2600 Croasdaile Farm Parkway

Durham, North Carolina 27705

(919) 384-2000

www.croasdailevillage.org

DISCLOSURE STATEMENT

Croasdaile Village must deliver a Disclosure Statement to a prospective resident prior to or

at the time a prospective resident executes a Residency Agreement to provide continuing

care, or prior to or at the time a prospective resident transfers any money or other property

to Croasdaile Village, whichever occurs first.

Croasdaile Village, like all other continuing care retirement communities in the State of

North Carolina, is subject to the Continuing Care Retirement Communities Act. This

Disclosure Statement has not been reviewed or approved by any government agency or

representative to ensure accuracy or completeness of the information set out.

FEBRUARY 27, 2024

Unless earlier revised, Croasdaile Village intends for this

Disclosure Statement to remain effective until July 28, 2025

i

TABLE OF CONTENTS

Page

INTRODUCTION ....................................................................................................................................................... 1

THE UNITED METHODIST RETIREMENT HOMES, INCORPORATED ...................................................... 2

BOARD OF TRUSTEES ............................................................................................................................................ 3

CORPORATE EXECUTIVE DIRECTOR............................................................................................................... 4

EXECUTIVE DIRECTOR ......................................................................................................................................... 4

RESIDENT COUNCIL ............................................................................................................................................... 4

LIFE CARE SERVICES LLC ................................................................................................................................... 4

CROASDAILE VILLAGE ......................................................................................................................................... 7

SMOKE-FREE CAMPUS .......................................................................................................................................... 7

THE PROPOSAL ........................................................................................................................................................ 8

THE SERVICES........................................................................................................................................................13

FINANCIAL INFORMATION ................................................................................................................................ 17

RESERVES AND INVESTMENTS......................................................................................................................... 17

OTHER MATERIAL INFORMATION ................................................................................................................. 18

AGREEMENTS WITH RESIDENTS ..................................................................................................................... 18

Attachments:

Attachment 1 – Audited Financial Statements of The United Methodist Retirement

Homes, Incorporated (includes the consolidated operations of Croasdaile Village,

Cypress Glen and Wesley Pines)

Attachment 2 – Forecasted Financial Statements of The United Methodist Retirement

Homes, Incorporated (includes the consolidated operations of Croasdaile Village,

Cypress Glen and Wesley Pines)

Attachment 3 – Interim Unaudited Financial Statements of The United Methodist

Retirement Homes, Incorporated (includes the consolidated operations of Croasdaile

Village, Cypress Glen and Wesley Pines)

Attachment 4 - Explanations of Material Differences

Attachment 5 – Traditional Residency Agreement

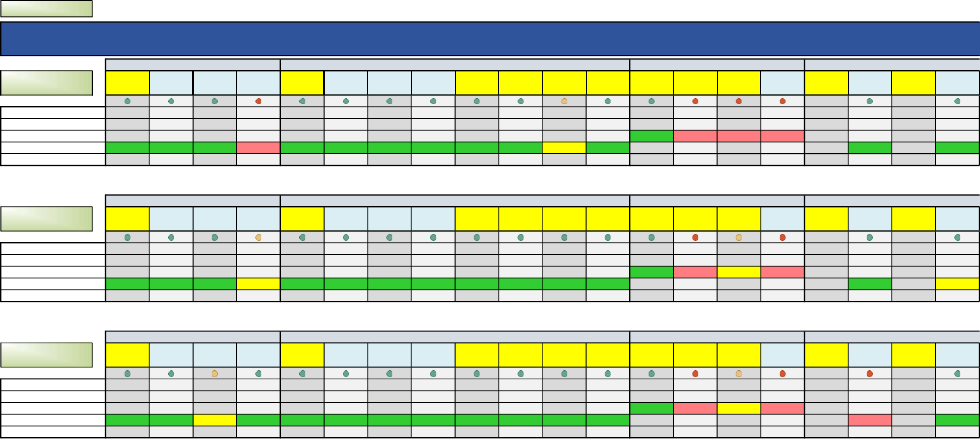

Attachment 6 – Communities Managed by Life Care Services LLC

Attachment 7 – List of Extra Charges

1

INTRODUCTION

Croasdaile Village brings to residents of the central North Carolina area, who are age 62

and over, a way of retirement living known as "continuing care." This concept offers retirees a

life style designed to meet their unique needs while allowing them the freedom to pursue their

personal interests. Continuing care communities, such as Croasdaile Village, encompass these

important components: a private residence, a wide array of personal services, assisted living

services, and the security of long-term care in the on-site health center.

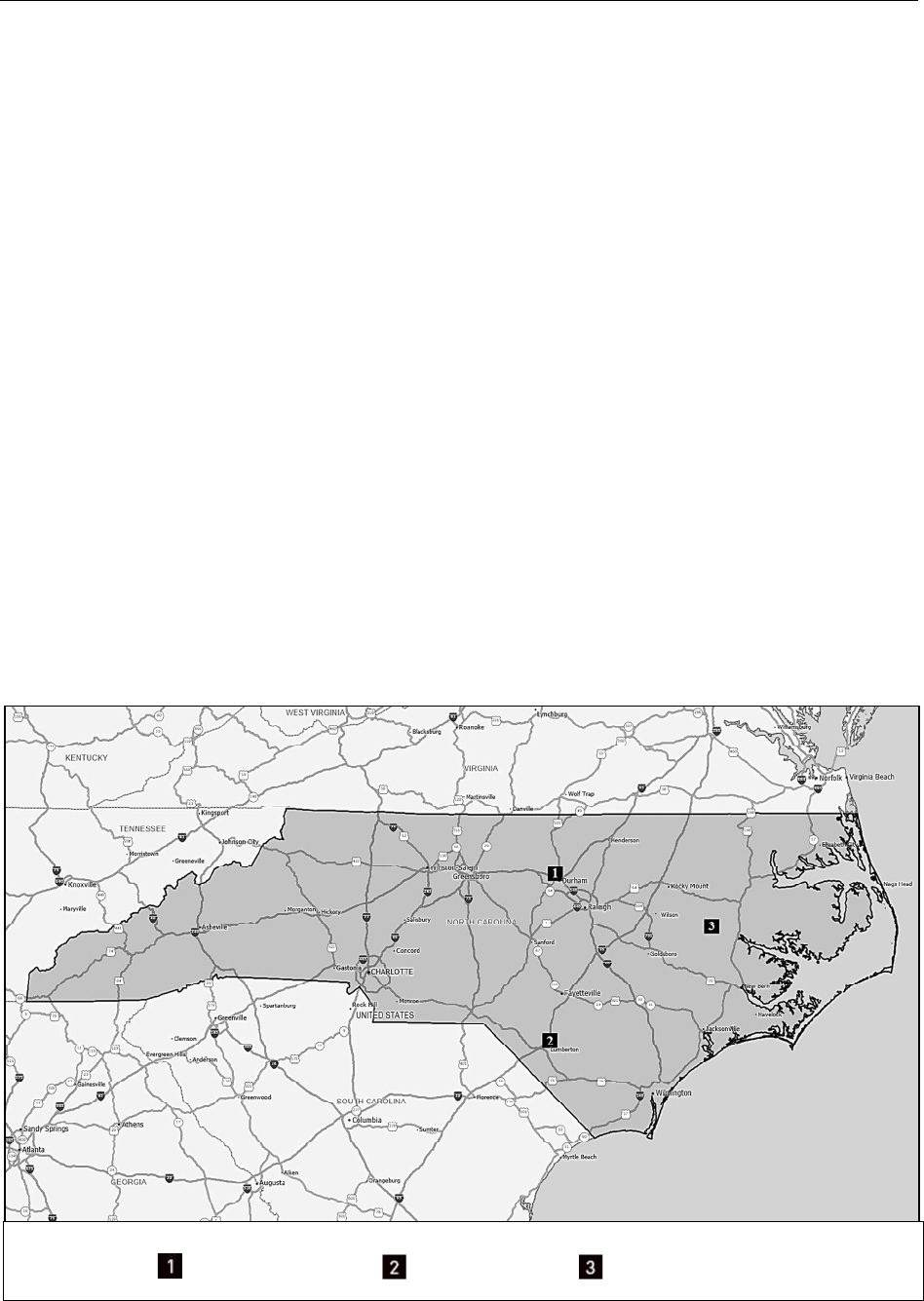

Croasdaile Village is owned and operated by The United Methodist Retirement Homes,

Incorporated ("UMRH"), a North Carolina not-for-profit corporation, which is committed to

providing a quality adult community that is fiscally sound and genuinely responsive to resident

needs. UMRH also owns Wesley Pines, a continuing care retirement community located in

Lumberton, North Carolina and Cypress Glen Retirement Community, a continuing care

retirement community located in Greenville, North Carolina. The financial information attached

to this Disclosure Statement includes financial information for UMRH and the consolidated

operations of Croasdaile Village, Cypress Glen and Wesley Pines. (See further explanation under

the "Financial Information" section of this Disclosure Statement.)

One of the purposes of this Disclosure Statement is to explain to prospective residents,

their families, and their advisors who and what is involved in the operation of Croasdaile Village.

This Disclosure Statement was prepared on the basis of information available at the time of its

publication and assumptions, which were believed to be realistic as of that date. Such information

and assumptions are, of course, subject to change and, in particular, are significantly affected by

changes in inflation and interest rates.

Since non-technical language has been used in this Disclosure Statement, the text of this

booklet and the language of the Residency Agreement signed by a resident may not be the same.

Although this Disclosure Statement details the provisions of the Residency Agreement, the

Residency Agreement serves as the sole binding contract between the resident and UMRH.

We are pledged to the letter and spirit of U.S. policy for the achievement of

equal housing opportunity throughout the Nation. We encourage and support

an affirmative advertising and marketing program in which there are no

barriers to obtaining housing because of race, color, religion, sex, handicap, or

national origin.

2

THE UNITED METHODIST RETIREMENT HOMES, INCORPORATED

The United Methodist Retirement Homes, Incorporated ("UMRH") is a not-for-profit

corporation originally chartered by the State of North Carolina on January 24, 1946. A Restated

Charter was filed with the Department of the Secretary of State for the State of North Carolina on

October 26, 1992. The principal business address of UMRH is 2600 Croasdaile Farm Parkway, Suite

A-500; Durham, North Carolina 27705.

UMRH is operated as a community service organization and is tax exempt under the

provisions of Section 501(c)(3) of Internal Revenue Code.

UMRH is the sole shareholder of UMRH Affordable Housing, Inc. UMRH-Affordable

Housing, Inc. is located at 2600 Croasdaile Farm Parkway, Suite A-500, Durham, NC 27705. It

was organized in 2002 in the State of North Carolina in conjunction with the Wesley Ridge project

(see more information below). UMRH Affordable Housing, Inc. is not responsible for the

contractual or financial obligations of UMRH.

UMRH is the sole member of UMRH Affordable Housing Development, LLC, located at

2600 Croasdaile Farm Parkway, Suite A-500, Durham, NC 27705. UMRH Affordable Housing

Development, LLC was organized in North Carolina in 2002 to further the charitable purposes of

UMRH by developing Wesley Ridge, a 24-unit affordable rental housing complex located adjacent

to Wesley Pines. UMRH Affordable Housing Development, LLC is not responsible for the

contractual or financial obligations of UMRH.

UMRH is also affiliated with The United Methodist Retirement Homes Foundation, Inc. (the

"Foundation"). The Foundation is a not-for-profit corporation, which was organized for the benefit

of the retirement communities operated by UMRH. Its purpose is to raise endowment funds, to

support benevolent care for those residents who are unable to pay for care, and to support special

programs. The Foundation is located at 2600 Croasdaile Farm Parkway, Suite A-500, Durham,

NC 27705. The Board of Trustees of UMRH are the same Board of Trustees for the Foundation.

UMRH and the Foundation are jointly obligated under the terms of the various bond agreements

entered into for the financing of Croasdaile Village, Cypress Glen and Wesley Pines.

UMRH is related by faith to the North Carolina Annual Conference, Southeastern

Jurisdiction, of The United Methodist Church. UMRH is governed by a corporate Board of Trustees.

The North Carolina Annual Conference of The United Methodist Church elects forty percent (40%)

of the Board of Trustees of UMRH. The North Carolina Annual Conference of The United Methodist

Church is not responsible for the financial and contractual obligations of UMRH.

UMRH and Croasdaile Village are also affiliated by membership with LeadingAge North

Carolina; the United Methodist Association of Health and Welfare Ministries; and LeadingAge

(National).

Other than disclosed above, UMRH is not affiliated with any other religious, charitable or

nonprofit organization.

3

BOARD OF TRUSTEES

The names and addresses of the members of the Board of Trustees of UMRH are listed below:

Mr. Lee Harris

Chair and Trustee

205 Shady Circle Dr.

Rocky Mount, NC 27893

Ms. Nancy Van Antwerp

Secretary and Trustee

649 Lipford Dr.

Cary, NC 27519

Mr. Mack Parker

Treasurer and Trustee

2204 Laurel Valley Way

Raliegh, NC 27604

Ms. Susan Ezekiel

Mr. Jonathan P. Erickson (ex-officio Trustee)

Corporate Executive Director

2600 Croasdaile Farm Parkway, Suite A-500

Durham, NC 27705

Vice Chair and Trustee

6303 Three Loy Rd.

McLeansville, NC 27301

Trustees:

Mr. Carl Hardy, 4104 Cypress Dr., Apt. B, Wilson, NC 27896

Mr. Charles Mercer, 4140 Parklane Avenue, Suite 200, Raleigh, NC 27612

Rev. Paul Lee, 105 Chancellors Ridge Ct., Cary, NC 27513

Rev. Gray Southern, P.O. Box 1970, Garner, NC 27529

Dr. Kenneth Steinweg, 108 Jamestown Rd., Greenville, NC 27858

Ms. Sheryl Taylor, 410 W 18

th

Street, Lumberton, NC 28358

Mr. James Martin 1902 N Walnut Street, Lumberton, NC 28358

Ex-Officio Members of the Board of Trustees:

Mr. Robert Brawley, 2 Aldersgate Court, Durham, NC 27705

Mr. Robert Clinkscales, 300 Francis Asbury Lane, Greenville, NC 27858

Ms. Phyllis Pate, 1000 Wesley Pines Road #306, Lumberton, NC 28358

Rev. Nina Paul Vinson, P.O. Box 238, Maury, NC 28554

There is not any professional service firm, association, trust, partnership or corporation, in

which the Executive Director, management staff or any member of the Board of Trustees has a 10

percent or greater interest in and which it is presently intended shall currently or in the future

provide goods, leases or services to the Community or to residents of the Community, of an

aggregate value of $500 or more within any year. Further, there is not any professional service

firm, association, trust, partnership, or corporation that currently provides any goods, leases or

services of an aggregate value of $500 or more within any year to the Community or to the

residents of the Community that has a 10% or greater interest in any officer, trustee or management

staff (including the Executive Director).

No Trustee or management staff of UMRH (i) has been convicted of a felony or pleaded

nolo contendere to a felony charge, or been held liable or enjoined in a civil action by final

judgment, if the felony or civil action involved fraud, embezzlement, fraudulent conversion, or

misappropriation of property; or (ii) is subject to a currently effective injunctive or restrictive court

4

order, or within the past five years, had any State or Federal license or permit suspended or revoked

as a result of an action brought by a governmental agency or department, if the order or action

arose out of or related to business activity of health care, including actions affecting a license to

operate a foster care facility, nursing home, retirement home, home for aged, or facility subject to

this Article or a similar law in another state. UMRH is not aware of any actions (as defined) against

any person (as defined) requiring disclosure.

CORPORATE EXECUTIVE DIRECTOR

Jonathan P. Erickson has been the corporate executive director over all of the UMRH

retirement communities since July 2007. Mr. Erickson holds a bachelor of arts in psychology from

North Park College in Chicago, Illinois, a master of science in community health from Northern

Illinois University in DeKalb, Illinois, and a certification in long-term care management from the

University of Connecticut. He is currently licensed as a nursing home administrator in the State of

Connecticut. Mr. Erickson has been an employee of Life Care Services LLC for over 25 years and

has over 35 years of experience in the senior housing industry.

EXECUTIVE DIRECTOR

Heather March, Executive Director, has been with The United Methodist Retirement

Homes, Inc. for over 23 years and served as the Assisted Living Administrator and Nursing Home

Administrator at Croasdaile Village for nine years prior to becoming the Associate Executive

Director in 2008. Ms. March holds a Bachelor of Science degree in Business Management from

West Virginia University Institute of Technology. In addition to her degree, Heather graduated

from the North Carolina LeadingAge Leadership Academy in 2018.

RESIDENT COUNCIL

Administration assisted residents in establishing the Resident Council and its bylaws. The

residents annually elect a council of representatives, which, in turn, forms committees in various

areas of concern to advise administration. Monthly meetings are held to facilitate communication

among residents, administration, and the Board of Trustees.

LIFE CARE SERVICES LLC

The Provider has retained Life Care Services LLC (“Life Care Services”) to manage the

Community. As the nation’s third largest operator of senior living communities, Life Care

Services serves more than 40,000 seniors in 140+ communities (see Exhibit A). With over 50

years of service, Life Care Services has developed expertise in nearly every facet of senior living

management. For more information, visit Life Care Services’ website:

https://www.lcsnet.com/management-services/management-services-overview.

Principal officers of Life Care Services include Joel Nelson, Chris Bird, Diane

Bridgewater, Jason Victor, and Jill Sorenson.

5

Joel Nelson: As chief executive officer of LCS, Joel Nelson is responsible for executing

mpany’s

stability and value among financial partners, property owners, and other stakeholders in the senior

living field. Joel joined LCS in 1986 and has held several executive roles during his long tenured

career with LCS. Today, he is responsible for the oversight of serving nearly 40,000+ seniors and

27,000 employees.

Joel serves as Chairman of the Board of Directors of LCS Holding Company, LLC, is a

member of the compensation committee and is a trustee of the Company’s 401(k) benefits

e

industry, Joel is the current chairman of the Argentum Board of Directors, and a member of the

National Investment Center operator advisory board and an executive member of the American

Senior Housing Association. Joel is active in the Des Moines community and serves as a trustee

for ChildServe. As a past board member, he remains active with the Alzheimer's Association and

the Central Iowa United Way Board of Directors.

Chris Bird: Capitalizing on his reputation as a change agent, Chris Bird brings his expertise

to the communities LCS serves. By leading operations, building community occupancy, fostering

capital partner relationships, and developing new business, Chris implements strategies to deliver

on the expectations of owners and shareholders. As president, chief operating officer, Chris

oversees Life Care Services, CPS, asset management, procurement, and onboarding operations.

His ability to analyze issues, devise continuous process improvements, and incorporate business

process initiatives drives performance improvement for the overall operation.

At LCS, Chris mentors future leaders by providing guidance, expertise and resources to

develop professional skills in the senior living industry. In addition, he is a member of the Board

of Directors of LCS Holding Company, LLC. Chris is a member of the Argentum Advisory

Council and the Argentum Chief Operating Officer Roundtable. He holds a bachelor's degree in

history from the University of Memphis, Tennessee.

Diane Bridgewater: As a high energy, results-driven executive, Diane Bridgewater directs

all financial aspects and operating infrastructure at LCS to ensure corporate, field and community

team members have the resources necessary to provide exceptional customer satisfaction to

residents. Serving as executive vice president/chief financial and administrative officer at LCS,

Diane is responsible for directing all financial and business operations in addition to overseeing

the company’s insurance business line, information technology, compliance, regulatory and legal

matters. In her executive leadership role, Diane helps to drive strategy development and execution

resulting in strong financial performance and growth.

