inflows as compared to the previous year, like

during 2001-02 to 2003-04 citing reasons like Gujrat earthquakes, pathetic attack on

World Trade Centre (now WTO) and Indian Parliament by the terrorists in the year

2001 or during 2008-09 to 2012-13 due to decline in global economy following the

2008 US Subprime Crisis and the 2012-13 Euro Crisis. Consequently, the investor

confidence declined globally.

However, India has also witnessed sudden as well as gradual surge in the percentage

of FDI inflows as compared to the previous years at multiple occasions. For instance,

during 2006-07, a sudden increase of more than 100 percent in the FDI inflows was

evident following positive amendments in in the FDI policy in 2006 whereby the FDI

procedure was made relatively simple, the capital limits were raised to 100 percent

and many restrictions were also lifted, thus resulting positive impact on civil aviation.

During 2007-08, the Indian government had organized events like Destination India

and also the DIPP (Department of Industrial Policy Promotion) website was made

user-friendly with the support of providing answers to investment-related questions to

attract more investments. After the prolonged period of line in the global economy

during 2008-09 to 2012-13, the FDI inflows in India finally recovered during 2014

due to the new government policies, initiatives like Make in India, Start Up India,

Skill India, development of smart cities and investor-friendly business environment

facilitating ease of doing business in the country. The further changes in the FDI

policy in 2017 by the government proved fruitful on eliminating several levels of

bureaucracy and making proposals for FDI to be made increasingly rational, swift and

positive under government approval route.

15974

A STUDY ON FOREIGN DIRECT INVESTMENT IN INDIA

PJAEE, 17 (7) 2020

However, India’s FDI equity inflows have declined over the last few years and has

even hit the lowest level in 2018-19 with a steep decline in foreign investments in

telecom, power and pharmaceuticals sectors. Another reason for such a decline may be

the slowing down of Indian economy in the recent past due to demonetization,

implementation of GST, job crisis, poor consumer demand, farmer crisis and NPA

burden among others. It is, however, to be noted that the new government has

alleviated 87 FDI rules across as many as 21 sectors over the past three years. For

example, it has opened up historically conservative sectors like railway and defence

for foreign direct investment.

Overall, there has been varying trends of FDI inflows in India observed in the recent

years which is in line with the world economy. On analysing the trends of FDI inflows

in India, it is generally on a rising side (particularly after 2012-13), also indicated by a

positive CAGR of FDI inflows of 15.7 percent.

Interpretation (2)

As a matter of fact, FDI comprises Equity Capital, Reinvested Earnings and Other

Capital. This other capital component further comprises amount remitted through

RBI’s NRI schemes.

Table I(A) indicates cumulative amount of FDI inflows (constituting Equity Capital,

Reinvested Earnings and Other Capital) as US$ 609,838 Million showing a positive

growth of 6% in the financial year 2018-19 over the previous financial year 2017-18.

On the contrary, Table I(B) indicates cumulative amount of FDI equity inflows

(excluding amount remitted through RBI’s NRI schemes) as US$ 420,142 Million

showing a negative growth of 1%. It implies that RBI’s NRI schemes constitute a

major part of total FDI inflows in India ignoring which the growth rate of inflows

reduced from (+)6% to (-)1%.

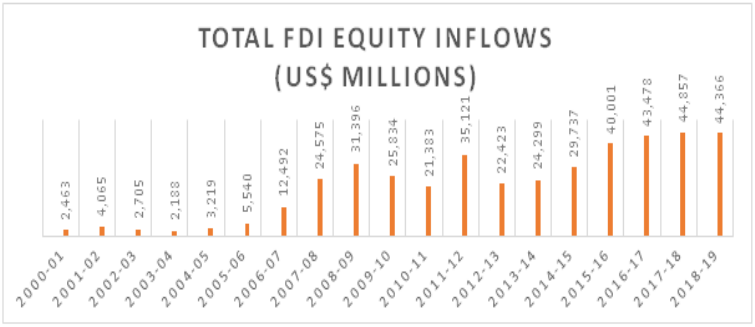

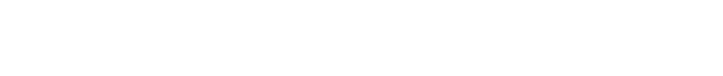

Table Ii. Share Of Top Investing Countries’ Fdi Equity Inflows (Financial Years):

Amount: Rupees in Crores (US$ in Millions)

Ranks

Country

Cumulative Inflows

(April,00-March,19)

Percentage of Total Inflows

(in terms of US $)

1.

Mauritius

738,156

(134,469)

32%

2.

Singapore

505,946

(82,998)

20%

3.

Japan

173,332

(30,274)

7%

4.

Netherlands

162,251

(27,352)

7%

5.

U.K.

140,370

(26,789)

6%

6.

U.S.A.

146,372

(25,556)

6%

7.

Germany

65,477

(11,708)

3%

8.

Cyprus

51,544

(9,869)

2%

9.

UAE

39,310

(6,652)

2%

10.

France

36,825

(6,643)

2%

Total FDI Inflows from All

2,378,886

15975

A STUDY ON FOREIGN DIRECT INVESTMENT IN INDIA

PJAEE, 17 (7) 2020

Countries*

(420,142)

-

Source: dipp.nic.in

*Includes inflows under NRI Schemes of RBI.

Note:

(i) Percentage worked out in terms of US$ & FDI inflows received through

FIPB/SIA+ RBI’s Automatic Route + acquisition of existing shares only.