At LCS, Diane serves on the Board of Directors of LCS Holding Company, LLC and its related

audit committee, compensation committee, retirement fiduciary committee, investment

committee, and enterprise risk management committee. Outside the organization, she is a member

of Argentum. In addition, Diane sits on the Casey’s General Stores board and audit committee.

She is also a member of the board and chair of the audit committee at Guide One Insurance. Diane

holds bachelor’s degrees in accounting and French from the University of Northern Iowa.

Jason Victor: Jason Victor is senior vice president, controller and treasurer for LCS. In

this role, he provides oversight and direction for the organization’s financial matters, ensuring its

consistent and efficient fiscal performance. Jason has responsibility for the organization’s

6

corporate accounting, corporate payroll, community payroll, treasury and tax departments. He

oversees all aspects of general accounting, cash management, billing and receivables, accounts

payable, payroll, consolidations, and financial reporting. In addition, Jason provides oversight and

guidance related to audits, internal controls, technical accounting, tax and financial management

systems.

At LCS, Jason serves on the insurance captive, Hexagon, board of directors. Jason holds a

bachelor’s degree in accounting from the University of Northern Iowa. He is a certified public

accountant with an active license in the state of Iowa.

Jill Sorenson: Leaning on her expertise to foster and maintain meaningful relationships,

Jill Sorenson leads the regional team serving a portfolio of 13 Life Plan communities. Following

her passion for serving seniors, Jill's responsibilities have grown during her career at LCS. From

roles in accounting, information technology, and corporate resource development to receiving her

nursing home administrator license, Jill is committed to serving others. Prior to her current

position, Jill provided leadership to 22 Life Plan communities where she was successful in

delivering on occupancy goals and achieving 4- and 5-star ratings from the Centers for Medicare

and Medicaid Services.

To ensure Life Care Services is serving the customer first and foremost, Jill initiated client

satisfaction surveys with client boards and owners to build stronger and more strategic

relationships. Outside LCS, Jill has served on the San Diego Region for Aging Services of

California and the Aging Services of California Board. She is a frequent presenter at national and

state industry conferences on topics affecting the senior living industry. Jill holds a bachelor's in

business administration from Simpson College and an MBA from the University of Phoenix.

Management of Croasdaile Village is performed by Life Care Services under contract with

UMRH. Life Care Services' responsibilities include: recruiting and employing the corporate

executive director; supervising the licensing, equipping, and staffing of Croasdaile Village;

preparing annual budgets; establishing and operating a system of financial controls for Croasdaile

Village, including comparative analyses with other facilities; and overseeing the food service and

quality accommodations provided by Croasdaile Village.

No managing member of Life Care Services (i) has been convicted of a felony or pleaded

nolo contendere to a felony charge, or been held liable or enjoined in a civil action by final

judgment, if the felony or civil action involved fraud, embezzlement, fraudulent conversion, or

misappropriation of property; or (ii) is subject to a currently effective injunctive or restrictive court

order, or within the past five years, had any State or Federal license or permit suspended or revoked

as a result of an action brought by a governmental agency or department, if the order or action

arose out of or related to business activity of health care, including actions affecting a license to

operate a foster care facility, nursing home, retirement home, home for aged, or facility subject to

this Article or a similar law in another state.

Life Care Services is not financially responsible for the contractual obligations or other

obligations of UMRH. The Board of Trustees of UMRH retains the ultimate responsibility for

hiring managers and monitoring the operating costs, wages, salaries, expenses, fees, and overall

fiscal viability of Croasdaile Village.

7

CROASDAILE VILLAGE

Croasdaile Village is located on Croasdaile Farm Parkway in Durham, North Carolina on

110 acres of land. It is a continuing care retirement community designed to accommodate persons

62 years of age or older in a dignified manner. Currently, Croasdaile Village has 298 apartments,

130 cottages, 24 Park Homes, 46 licensed assisted living units, and 104 licensed skilled nursing beds

in The Pavilion. As of September 30, 2023, there were 68 residents residing at Croasdaile Village.

Presently, the types of residences available include: studio/alcove apartments, one and

two-bedroom apartments, Park Home Apartments, duplex cottages, and free-standing homes. All

of the residences are equipped with safety features such as grab rails in the shower/bathtub and a

personal emergency transmitter system.

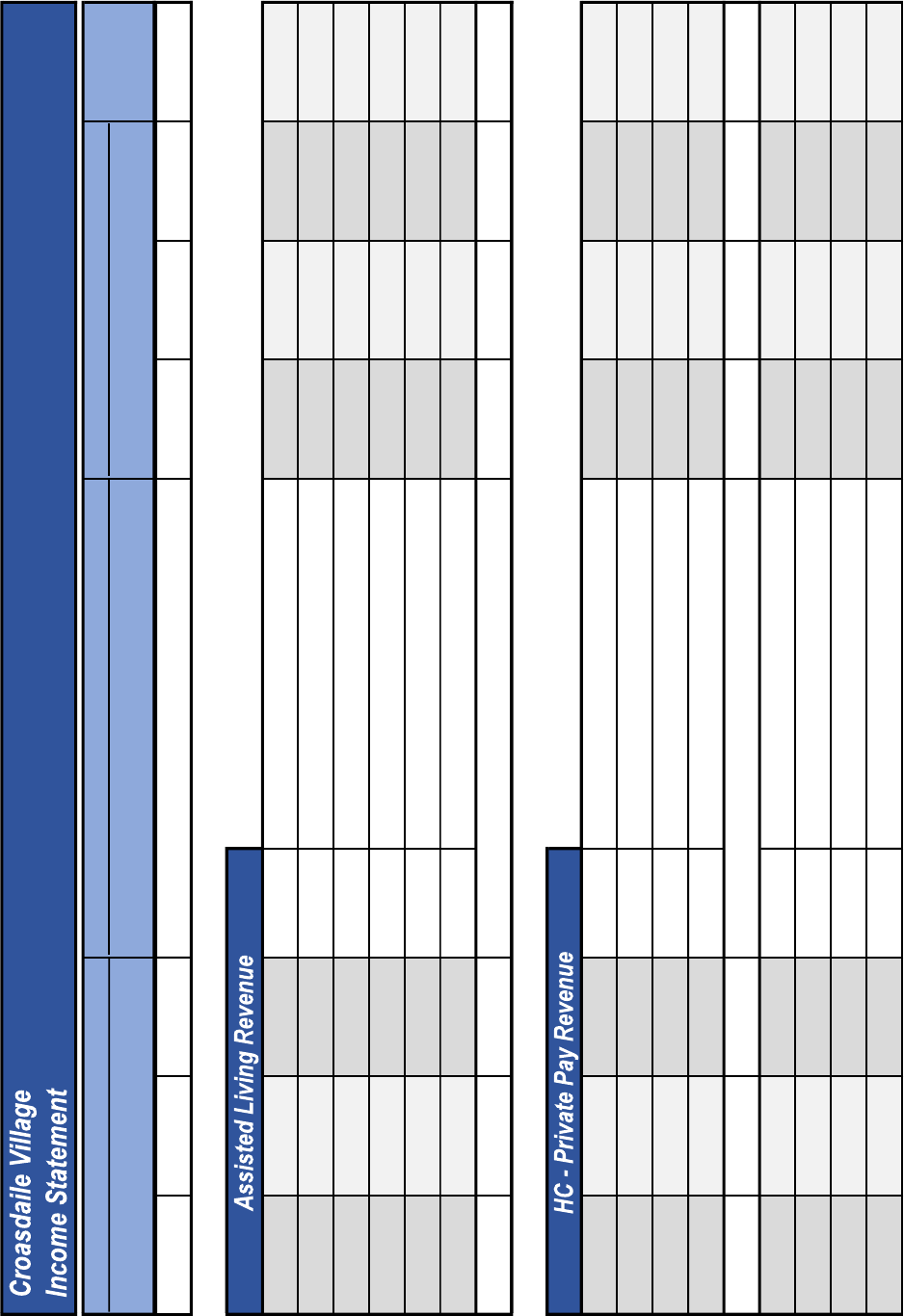

Assisted living services are offered in the licensed assisted living portion of Croasdaile

Village for an assisted living fee. Services include assistance with the activities of daily living,

such as ambulation, bathing, dressing, eating, personal hygiene, toileting, and the supervision or

administration of medications.

The Croasdaile Village health center, known as The Pavilion, offers intermediate care and

skilled nursing care and is licensed by the North Carolina Division of Health Services Regulation.

The Pavilion is also Medicare and Medicaid certified.

Each continuing care resident at Croasdaile Village is entitled to receive a total of six (6)

days of assisted living or nursing care at The Pavilion at no additional charge, except for the

charges for physician services and ancillary health services and supplies. Such six (6) days renews

on an annual basis and does not accumulate. After the six (6) days of care each year, the services

in assisted living and in The Pavilion are available for the assisted living fee or the per diem charge.

In addition to the primary intent of Croasdaile Village, which is to assure the residents of

continuing care throughout their retirement years, Croasdaile Village is designed to create an

environment that will enrich the lives of the people who live and work there. The design of the

main commons building provides areas for dining and meetings without detracting from the

homelike environment of Croasdaile Village. Some of the amenities that residents can enjoy

include: multiple dining venues, a private dining room, a multi-purpose room, an exercise room,

a health clinic, a physical and occupational therapy area, card rooms, a library, a mail area, an arts

and crafts studio, a gift shop, a living room, and a swimming pool.

SMOKE-FREE CAMPUS

Croasdaile Village is a "smoke-free" campus. Smoking (including E-Cigarettes) is not

allowed by residents, guests, and business invitees on the Croasdaile Village campus (inside or

outside), except in a designated outside area. No smoking areas include, but are not limited to, the

residences, Assisted Living, The Pavilion, hallways, dining rooms, public restrooms, lounge areas,

reception areas, waiting rooms, courtyards, entrances, walking paths, driveways, and any other

common areas. Smoking is only permitted at the designated area. Violation of the Smoke-Free

Campus Policy can result in cancellation of the Residency Agreement for just cause.

8

F

The UMRH Board and management team continually update the strategic master plan with

a focus on monitoring opportunities to improve Croasdaile Village. Included in the master plan

are common area improvements including renovation to kitchen, staff amenities space, and

wellness space and the addition of new independent living units to meet the demands of a growing

wait list. The master plan includes a net addition of 31 units in Coke Court and a net addition of

19 new units on the North Parcel. No definitive decisions as to timing, scope or financing have

been made or licenses applied for regarding future improvement projects at Croasdaile

Village. The addition of more independent living units would be contingent upon favorable

financial performance taking into account the new units and the receipt of an acceptable level of

pre-sales.

THE PROPOSAL

1. Criteria for Resident Acceptance and Continued Acceptance. Residency Agreements

are subject to acceptance by UMRH. At the time of the execution of a Residency Agreement, the

resident must be 62 years of age or older, capable of living in a residence (with or without

reasonable accommodation or reasonable modification), and have sufficient financial resources to

pay the Entrance Fee, Monthly Fee, and any extra charges incurred as defined in the Residency

Agreement.

UMRH uses the FINAID system to financially evaluate a prospective resident's net worth

and monthly income. FINAID projects income for prospective residents based on their financial

assets and income sources, and compares this revenue to projected expenses such as monthly fees,

personal expenses, and income taxes. Generally, a prospective resident should have a minimum

net worth equal to three (3) times the amount of the Entrance Fee (prior to payment of the Entrance

Fee). Generally, a prospective resident should have a minimum monthly income range of two times

the Monthly Fee (including second person fees when applicable) in effect at the time of residency.

Although the asset and income tests listed above are appropriate tests for financial wherewithal,

the FINAID software program will be used for all applicants to measure financial qualification.

An inquiry will be made of all prospective residents regarding the prospective resident's

ability to live in a residence, with or without reasonable accommodation or reasonable

modification. To determine whether a prospective resident meets the health guidelines, the

following information will be gathered: (1) insurance and health information will be obtained on

a Confidential Data Application and Resident Health Information Form – to be completed by the

prospective resident; (2) a Memory Health Assessment will be administered by the Community;

and (3) a Health Information Form will be completed by the prospective resident's physician.

After executing a Residency Agreement but prior to occupancy, UMRH can cancel the

Residency Agreement if the resident does not pay his or her Entrance Fee; for non-acceptance

based on the residency criteria listed above; or if the resident is unable to occupy the residence

because of illness, injury or incapacity.

If the resident encounters financial difficulties after residency at Croasdaile Village and is

unable to pay the total Monthly Fee or the fees for care in Assisted Living or The Pavilion, these

charges may be deferred as long as the resident has met all "spend-down" provisions of eligibility

for the Medicaid program (if applicable) and any public assistance funds. Financial assistance is

not available to a resident if he/she impaired his/her ability to meet financial obligations by

9

transferring assets other than to meet ordinary and customary living expenses or by not maintaining

Medicare Part A, Medicare Part B, supplemental insurance, or other health insurance after

assuming occupancy. A resident will be permitted to remain at Croasdaile Village for reduced fees

based on his/her ability to pay for as long as the resident establishes facts to justify the deferment.

Financial assistance is only available if it does not impair UMRH's ability to operate Croasdaile

Village on a sound financial basis for the benefit of all residents.

UMRH has the right to cancel the resident's residency (i) if the resident does not comply with the

terms of the Residency Agreement or the published operating procedures, covenants, rules,

regulations or policies; or (ii) if the resident misrepresented himself/herself during the residency

process; or (iii) for nonpayment of fees or charges; or (iv) if it is determined the resident's health

status or behavior constitutes a substantial threat to the health or safety of the resident or others,

including refusal to consent to relocation, or behavior that would result in physical damage to the

property of others or Croasdaile Village; or (v) if the resident's physical or mental condition cannot

be cared for in Assisted Living or The Pavilion within the limits of their licenses.

2. Residency Agreement. At the time the resident makes application for residency at

Croasdaile Village, the resident will sign a Residency Agreement to reserve the residence selected

and will pay an Entrance Fee deposit to UMRH. The balance of the Entrance Fee is due upon the

earlier of the date the resident occupies Croasdaile Village or within 90 days after the resident

executes the Residency Agreement. The resident will also pay a non-refundable Application Fee.

The Application Fee will be used by UMRH to process resident's application for residency.

Croasdaile Village offers various types of Residency Agreements for the residential living

portion of Croasdaile Village: a 90 Percent Return of Capital Plan; a 50 Percent Return of Capital

Plan; and a Standard Plan. The difference between these types of Plans is the amount of the

Entrance Fee paid and the amount of the refund a resident (or resident's estate) is entitled to after

a resident assumes occupancy at Croasdaile Village as described in Paragraph 3.5 below.

3. Reimbursement of the Entrance Fee.

3.1 Nonacceptance. If the resident is not accepted for residency at Croasdaile

Village, the full amount of the Entrance Fee paid by the resident will be promptly refunded,

without interest. If the resident's spouse or second person does not meet the requirements for

residency, said person may be admitted directly into Assisted Living or The Pavilion as long

as accommodations are available and such person qualifies for the care available in those

facilities. He/she will pay the full assisted living fee, and Pavilion per diem charge for such

care.

3.2 Right of Rescission. In accordance with North Carolina laws and regulations

governing continuing care retirement communities, a resident has the right to rescind the

Residency Agreement within thirty (30) days following the later of (i) his/her execution of the

Residency Agreement; or (ii) the receipt of a Disclosure Statement. The resident is not

required to move into Croasdaile Village before the expiration of the 30-day rescission period.

If the resident rescinds the Residency Agreement, the full amount of the Entrance Fee paid by

the resident will be refunded, without interest, within sixty (60) days of receipt of the written

notice of rescission.

3.3 Cancellation Prior to Occupancy Due to Death, Illness, Injury, Incapacity or a

Substantial Change in Physical, Mental or Financial Condition. If the resident dies before

10

occupying the residence at Croasdaile Village or if, on account of illness, injury or incapacity,

a resident is unable to occupy the residence at Croasdaile Village, then the Residency

Agreement will automatically cancel. The resident may also cancel the Residency Agreement

prior to occupancy due to a substantial change in resident's physical, mental or financial

condition. In all of these events of cancellation prior to occupancy, the resident or resident's

estate will receive a refund of the Entrance Fee paid, without interest, less any costs

specifically incurred by Croasdaile Village at the resident's request. Said refund will be made

within sixty (60) days of receipt of the notice of cancellation.

3.4 Cancellation Prior to Occupancy for Other Reasons. If the resident cancels

the Residency Agreement prior to occupancy, but after the right of rescission period, for

reasons other than those state in Paragraph 3.3 above, the resident will receive a refund of the

Entrance Fee paid, without interest, less a non-refundable portion of the Entrance Fee equal

to $2,000 and less any costs specifically incurred by Croasdaile Village at resident's request.

Said refund will be made within sixty (60) days of receipt of the notice of cancellation.

3.5 Cancellation After Occupancy. In the event the Residency Agreement is

canceled after occupancy or in the event of resident's death after occupancy, refund of the

Entrance Fee will be as follows:

3.5.1 90 Percent Return of Capital Residency Agreement: Under the 90 Percent

Return of Capital Residency Agreement, resident or resident's estate will receive a

refund of the amount of the Entrance Fee previously paid by resident, without interest,

less two percent (2%) for each month of residency or portion thereof for up to five (5)

months. Subject to Croasdaile Village's right of offset, the refund of the Entrance Fee

will not be less than ninety percent (90%). Said refund will be paid at such time as

the residence is reserved by a new resident and said new resident has paid the full

amount of the Entrance Fee or within two years from the date of cancellation,

whichever occurs first.

3.5.2 50 Percent Return of Capital Residency Agreement: Under the 50 Percent

Return of Capital Residency Agreement, resident or resident's estate will receive a

refund of the amount of the Entrance Fee previously paid by resident, without interest,

less two percent (2%) for each month of residency or portion thereof for up to twenty-

five (25) months. Subject to Croasdaile Village's right of offset, the refund of the

Entrance Fee will not be less than fifty percent (50%). Said refund will be paid at

such time as the residence is reserved by a new resident and said new resident has paid

the full amount of the Entrance Fee or within two years from the date of cancellation,

whichever occurs first.

3.5.3 Standard Residency Agreement: Under the Standard Residency Agreement,

resident or resident's estate will receive a refund of the amount of the Entrance Fee

previously paid by resident, without interest, less two percent (2%) for each month of

residency or portion thereof for up to fifty (50) months. After fifty (50) months of

occupancy, no refund of the Entrance Fee will be made. Said refund, if any, will be

paid at such time as the residence is reserved by a new resident and said new resident

has paid the full amount of the Entrance Fee or within two years from the date of

cancellation, whichever occurs first.

11

3.5.4 Residential Living with Personal Services Residency Agreement: Under the

Residential Living with Personal Services Residency Agreement, resident or

resident's estate will receive a refund of the amount of the Entrance Fee previously

paid by resident, without interest, less two percent (2%) for each month of residency

or portion thereof for up to fifty (50) months. After fifty (50) months of occupancy,

no refund of the Entrance Fee will be made. Said refund, if any, will be paid at such

time as the residence is reserved by a new resident and said new resident has paid the

full amount of the Entrance Fee or within two years from the date of cancellation,

whichever occurs first.

3.6 Cancellation Upon Death. In the event of death of the resident at any time after

occupancy, the Residency Agreement shall cancel and the refund of the Entrance Fee paid by

the resident will be as outlined in Paragraph 3.5 above.

3.7 Cancellation by UMRH. Upon thirty (30) days written notice to the resident

and/or his or her legal representative, UMRH may cancel the Residency Agreement at any

time on the following grounds, which shall be determined by UMRH in its sole discretion:

Resident does not comply with the terms of the Residency Agreement or Croasdaile

Village's procedures, covenants, rules or policies; or

Resident misrepresents himself or fails to disclose information during the residency

process; or

Resident fails to make payment to UMRH of any fees or charges due UMRH within

sixty (60) days of the date when due; or

Resident's health status or behavior constitutes a substantial threat to the health or

safety of resident, other residents, or others, including Resident's refusal to consent to

relocation, or would result in physical damage to the property of Croasdaile Village

or others; or

Resident's physical or mental condition cannot be cared for in the Croasdaile Village

Health Center within the limits of Croasdaile Village's license.

Cancellation by UMRH occurs only as a last resort, after it becomes clear to UMRH

that cancellation is necessary, and after the resident and/or the resident's legal representative/

responsible party has an opportunity to be heard. Any refund of the Entrance Fee would be

computed on the same basis as stated in Paragraph 3.5 above.

4. Payment of a Monthly Fee. The resident is required to pay a Monthly Fee to

Croasdaile Village upon receipt of a statement and by no later than the fifteenth (15

th

) day of each

month. If there are two residents, a second person Monthly Fee will also be paid. The Monthly

Fees are paid to provide the services and amenities described in the Residency Agreement and to

meet the expenses associated with the operation of Croasdaile Village. UMRH may increase the

Monthly Fee upon thirty (30) days written notice to the residents if UMRH deems it necessary in

order to meet the financial needs of Croasdaile Village and to provide the services to the residents.

5. Health Care Services. Each resident is eligible to receive a total of six (6) days

each year of either assisted living care or nursing care in The Pavilion while a resident of his/her

residence. If there are two residents under a Residency agreement, each resident will receive six

(6) days, but the days cannot be combined and used by only one resident. Such six (6) days renews

on an annual basis and does not accumulate. While utilizing the six (6) days, the resident will be

12

required to continue to pay the Monthly Fee for his/her residence, as well as any charges for

physician services and ancillary health services and supplies. Once a resident is permanently

relocated to Assisted Living or to The Pavilion, he/she no longer qualifies for the six (6) free days

of assisted living or nursing care and will be required to pay the assisted living fee or the per diem

charge for such care. [NOTE: The six (6) days of care is a combined total for assisted living care

and nursing care at Croasdaile Village.]

6. Relocation/Moves. UMRH reserves the right to relocate a resident to a different

residence or a higher level of care after consultation with the resident, resident’s family and attending

physician if it is determined that such a move should be made for the benefit of the resident or for the

proper operation of Croasdaile Village or to meet the requirements of law.

7. Provisions for New Second Resident. No person other than the resident may

occupy the residence without UMRH's prior written approval. If a second person, who is not a

party to the Residency Agreement, wishes to become a resident of Croasdaile Village, that person's

acceptance will be in accordance with the current residency policy. An Entrance Fee as determined

by Croasdaile Village will be paid upon residency. In addition, each month the then-current

Monthly Fee for second persons will be paid. If the second person does not meet the requirements

for residency, he or she will not be permitted to occupy the residence for more than thirty (30)

days, except with UMRH's written approval.

8. Provisions for Resident Marrying Resident. Should the resident marry a person who

is also a resident of Croasdaile Village and should they decide to occupy one residence, they must

declare which residence will be occupied and which residence will be released. The refund due

for the released residence will be as described in Paragraph 3.5 above. Each month, the then-

current Monthly Fee for second persons shall be paid.

9. Insurance. The Residency Agreement requires that the resident maintain Medicare

Part A, Medicare Part B and one supplemental health insurance policy or equivalent insurance

coverage acceptable to UMRH. It is also recommended that residents carry personal property

insurance and liability insurance.

10. Financial Assistance. Financial assistance may be available to existing continuing

care residents who live at Croasdaile Village under a continuing care residency agreement. The

resident cannot impair his/her ability to meet his/her financial obligations by transfer of assets

other than to meet ordinary and customary living expenses or by not maintaining Medicare Part

A, Medicare Part B, supplemental insurance or other health insurance as outlined in the Residency

Agreement. A resident must have met all "spend-down" provisions established in UMRH's

Benevolence Policy. The Pavilion at Croasdaile Village is Medicaid certified. The resident must

agree to apply for public assistance funds (if available) and/or Medicaid, depending on the level

of care required by the resident. Financial assistance funds are available as long as providing

financial assistance does not impair UMRH's ability to operate Croasdaile Village on a sound

financial basis for the benefit of all residents.

UMRH does not offer financial assistance to those residents who are admitted directly to

Assisted Living or The Pavilion (skilled nursing) as private pay residents. Private pay residents

are individuals who did not execute a continuing care residency agreement for residential living.

11. Tax Deductions. In accordance with the Internal Revenue Code of 1954, Section

213 and Revenue Rulings (67-185, 68-625, 76-481, 75-302, 75-303, and 93-72) and a Private

13

Letter Ruling (8213102), residents of Croasdaile Village may be entitled to an itemized deduction

for medical expenses for that portion of the Monthly Fees and Entrance Fees, which represents

medical care in the year paid. The tax regulations do not specifically provide a formal method for

computing what this portion is; however, IRS Letter Ruling 8213102 indicates a method of

calculating a medical expense percentage by using the ratio of medical expenses to all expenses of

the Community. Currently, this methodology is in use, but may be subject to change. Each year,

the Community distributes a letter to residents describing the recommended medical expense

percentages for tax purposes.

All deductions are, of course, subject to limitations imposed by the Internal Revenue Code.

Residents are encouraged to consult with a qualified tax advisor before taking any tax deductions.

THE SERVICES

1. The following services are provided for the Monthly Fee to the residents of the

residential living apartments, cottages and homes of Croasdaile Village:

Flexible Meal Plan

Studio apartment residents receive three meals per day;

Limited tray service to be provided when approved by authorized staff;

Consultation and preparation of routine special diets;

Utilities, which include heating, air conditioning, electricity, water, sewer and

trash removal;

Basic cable television package;

Building janitor and maintenance;

Grounds keeping;

Weekly housekeeping services;

Availability of laundry facilities so that resident can wash and dry personal

laundry;

Planned activities (social, cultural, recreational, educational, and spiritual) for

those who wish to participate;

Services of a chaplain;

Parking for residents and guests;

Carpeting (except in kitchen and bath), unless some other floor surface has

been installed;

Kitchen facilities, except studio apartments only containing a sink, a

refrigerator, and a microwave;

Local transportation as scheduled by us and as posted;

Limited additional storage space;

Personal emergency transmitter system;

Smoke detectors;

Security – 24 hours a day; and

Six (6) days of assisted living or nursing care in the Village Health Center.

2. The following services are available for an extra charge to the residents of the residential

living apartments, cottages and homes of Croasdaile Village:

The dining room is available for three (3) meals per day with the second and

third meals at additional charge;

Extended tray service as approved by authorized staff;

14

Preparation of special diets (beyond those which are routine and based upon

our ability to prepare/offer such diet), as prescribed by resident's attending

physician;

Additional housekeeping services;

Guest accommodations, if available;

Guest meals;

Private catered functions;

Personal transportation and transportation for special events and group trips;

Expanded cable television package;

Services of the Clinic – a copy of the charges for Clinic services can be

obtained from the Clinic;

Home care services through the Croasdaile Village Home Care Program;

Assisted living services or nursing care services through the Village Health

Center; and

Certain ancillary services and supplies (such as therapies, pharmacy,

laboratory, therapeutic activities, rehabilitative treatments, medical

equipment, medical supplies, medical treatment, physician services, and other

miscellaneous medical services and supplies).

3. Assisted living services are available in the Assisted Living building and skilled

nursing services are available in The Pavilion, which is staffed by licensed nursing personnel 24

hours a day. If the resident occupies Assisted Living or The Pavilion, the resident will be required

to enter into a separate admission agreement for the applicable level of care. These separate

admission agreements will outline in detail the services available in those levels of care. The

resident’s continuing care Residency Agreement will continue to stay in effect unless it is canceled

by the Resident or by UMRH as outlined in the Residency Agreement. Services provided in

Assisted Living and The Pavilion are governed by the North Carolina Division of Health Service

Regulation.

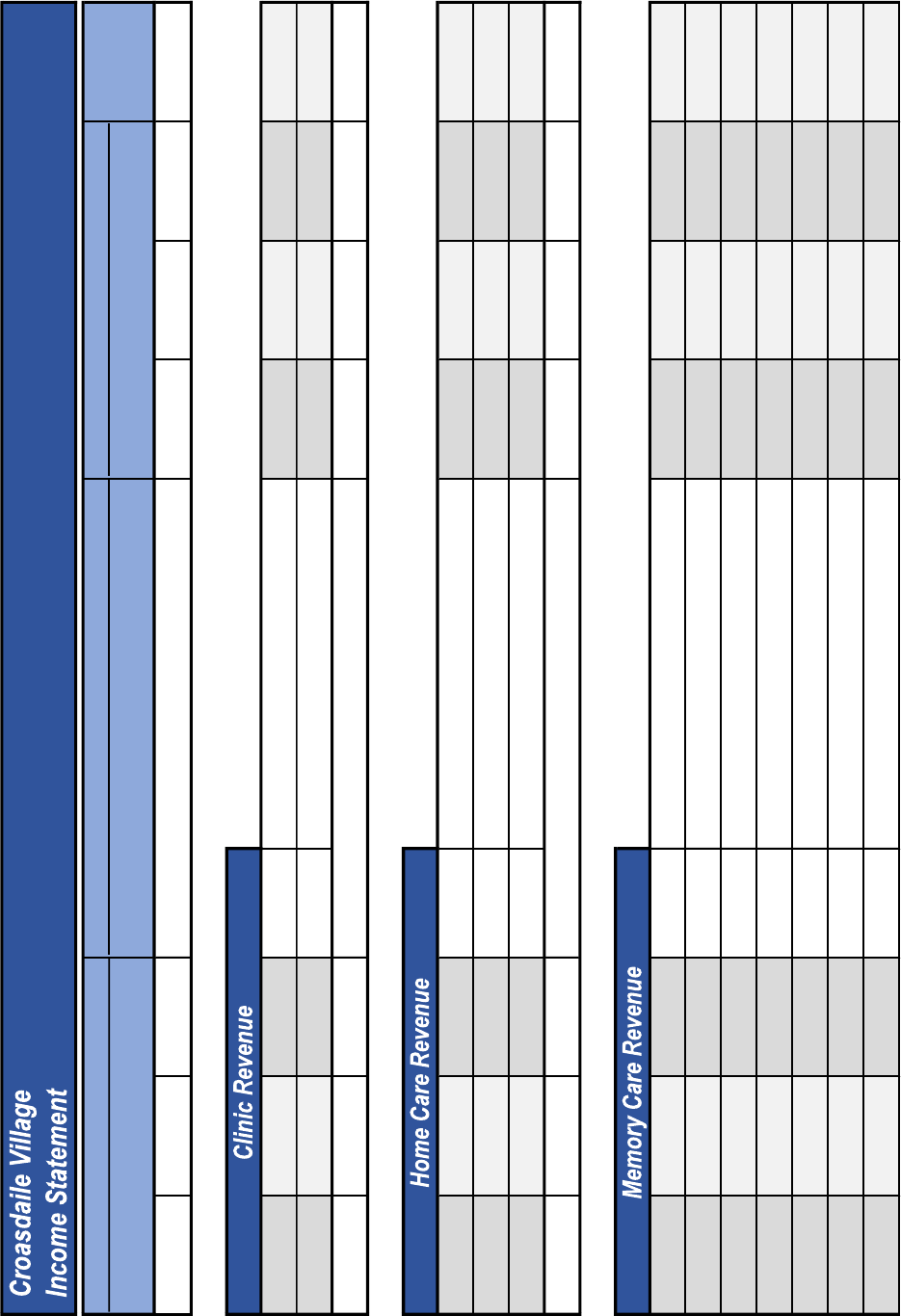

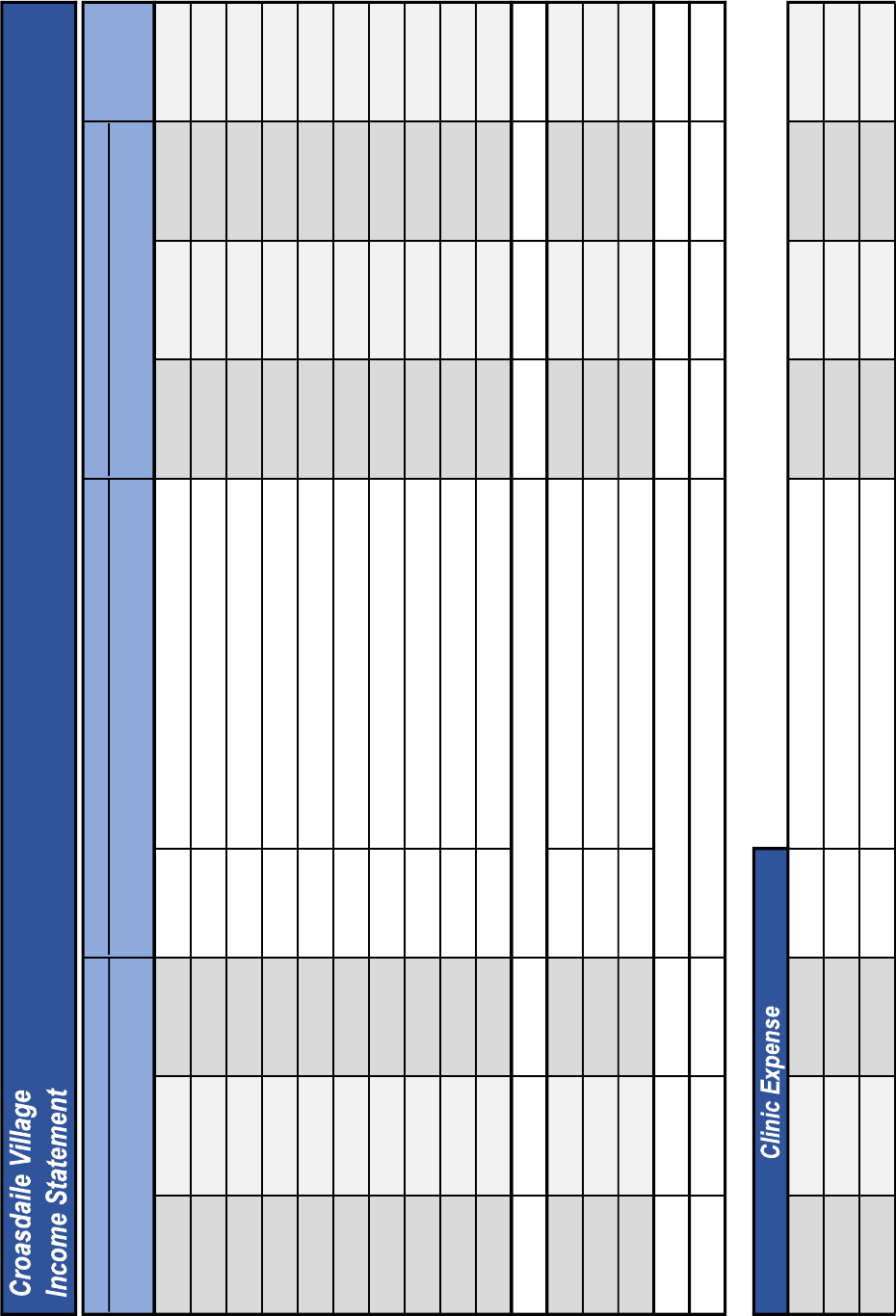

4. The Clinic is available for certain examinations, consultations, tests and

appointments. Such services will be at an extra charge to the resident.

FEES

1. The fee requirements for residential living in an apartment, cottage or home at

Croasdaile Village are as follows:

A. Application Fee. Non-refundable application fee of $200 for an individual or

$300 for a couple is required to be paid at the time of application.

B. Entrance Fee. Payment of an Entrance Fee assures a resident a place in the

Community for life as long as the resident complies with the Residency Agreement. At the

time the resident makes application for residency at the Community, the resident will sign a

Residency Agreement to reserve the residence selected and will pay an Entrance Fee deposit

to the Community. The balance of the Entrance Fee will be paid upon the earlier of (i)

occupancy or (ii) 90 days after the Residency Agreement is executed. For residents who enter

Residency Agreements for a unit to be constructed, the balance of the Entrance Fee will be

paid upon the earlier of (i) occupancy or (ii) 30 days from the date the resident is notified that

the residence is ready for occupancy. The amount of the Entrance Fee is determined by single

or double occupancy and the size and type of the residence reserved. A schedule of Entrance

15

Fees can be found later in this Disclosure Statement. Additional information regarding

payment terms and Entrance Fee refunds can be found in Sections 2 and 3 of The Proposal

section of this Disclosure Statement.

C. Monthly Fee. A Monthly Fee for services is required to be paid each month

per person. Monthly Fees are determined by single or double occupancy and the size and type

of residence reserved. A schedule of current Monthly Fees can be found later in this

Disclosure Statement.