(ii) Figures are provisional.

Interpretation

From the above table it can be observed that among the top ten countries investing in

India over the last 19 years, Mauritius and Singapore stands first and second

respectively, contributing around 52 percent of the total FDI inflows during this

period.

Table Iii. Sectors Attracting Highest Fdi Equiiy Inflows:

Amount: Rupees in Crores (US$ in Millions)

Ranks

Sector

Cumulative Inflows

(April,00-March,19)

Percentage of Total Inflows

(in terms of US $)

1.

Service Sector

416,301

(74,149)

18%

2.

Computer Hardware &

Software

221,756

(37,238)

9%

3.

Telecommunication

188,249

(32,826)

8%

4.

Construction Development

(Township)

119,614

(25,046)

6%

5.

Trading

143,599

(23,021)

5%

6.

Automobile Industry

123,989

(21,387)

5%

7.

Chemicals (Other than

Fertilizers)

91,062

(16,582)

4%

8.

Drugs and Pharmaceuticals

84,165

(15,983)

4%

9.

Construction

(Infra- structure) Activities

93,873

(14,805)

4%

10.

Power

77,889

(14,316)

3%

Total FDI Inflows from All Countries*

2,378,886

(420,142)

-

Source: dipp.nic.in

Note: Figures are provisional.

Interpretation

Among the top ten sectors attracting the most FDI inflows, it is observed that the

service sector of our country received the maximum investments constituting almost

18 percent of the total investments from these countries over the last 19 years,

followed by Computer Hardware & Software and Telecommunication sectors with 9%

and 8% respectively. It is because of the fact that among all the sectors the service

sector has been the fastest growing sector of Indian economy over a longer period of

time. The contribution of various components of this service sector like trade,

15976

A STUDY ON FOREIGN DIRECT INVESTMENT IN INDIA

PJAEE, 17 (7) 2020

financing, hotels, insurance, transport and communication, real estate and business

services, social and personal services exceed 60 percent of India’s GDP.

FINDINGS

Findings Pertaining To Objective 1

(i) There has been varying trends of FDI inflows in India observed in the recent years

which is in line with the world economy. On analysing the same, it is generally on a

rising side (particularly after 2012-13), also indicated by a positive CAGR of FDI

inflows of 15.7 percent.

(ii) There has been a remarkable growth in FDI inflows during 2013 to 2016 after a

sharp fall in 2012-13. As a result, India managed to attract good amount of FDI during

this period. However, India’s FDI equity inflows have declined over the last few years

and has even hit the lowest level in 2018-19 with a steep fall in foreign investments in

telecom, power and pharmaceuticals sectors.

Findings Pertaining To Objective 2

Mauritius and Singapore were found to be the top two countries investing directly in

India constituting around 52 percent of the total FDI inflows among the top ten

countries investing in India over the last 19 years.

Findings Pertaining To Objective 3

Among the top ten sectors attracting the most FDI inflows, the service sector stands

first with 18 percent of the total inflows over the last 19 years followed by Computer

Hardware & Software and Telecommunication sectors with 9 percent and 8 percent

respectively.

CONCLUSION

Trends are just relative numbers which might differ from that of the original numbers.

It only shows the relation in the form of percentage growth over last year whereas the

foreign direct investment keeps on coming into the economy. There can be many

factors responsible for such variations in the trends of foreign direct investment

inflows like economic, institutional and political factors. These factors include

economic growth of the country, market size, resource location, return on investment,

inflation, government regulation, political stability, tax policies and foreign exchange

rate among others.

RECOMMENDATIONS

According to previous studies by other researchers, India has been able to attract huge

amount of FDI only in the post-reform period, that is, since July 1991. However, it

cannot be denied that it is still lagging behind many other developing nations based on

the quantum of FDI inflows in respect of its size. Hence, it is recommended to shift

the focus more to the long-term development of the country rather than its short-term

growth. In the context of FDI, the government is suggested to further liberalise the

foreign direct investment policies and make India more investment-friendly. It cannot

keep relying upon a handful number of nations; rather it should look for multiple

opportunities. At the same time, it can look for possible sectors where foreign

investors can enter through automatic route and formulate policies favourable for

investments in other sectors alongside service sector.

BIBLIOGRAPHY

1. Anitha, R. (2012). Foreign Direct Investment and Economic Growth in

India. International Journal of Marketing, Financial Services & Management

Research, 1(8).

15977

A STUDY ON FOREIGN DIRECT INVESTMENT IN INDIA

PJAEE, 17 (7) 2020

2. Azhar, S. and Marimuthu, K. (2012). An Overview of Foreign Direct Investment

in India. EXCEL International Journal of Multidisciplinary Management Studies,

2.

3. Bajpai, N. and Dasgupta, N. (2004), “Multinational Companies and Foreign

Direct Investment in China and India”, Columbia Earth Institute, Columbia

University, Working Paper No. 2.

4. Goswamia, C. and Kanta Saikiab, K. (2012). FDI and its relation with exports in

India, status and prospect in north east region. Procedia - Social and Behavioral

Sciences, 37, pp.123-132.

5. Patil, D. and Kadam, S. (2014). Effects of FDI on Indian Economy: A Critical

Appraisal. Journal of Economics and Sustainable Development, 5(19).

WEBSITES REFERRED

(a) www.ibef.org

(b) www.statisticstimes.com

(c) www.coursehero.com

(d) https://witanworld.com

(e) https://taxguru.in

(f) www.nso.gov.pg

(g) https://dipp.gov.in