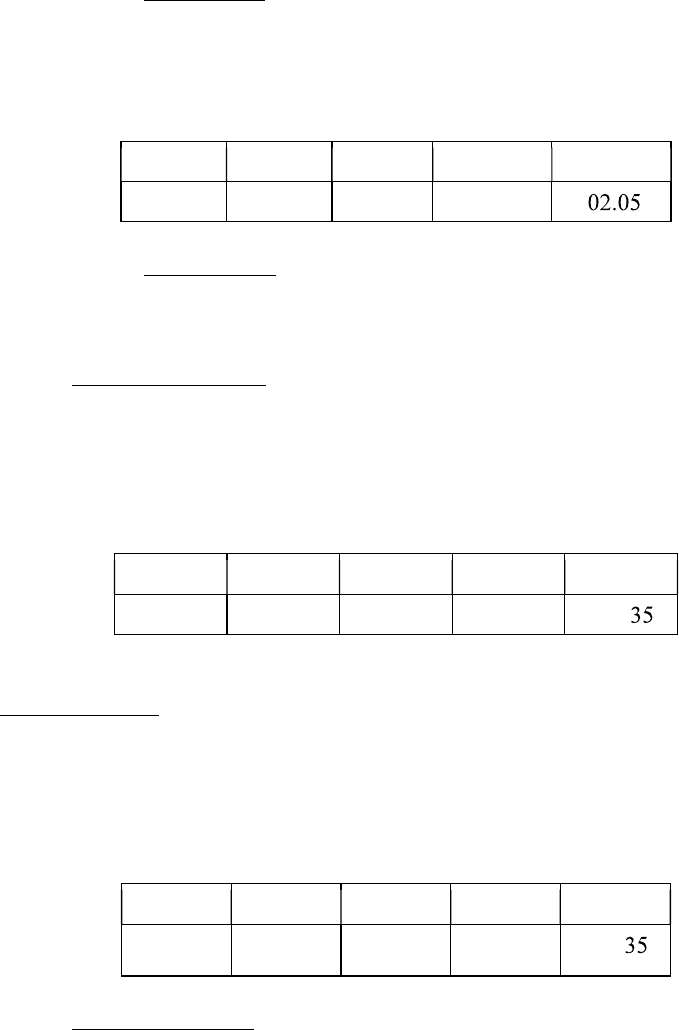

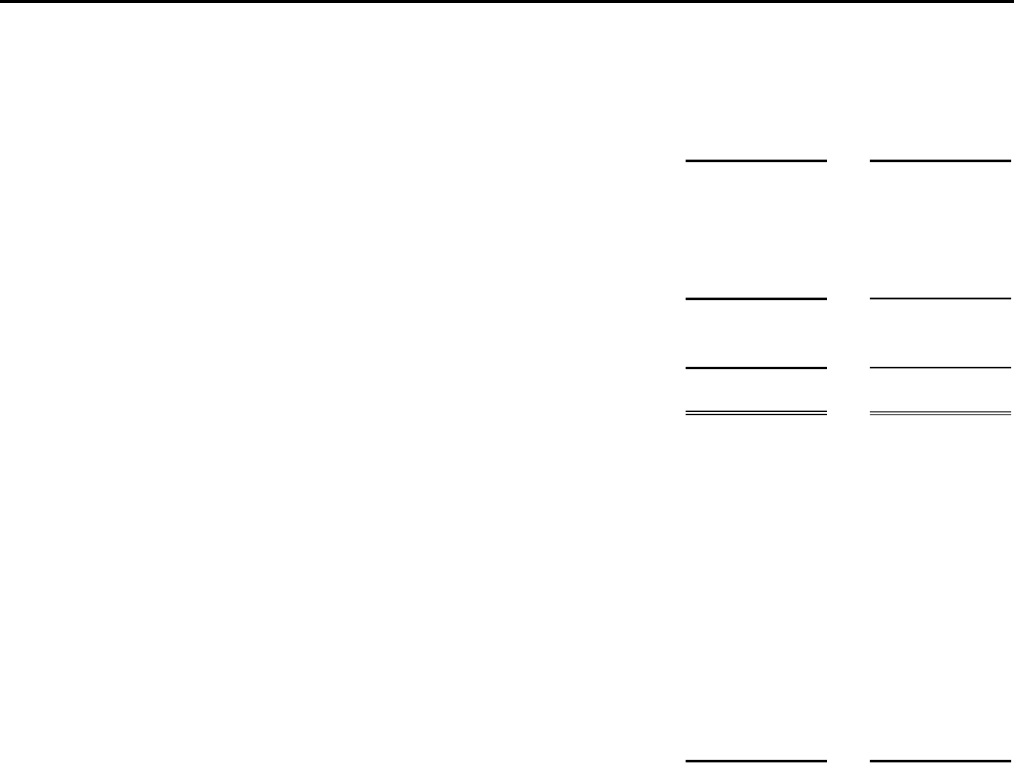

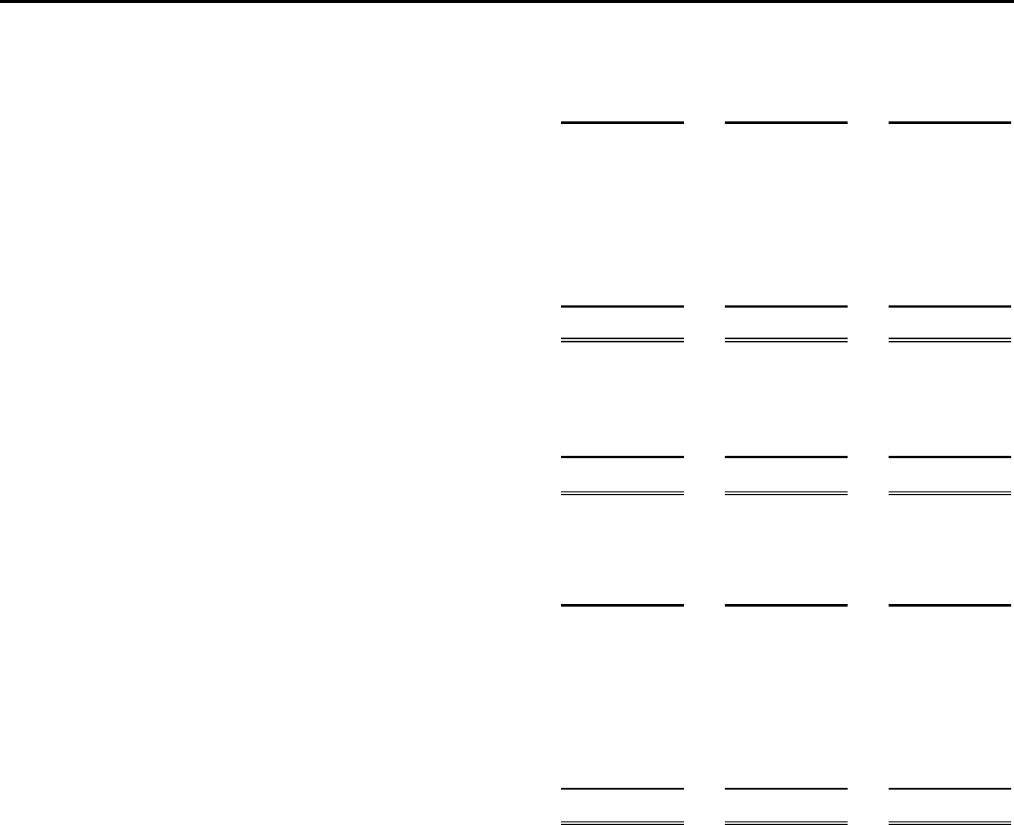

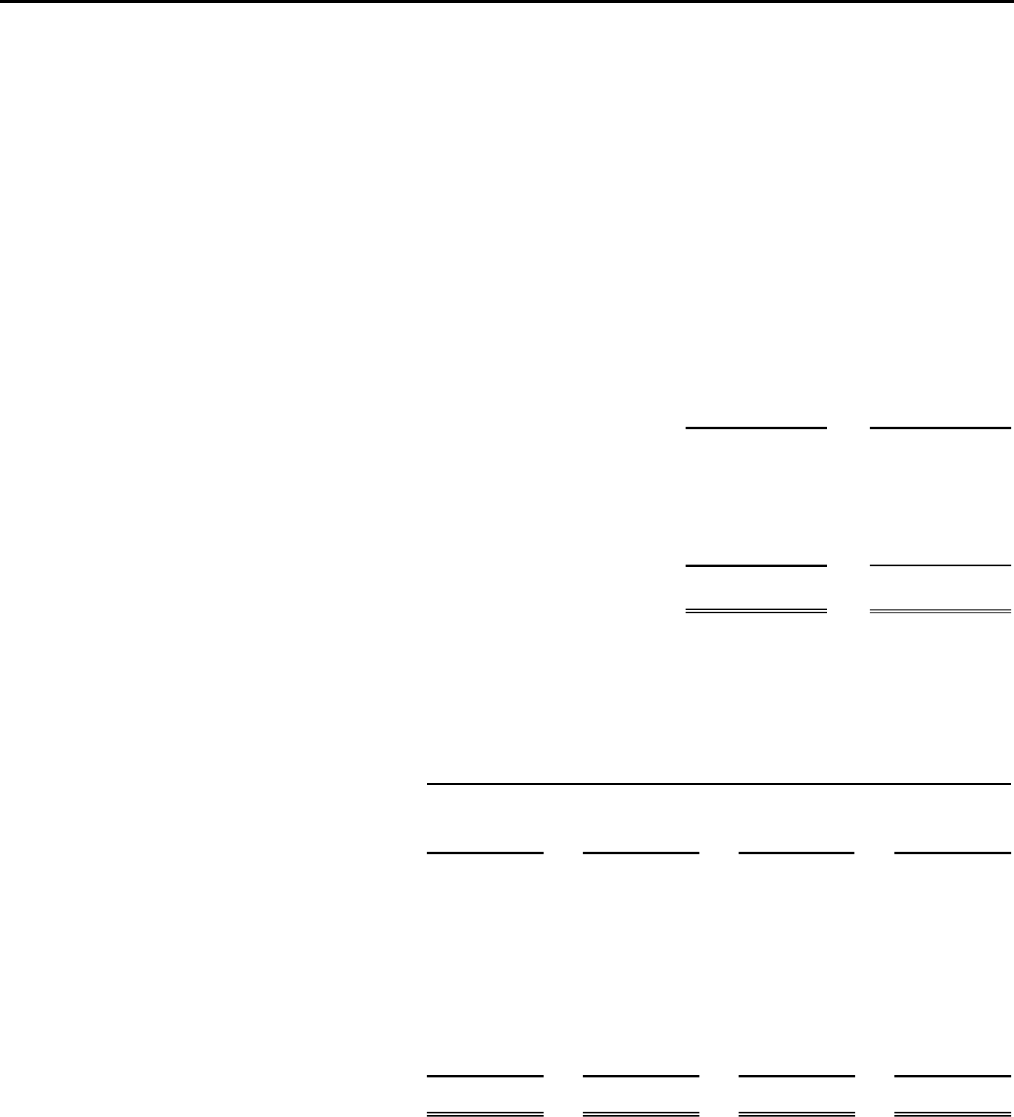

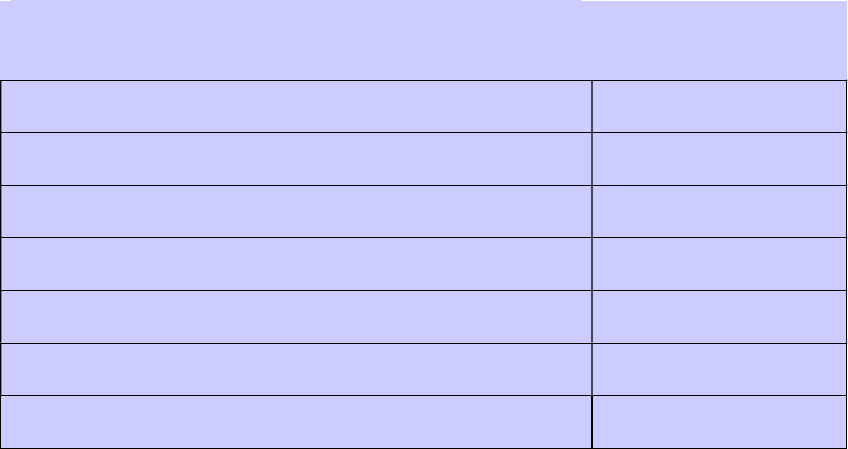

Monthly Fees – Average Dollar Amount of Increase

2020 2021 2022 2023 2024

$108.26 $133.41 $138.17 $295.71 $2

D. Extra Charges. A list of items available for an extra charge, including the fees

for such items, is included in this Disclosure Statement as Attachment 7. The list can also be

obtained from the Village's Business Office and the Village's Marketing Office.

2. Assisted Living Fees. The Entrance Fee requirements for direct admission to Assisted

Living at Croasdaile Village have been established at $26,221. There is a non-refundable application

fee of $200 per individual. The per diem charge for assisted living care is $372 for a one- or two-

bedroom apartment and $334 for a studio apartment in medical assisted living and the per diem charge

for residents living in the memory support apartments is $372.

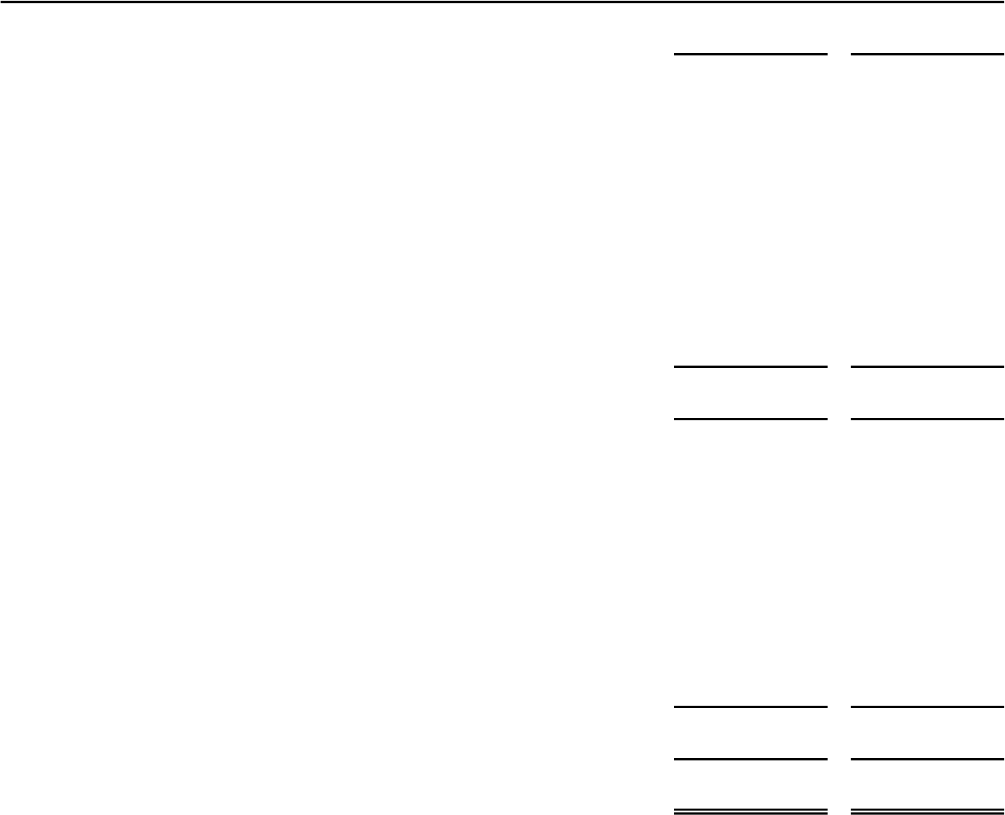

Assisted Living Fees – Average Dollar Amount of Increase

2020 2021 2022 2023 2024

$9.00 $10.75 $11.75 $19.50 $17.

3. Health Care Fees. The per diem charges for nursing care in The Pavilion at Croasdaile Village

are:

Skilled Nursing Care

Semi-Private Room $417

Private Room $467

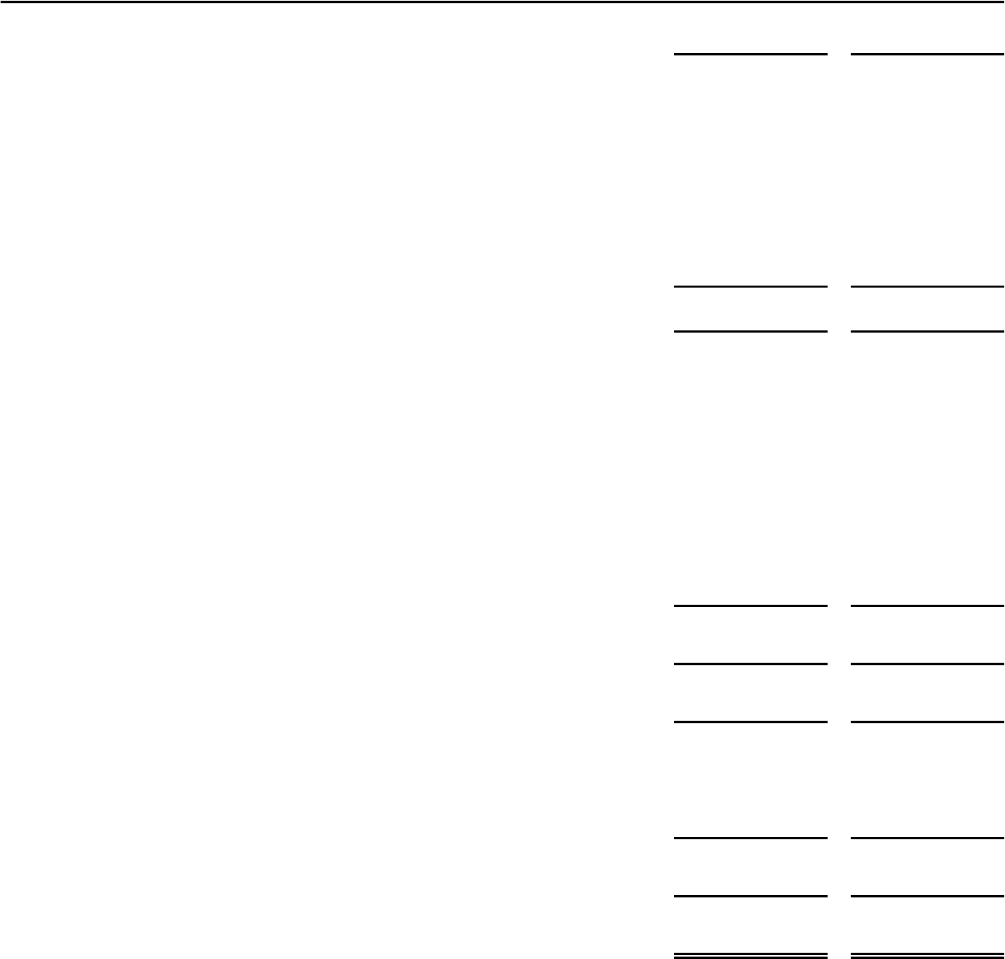

Health Care Fees – Average Dollar Amount of Increase

2020 2021 2022 2023 2024

$12.00 $13.50 $15.00 $23.50 $25.

4. Adjustment of Fees. UMRH may adjust the Monthly Fee as determined by the Board

of Trustees in order to maintain the desired quality of service and to operate Croasdaile Village on a

fiscally sound basis. UMRH shall provide the resident with thirty (30) days' written notice in advance

of any change in the Monthly Fees.

The Standard Entrance Fee amortizes by two percent (2%) each month for fifty (50) months.

For a fifty percent (50%) refundable fee, multiply the Standard Entrance Fee times 1.4. The

16

Fifty Percent (50%) Refundable Plan amortizes by two percent (2%) each month for the first

twenty-five (25) months and does not reduce thereafter.

For a ninety percent (90%) refundable fee, multiply the Standard Entrance Fee times 1.8.

The Ninety Percent (90%) Refundable Plan amortizes by two percent (2%) each month for the first

five (5) months and does not reduce thereafter.

17

FINANCIAL INFORMATION

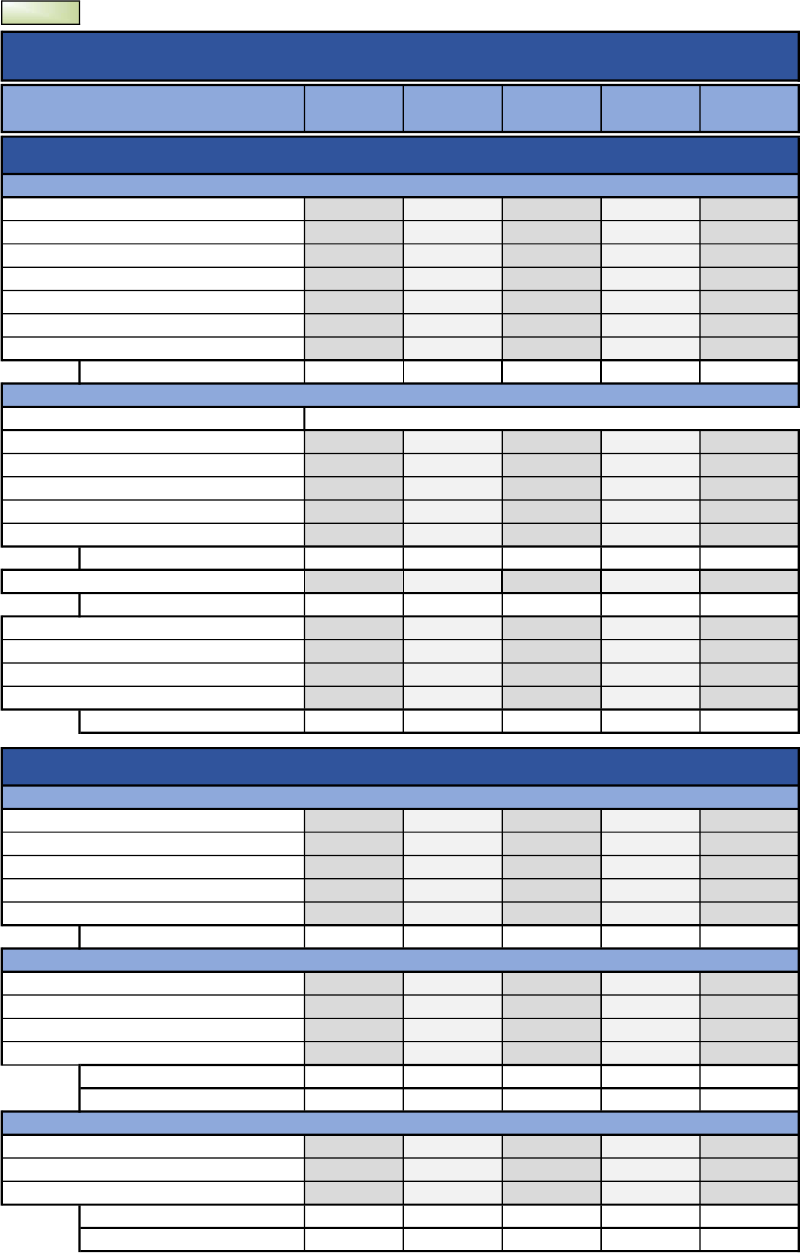

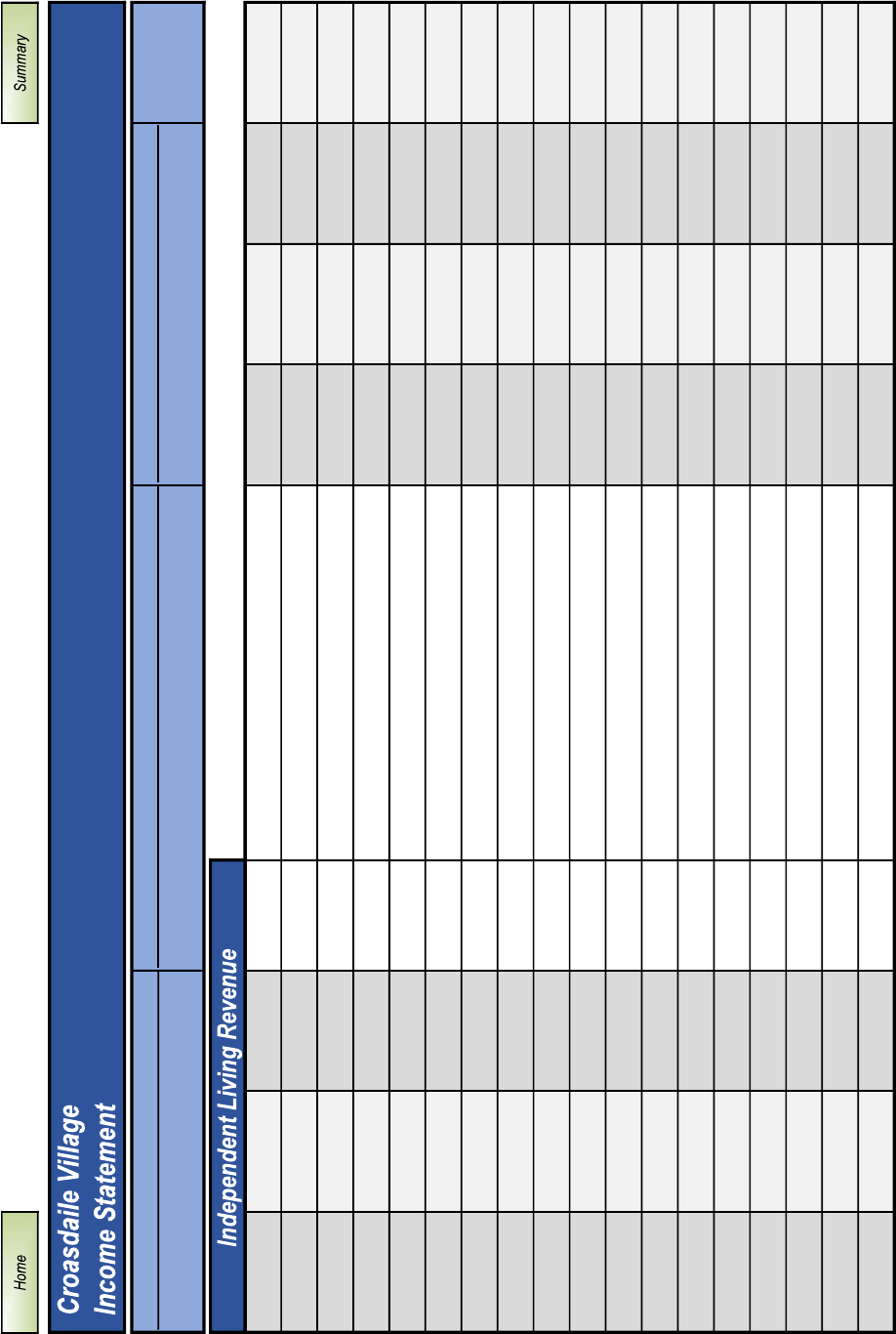

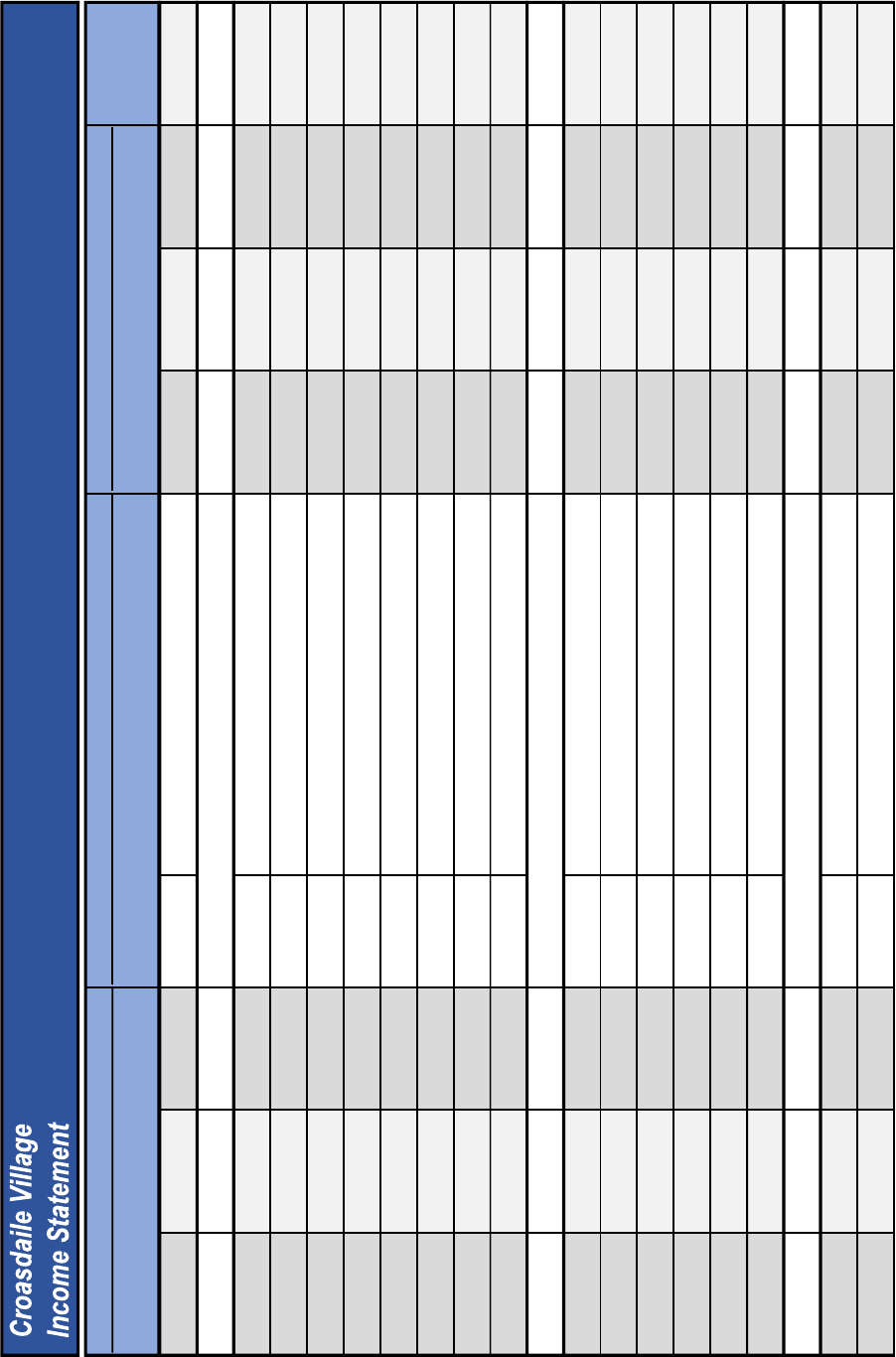

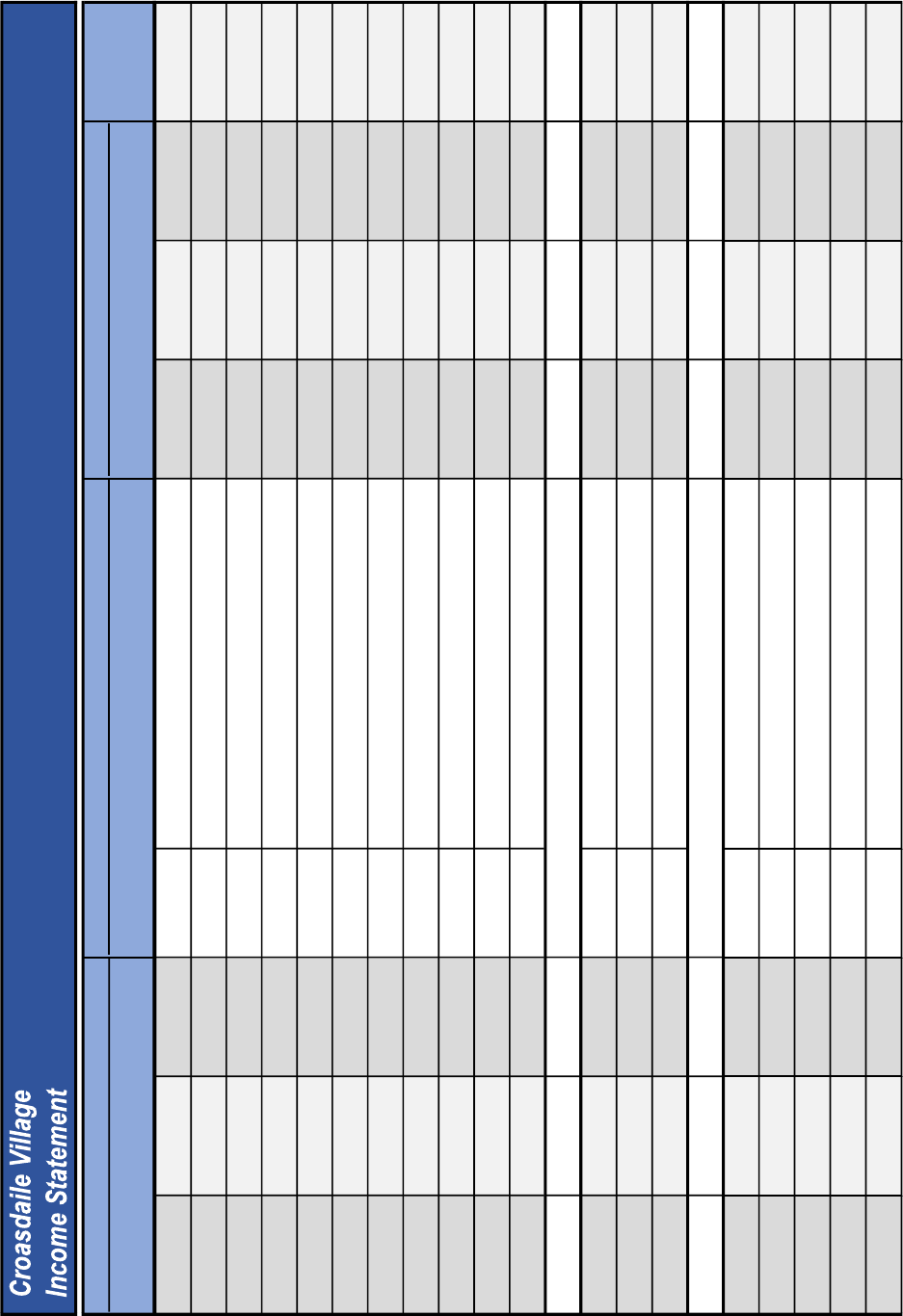

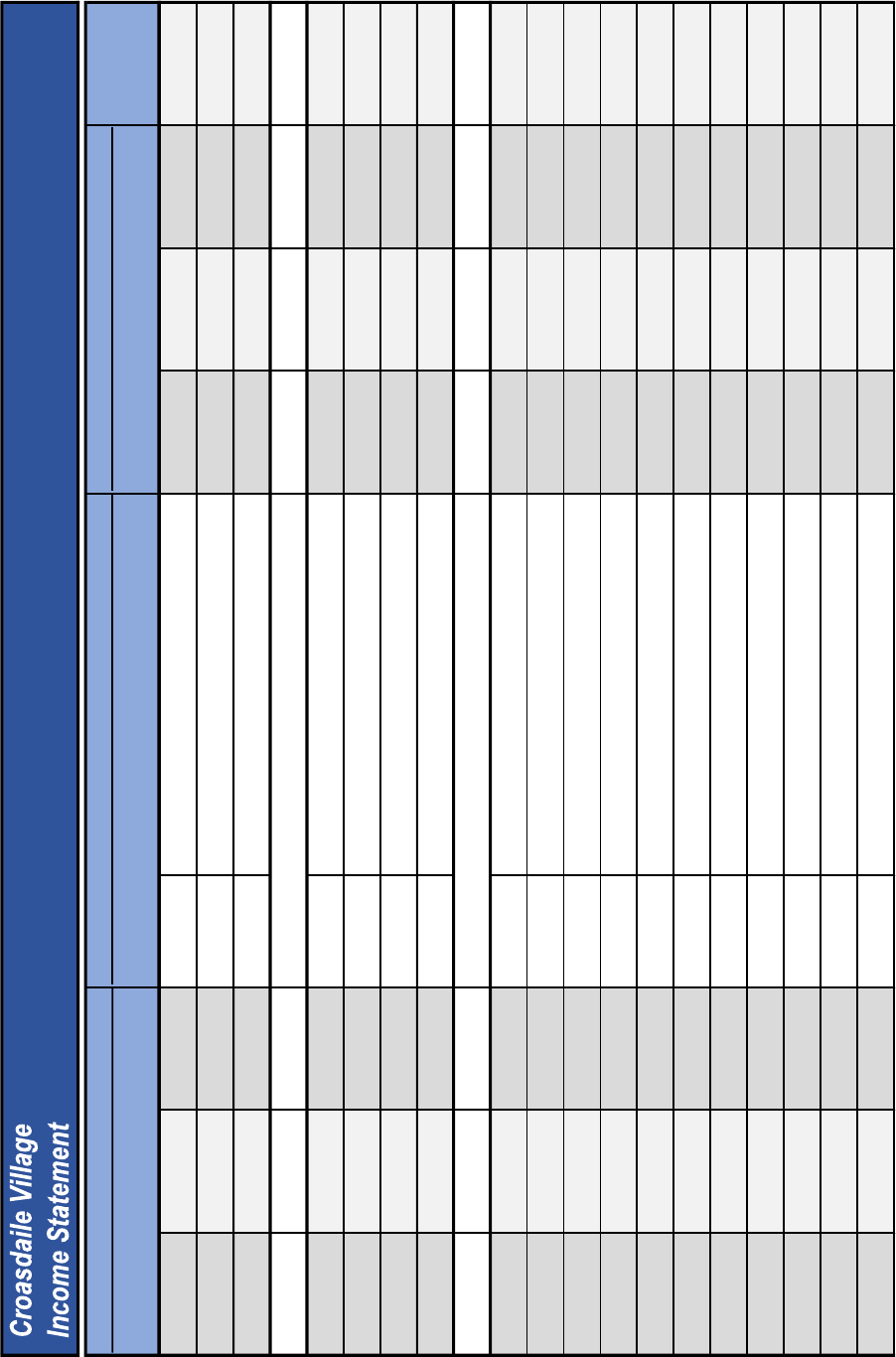

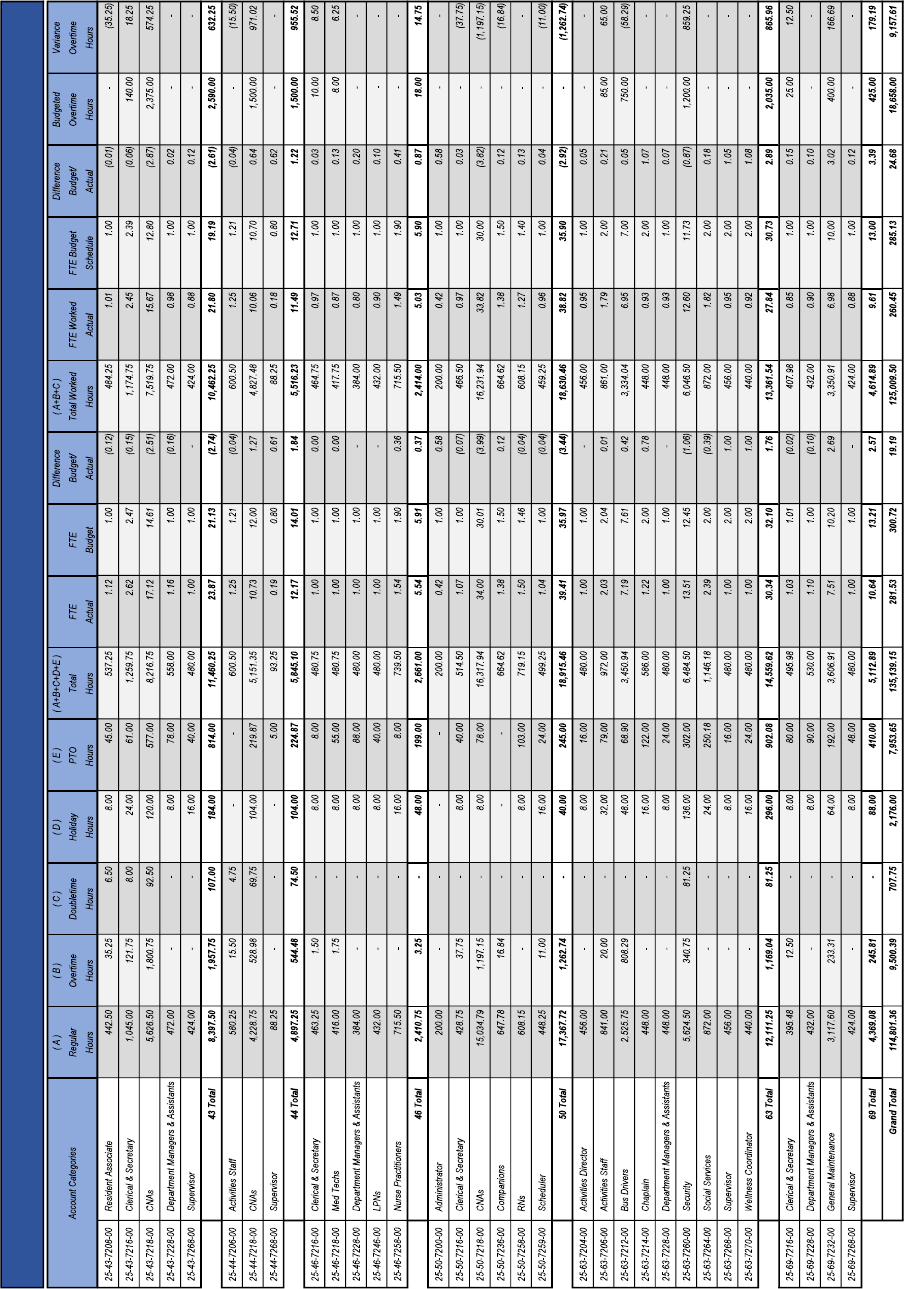

1. Financial Statements. UMRH operates on a fiscal year ending September 30. The

financial position of UMRH is represented by the independent auditors' report prepared by Dixon

Hughes Goodman LLP. The audited financial statements for UMRH present the consolidated

operations for Croasdaile Village, Cypress Glen and Wesley Pines. The independent auditors' report

for the fiscal year ending September 30, 2023 for UMRH is reproduced in its entirety and is attached

to this Disclosure Statement as Attachment 1.

2. Forecasted Financial Statements. Forecasted financial statements for the next five

years are included as part of this Disclosure Statement as Attachment 2. These forecasted financial

statements present the consolidated operations for Croasdaile Village, Cypress Glen and Wesley Pines

and the individual operations for Croasdaile Village.

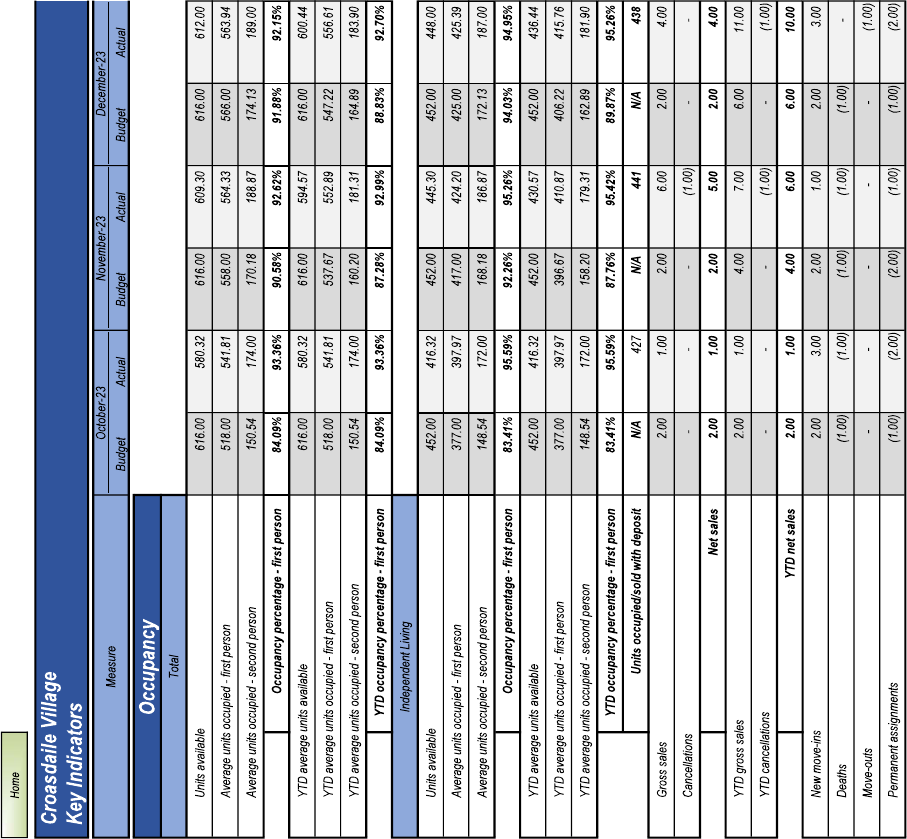

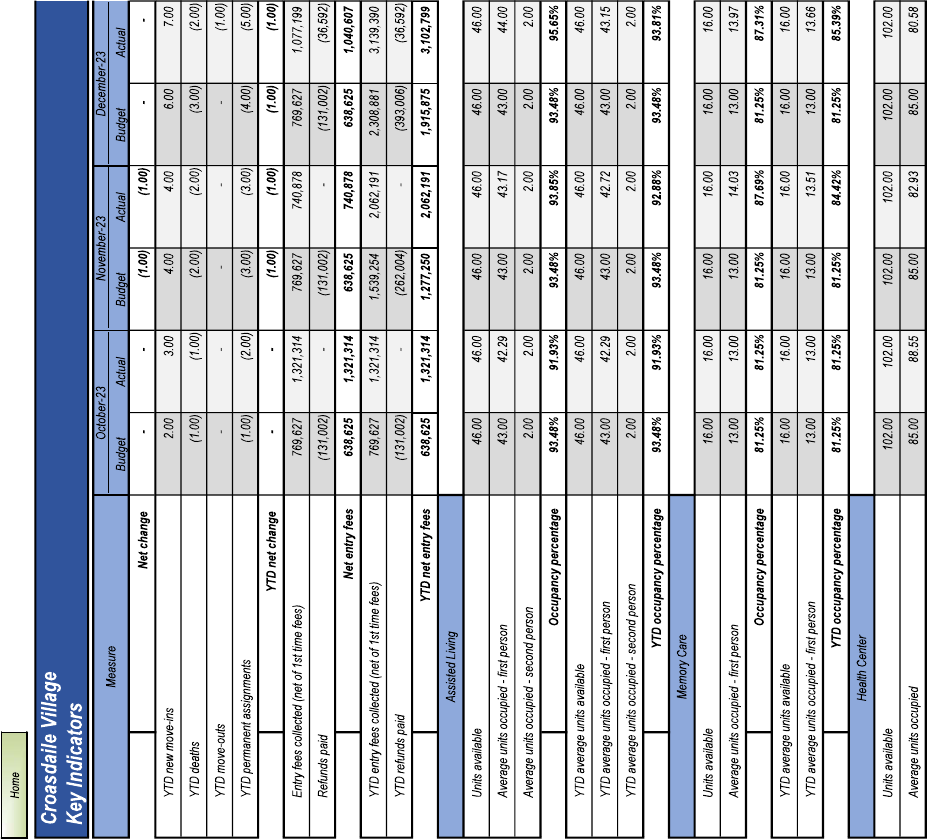

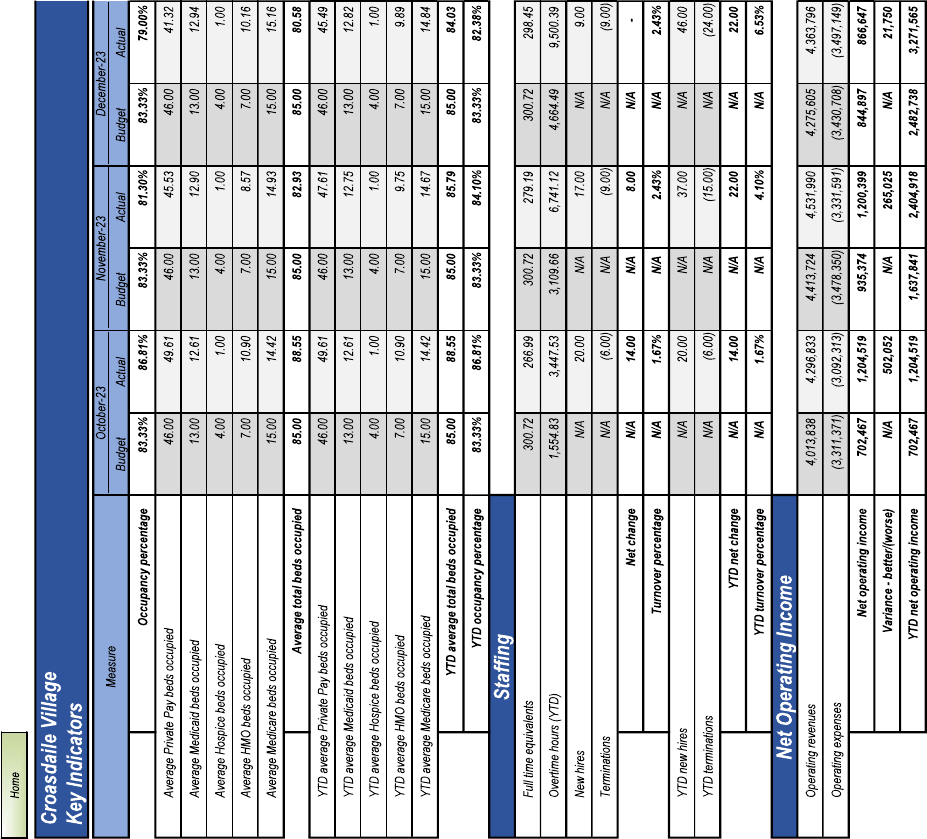

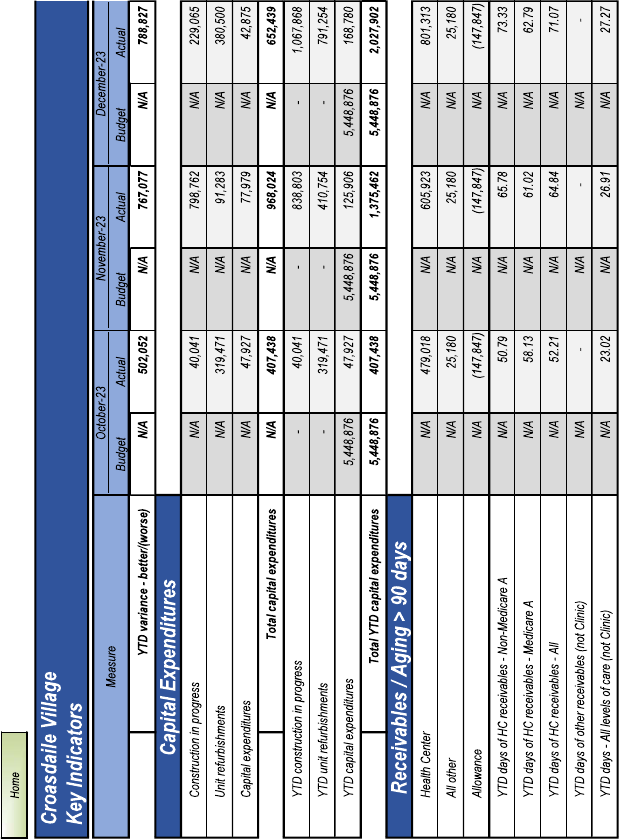

3. Interim Unaudited Financial Statements. Interim unaudited financial statements are

included as part of this Disclosure Statement as Attachment 3. These statements present the

consolidated operations of Croasdaile Village, Cypress Glen and Wesley Pines and the individual

operations for Croasdaile Village.

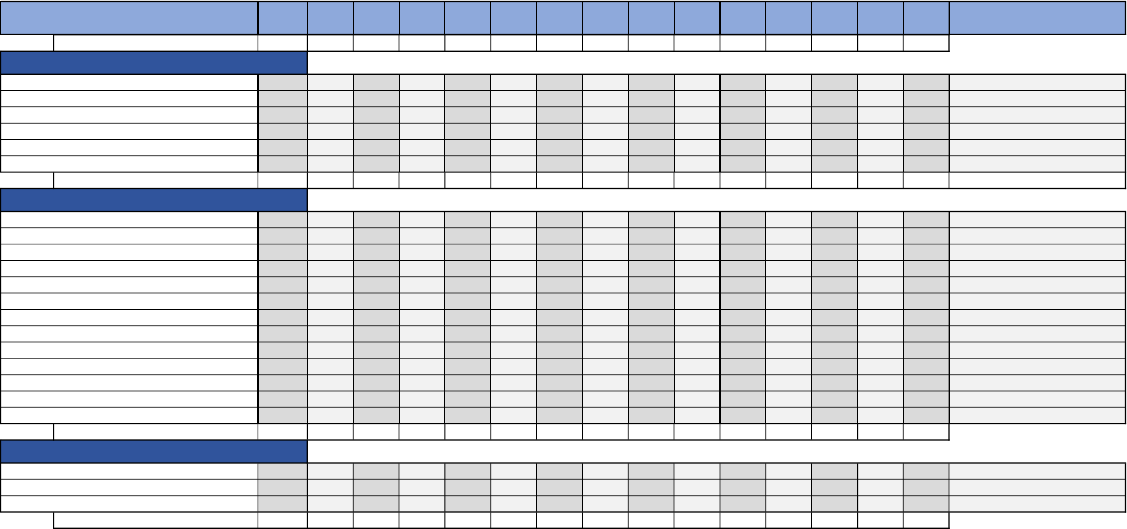

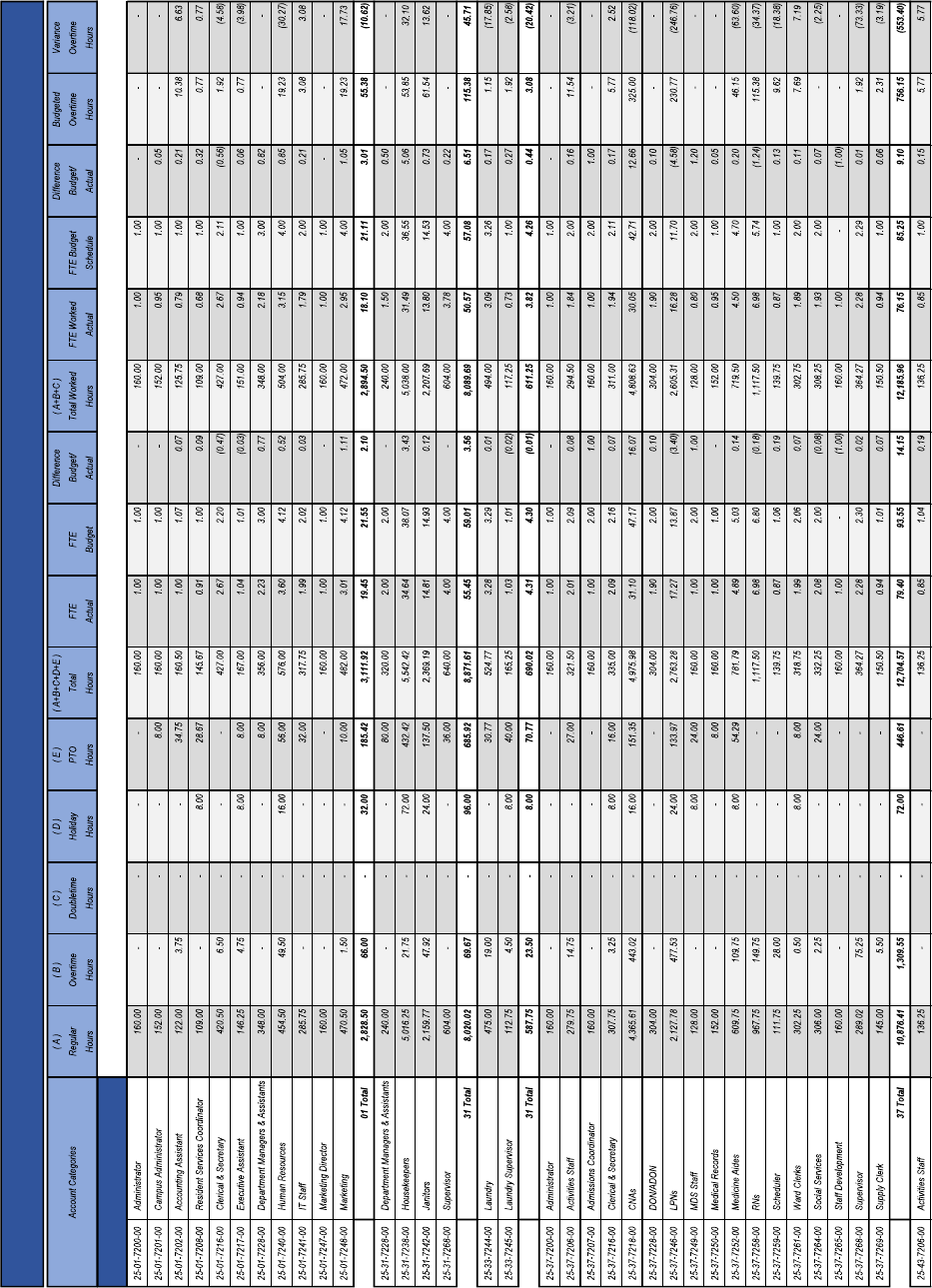

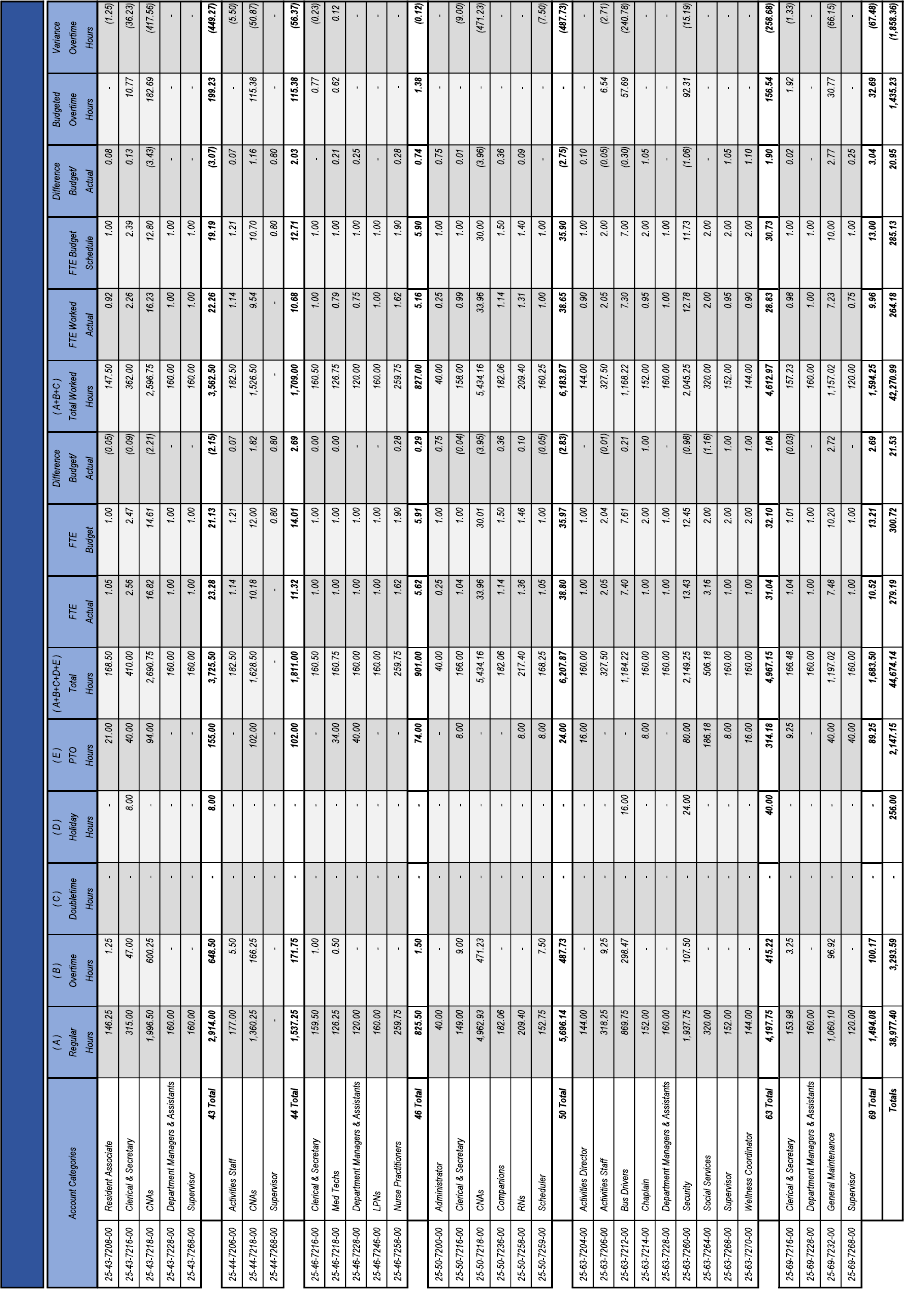

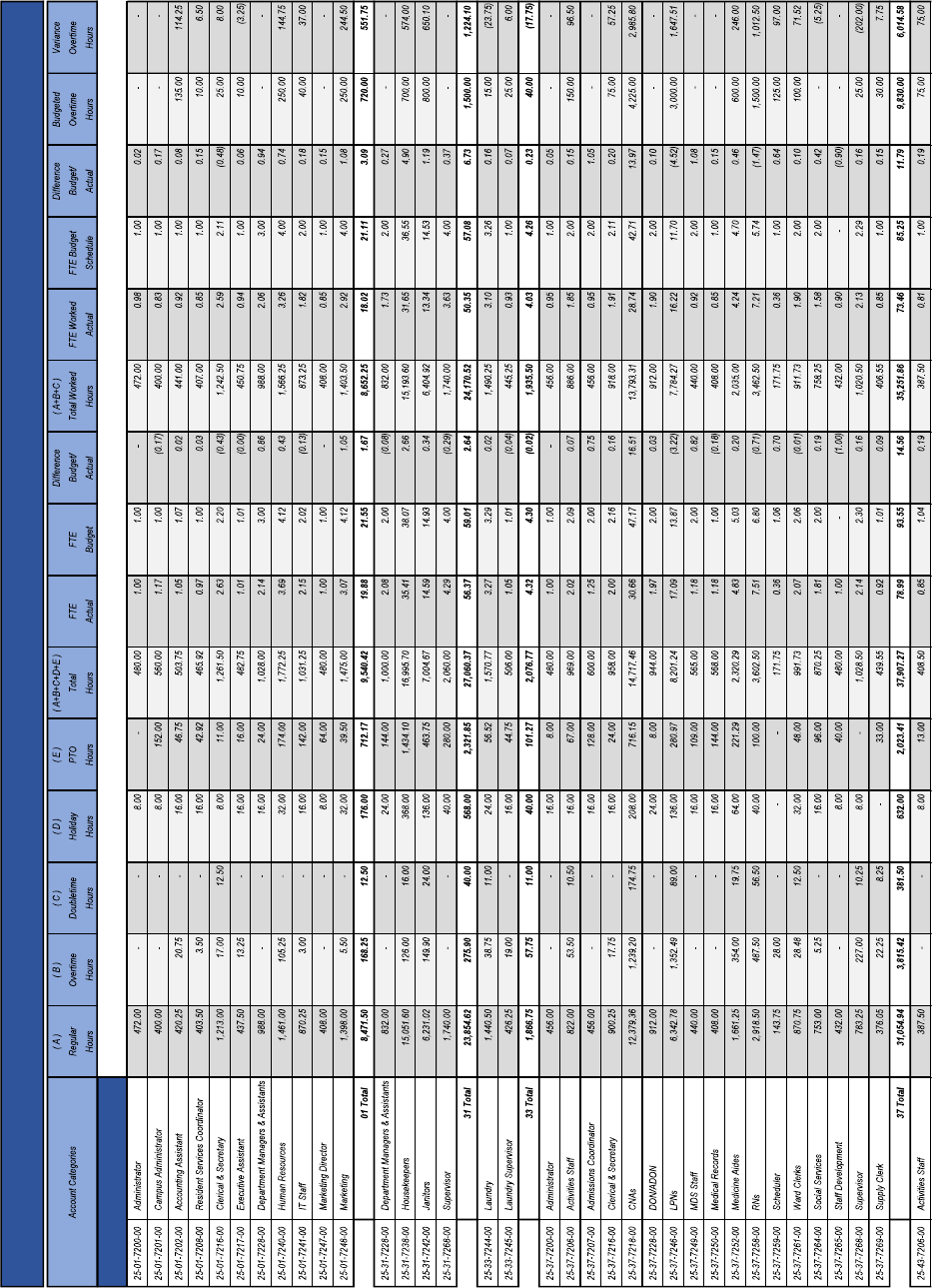

4. Explanations of Material Differences. Explanations of the material differences for the

Balance Sheet, Statement of Operations, and Statement of Cash Flows for the fiscal year 2023 and

the actual results for the fiscal year 2023 are included as part of this Disclosure Statement as

Attachment 4.

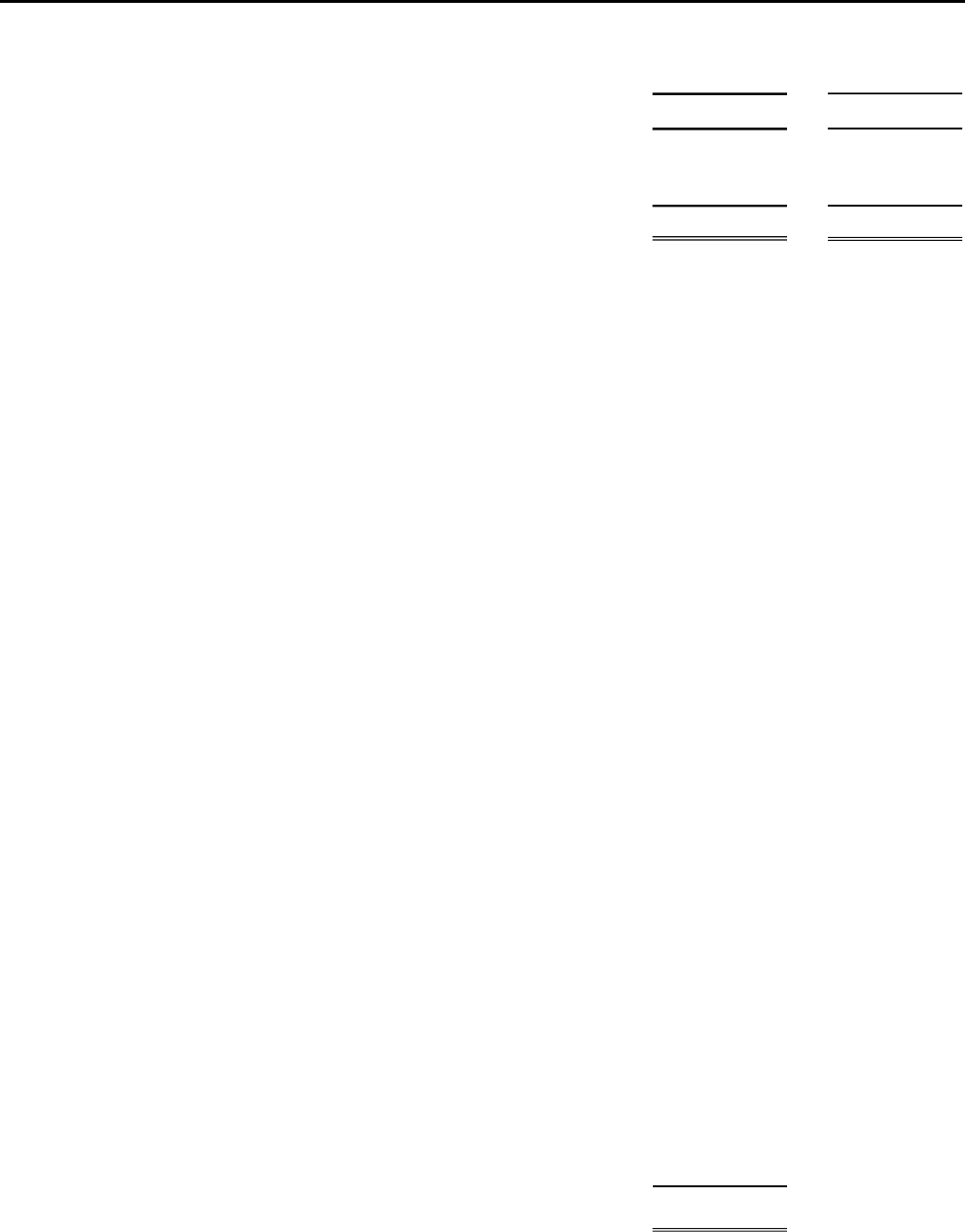

5. Reserves. In accordance with Section 58-64-33 of the North Carolina General

Statutes, UMRH is required to maintain an operating reserve for Croasdaile Village equal to 25

percent of the total operating costs projected for the 12-month period following the period covered by

the most recent annual statement filed with the Department of Insurance. Based on the operating

reserve calculation submitted to the Department of Insurance, UMRH meets the operating reserve

requirement for Croasdaile Village.

6. Financing. See Notes 7 and 8 of the UMRH audited financial statements for

information on long-term debt and financing.

RESERVES AND INVESTMENTS

1. Reserve Requirement. In accordance with Section 58-64-33, North Carolina General

Statutes, UMRH is required to maintain $12,098,205 in an operating reserve for Croasdaile Village.

UMRH meets the operating reserve requirement for Croasdaile Village, and management believes

that UMRH will continue to possess sufficient reserves to satisfy the operating reserve requirement

based on the financial forecasts.

2. Financial Assistance Funds. UMRH attempts to provide benevolent care funds to

those individuals who have exhausted their resources. The funds are in the amounts necessary to

make up the difference between the financial resources of the individual and the Monthly Fees for

the occupancy of a unit. Some of the benevolence is covered through apportionments from the

North Carolina Annual Conference of The United Methodist Church, Southeastern Jurisdiction;

benevolent care endowments; The United Methodist Retirement Homes Foundation; special

offerings conducted by local churches; and individual gifts. Persons receiving benevolent care

18

funds must be residents who have entered the Community under a continuing care residency

agreement for residential living and must have met all "spend-down" provisions established in the

UMRH Benevolence Policy. UMRH does not offer benevolent care funds to those residents who

are admitted directly to Assisted Living or The Pavilion (skilled nursing) as private pay residents.

Private pay residents are individuals who did not execute continuing care residency agreement for

residential living. The resident must agree to apply for public assistance funds and/or Medicaid,

depending on the level of care required by the resident. Benevolent care funds are available as

long as providing such funds does not impair UMRH's ability to operate the Community on a

sound financial basis for the benefit of all residents.

The Marketing, Occupancy, and Benevolence Committee of the Board of Trustees reviews

each benevolence application, provides a recommendation to the Board of Trustees, monitors the

availability of benevolent funds, and projects potential future demands on benevolent funds.

3. Investments. Investment decisions are made by the Finance Committee of the Board

of Trustees of UMRH. Committee members include: Lee Harris, Charles Mercer, John Link, Paul

Lee, Gray Southern, and Susan Ezekiel. Funds are invested in accordance with UMRH's Investment

Policy in the following investment portfolios:

(a) United Methodist Retirement Homes Trust Fund #1. Investment Goal –

Maintain principal values with adequate liquidity for debt/cash ratio.

(b) United Methodist Retirement Home Reserve Fund. Investment Goal – This

Fund includes assets that may be managed for long-term capital growth with a moderate

level of income.

A copy of the Investment Policy is available to residents upon request.

OTHER MATERIAL INFORMATION

As of the date of this Disclosure Statement, there is no material litigation pending against

Croasdaile Village.

AGREEMENTS WITH RESIDENTS

A copy of the current Standard Residency Agreement is attached to this Disclosure Statement

as Attachment 5.

This agreement is in compliance with the pertinent specifications of Section 58-64-25 of the

North Carolina General Statutes. UMRH reserves the right to offer to new prospective residents

alternative forms of Residency Agreements from time to time.

ATTACHMENT 1

Audited Financial Statements

of

The United Methodist

Retirement Homes, Incorporated

(Includes Consolidated Operations of

Croasdaile Village, Cypress Glen

and Wesley Pines)

The United Methodist

Retirement Homes,

Incorporated, Its Affiliate,

and Subsidiary

Independent Auditors Report, Consolidated Financial

Statements and Consolidating Supplementary

Information

September 30, 2023 and 2022

Table of Contents

Independent Auditors Report ............................................................................................................ 1

Consolidated Financial Statements:

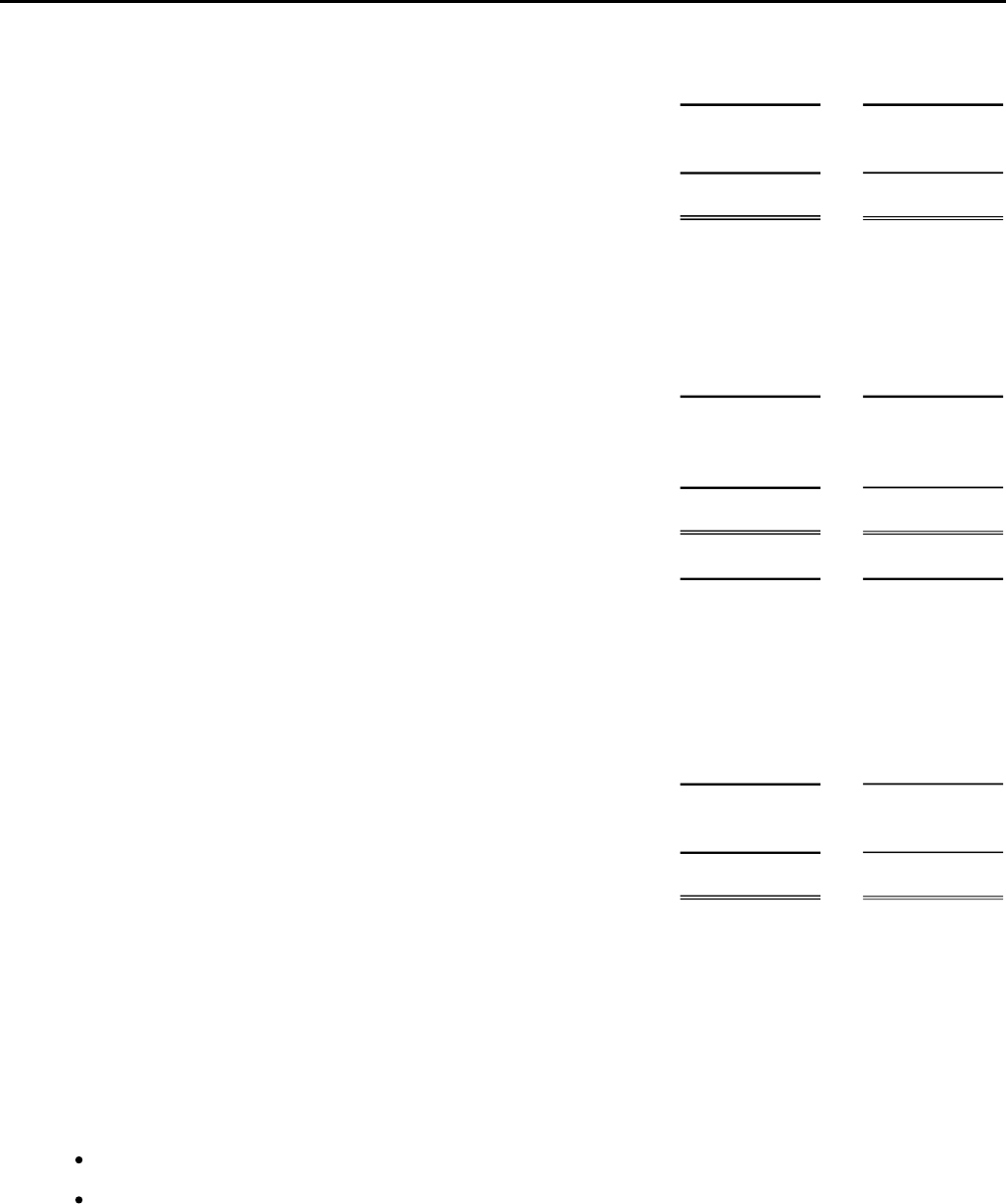

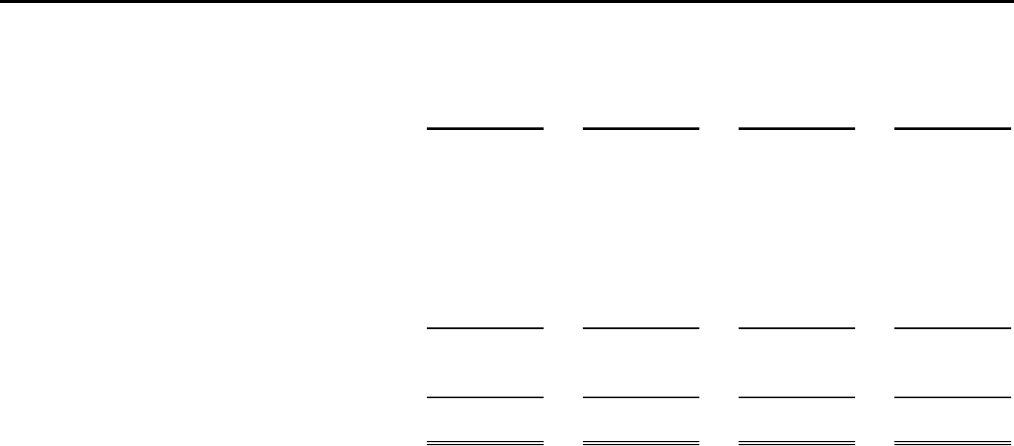

Consolidated Balance Sheets ....................................................................................................... 3

Consolidated Statements of Operations and Changes in Net Assets ........................................... 5

Consolidated Statements of Cash Flows ....................................................................................... 7

Notes to Consolidated Financial Statements................................................................................. 9

Consolidating Supplementary Information:

Consolidating Balance Sheet Information ..................................................................................... 27

Consolidating Statement of Operations and Changes in Net Assets Information ......................... 28

FORVIS is a trademark of FORVIS, LLP, registered with the U.S. Patent and Trademark Office. 1

Independent Auditors Report

Board of Trustees of

The United Methodist Retirement Homes, Incorporated,

its Affiliate, and Subsidiary

Durham, North Carolina

Opinion

We have audited the accompanying consolidated financial statements of The United Methodist

Retirement Homes, Incorporated, its Affiliate, and Subsidiary (the Company), which comprise the

consolidated balance sheets as of September 30, 2023 and 2022, and the related consolidated

statements of operations and changes in net assets, and cash flows for the years then ended, and the

related notes to the consolidated financial statements.

In our opinion, the consolidated financial statements referred to above present fairly, in all material

respects, the financial position of the Company as of September 30, 2023 and 2022, and the results of

their operations, changes in net assets, and their cash flows for the years then ended in accordance

with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audits in accordance with auditing standards generally accepted in the United States

of America (GAAS). Our responsibilities under those standards are further described in the Auditors

Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are

required to be independent of the Company and to meet our other ethical responsibilities, in

accordance with the relevant ethical requirements relating to our audits. We believe that the audit

evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of the consolidated financial

statements in accordance with accounting principles generally accepted in the United States of

America, and for the design, implementation, and maintenance of internal control relevant to the

preparation and fair presentation of the consolidated financial statements that are free from material

misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, management is required to evaluate whether there

are conditions or events, considered in the aggregate, that raise substantial doubt about the Companys

ability to continue as a going concern within one year after the date that these consolidated financial

statements are issued.

Auditors Responsibilities for the Audit of the Consolidated Financial Statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements

as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors

report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute

assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will

always detect a material misstatement when it exists. The risk of not detecting a material misstatement

resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery,

intentional omissions, misrepresentations, or the override of internal control. Misstatements are

considered material if there is a substantial likelihood that, individually or in the aggregate, they would

influence the judgment made by a reasonable user based on the consolidated financial statements.

FORVIS is a trademark of FORVIS, LLP, registered with the U.S. Patent and Trademark Office. 2

In performing an audit in accordance with GAAS, we:

Exercise professional judgment and maintain professional skepticism throughout the audit.

Identify and assess the risks of material misstatement of the consolidated financial statements,

whether due to fraud or error, and design and perform audit procedures responsive to those risks.

Such procedures include examining, on a test basis, evidence regarding the amounts and

disclo

sures in the consolidated financial statement

s.

Obtain an understanding of internal control relevant to the audit in order to design audit

procedures that are appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of the Companys internal control. Accordingly, no such opinion is

expressed.

Evaluate the appropriateness of accounting policies used and the reasonableness of significant

accounting estimates made by management, as well as evaluate the overall presentation of the

consolidated financial statements.

Conclude whether, in our judgment, there are conditions or events, considered in the aggregate,

that raise su

bstantial doubt about the Companys ability to continue as a going concern for a

reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters,

the planned scope and timing of the audit, significant audit findings, and certain internal control-related

matters that we identified during the audit.

Report on Supplementary Information

Our audit was conducted for the purpose of forming an opinion on the consolidated financial statements

that collectively comprise the Companys basic consolidated financial statements. The consolidating

balance sheet information and the consolidating statement of operation and changes in net assets

information listed in the table of contents is presented for purposes of additional analysis rather than to

present the financial position and results of operations of the individual organizations and is not a

required part of the consolidated financial statements. Such information is the responsibility of

management and was derived from and relates directly to the underlying accounting and other records

used to prepare the consolidated financial statements. The consolidating balance sheet information

and the consolidating statement of operation and changes in net assets information has been subjected

to the auditing procedures applied in the audit of the consolidated financial statements and certain

additional procedures, including comparing and reconciling such information directly to the underlying

accounting and other records used to prepare the consolidated financial statements or to the

consolidated financial statements themselves, and other additional procedures in accordance with

GAAS. In our opinion, the information is fairly stated in all material respects in relation to the

consolidated financial statements as a whole.

Raleigh, North Carolina

January 2 , 2024

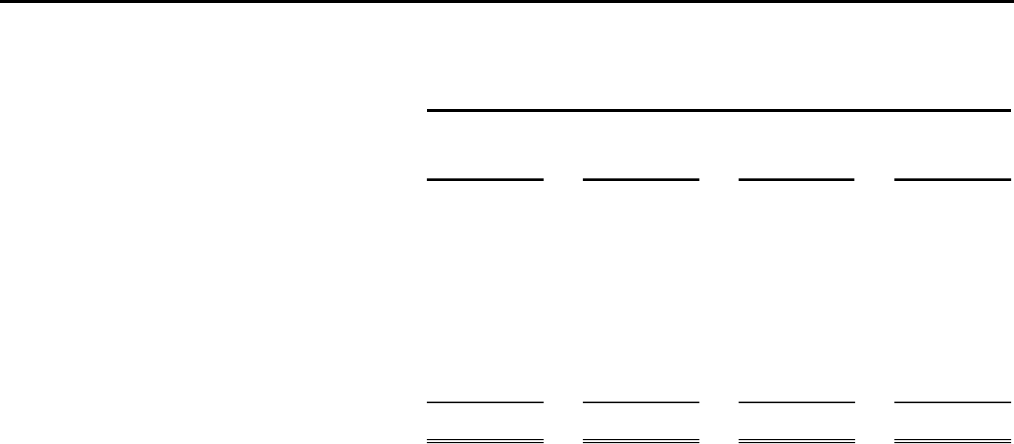

September 30, 2023 and 2022

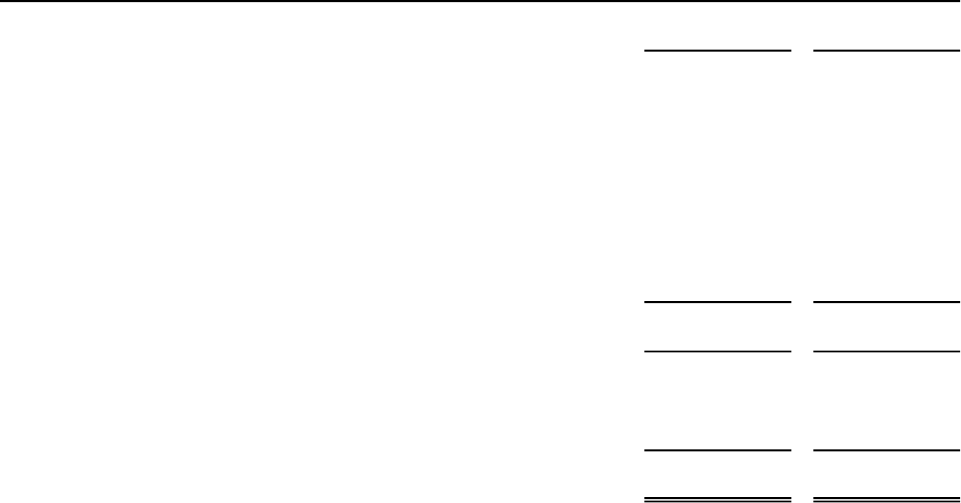

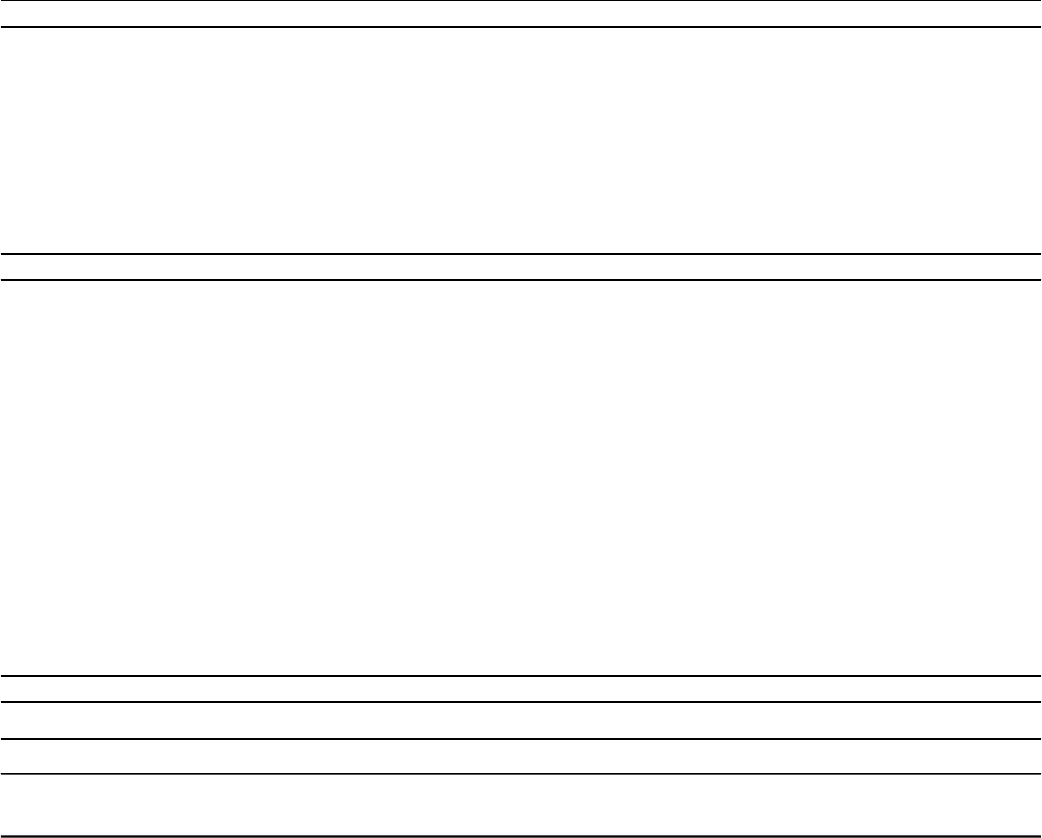

2023 2022

Current assets:

Cash 5,177,988$ 5,954,084$

Contributions receivable, current portion 25,846 2,412

Investments 88,037,087 81,293,248

Assets limited as to use, current portion 6,636,490 17,271,385

Accounts receivable, net of allowance for uncollectible

accounts of approximately $184,000 and $265,000

in 2023 and 2022, respectively 3,890,546 3,127,429

Other receivables 2,516,922 1,291,459

Inventories 231,303 177,215

Prepaid expenses and other current assets 1,293,484 1,212,086

Total current assets 107,809,666 110,329,318

Non-current assets:

Assets limited as to use, net of current portion 27,097,658 24,307,039

Investments - restricted 8,771,194 7,793,000

Asset held for resale - 197,103

Property and equipment, net 222,348,613 214,309,967

Investment in Wesley Ridge - 75,494

Trusts receivable 125,130 119,600

Deferred marketing costs, net 87,012 101,570

Interest rate swap agreements 11,565,561 10,442,208

Total non-current assets 269,995,168 257,345,981

Total assets 377,804,834$ 367,675,299$

The United Methodist Retirement Homes, Incorporated, Its Affiliate, and Subsidiary

Consolidated Balance Sheets

ASSETS

See accompanying notes to the consolidated financial statements. 3

September 30, 2023 and 2022 (Continued)

2023 2022

Current liabilities:

Annuity payable, current portion 63,319$ 81,502$

Bonds payable, current portion 5,410,000 5,785,000

Accounts payable 4,473,013 4,120,054

2,257,501 2,152,753

1,764,449 1,719,639

Provider relief advanced funding - 120,181

Total current liabilities 13,968,282 13,979,129

Long-term liabilities:

Annuity payable, net of current portion 395,706 439,945

Bonds payable, net of current portion 154,830,169 160,327,909

Liability for refundable advance fees 14,651,478 14,737,849

Deferred revenue from non-refundable advance fees 80,652,605 76,325,122

Deferred revenue - other 6,500 -

Due to related parties - 71,377

Funds held for others 86,572 147,814

Total long-term liabilities 250,623,030 252,050,016

Total liabilities 264,591,312 266,029,145

Net assets:

99,508,415 89,297,478

13,705,107 12,348,676

Total net assets 113,213,522 101,646,154

Total liabilities and net assets 377,804,834$ 367,675,299$

With donor restrictions

Accrued salaries and related expenses

Accrued interest payable

The United Methodist Retirement Homes, Incorporated, Its Affiliate, and Subsidiary

Consolidated Balance Sheets

Without donor restrictions

LIABILITIES AND NET ASSETS

See accompanying notes to the consolidated financial statements. 4

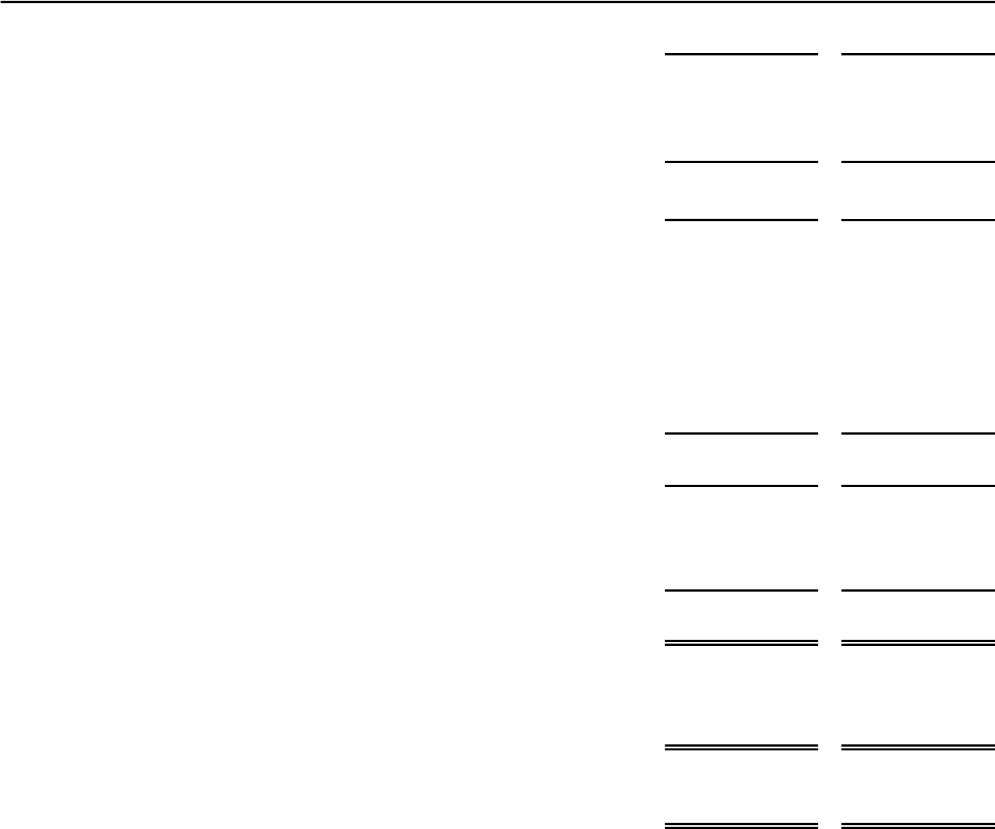

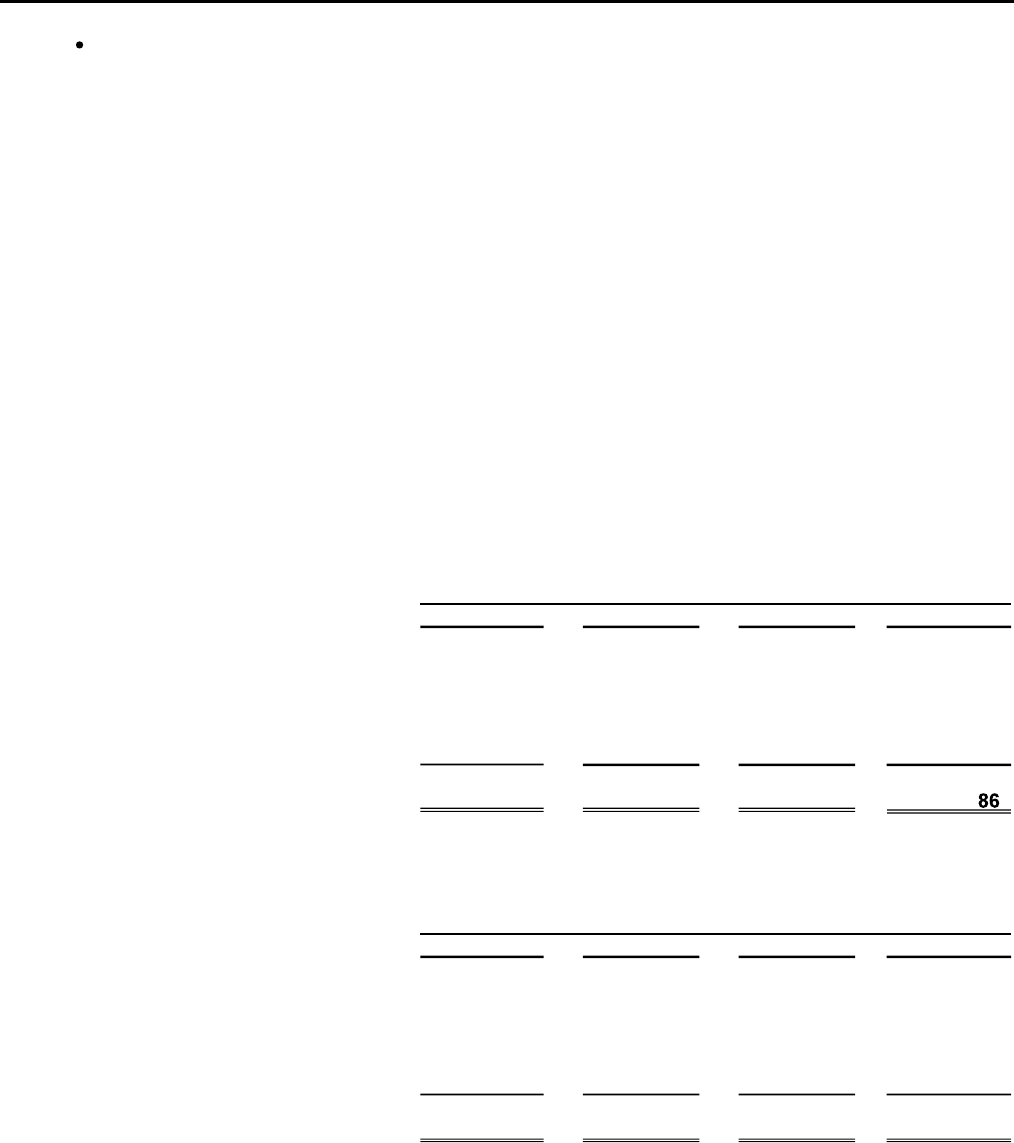

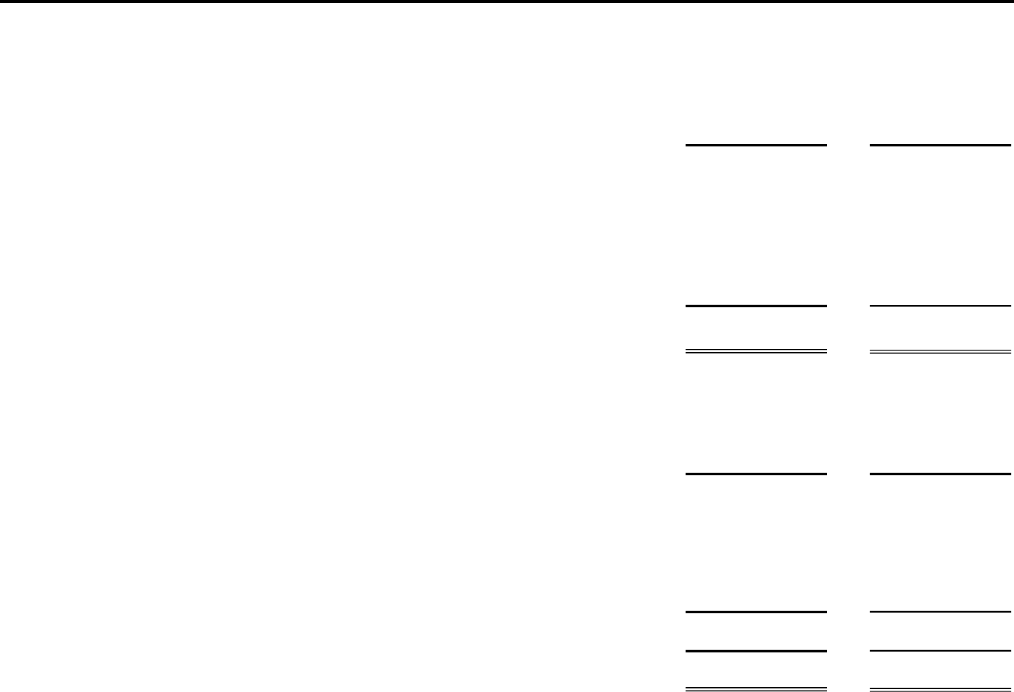

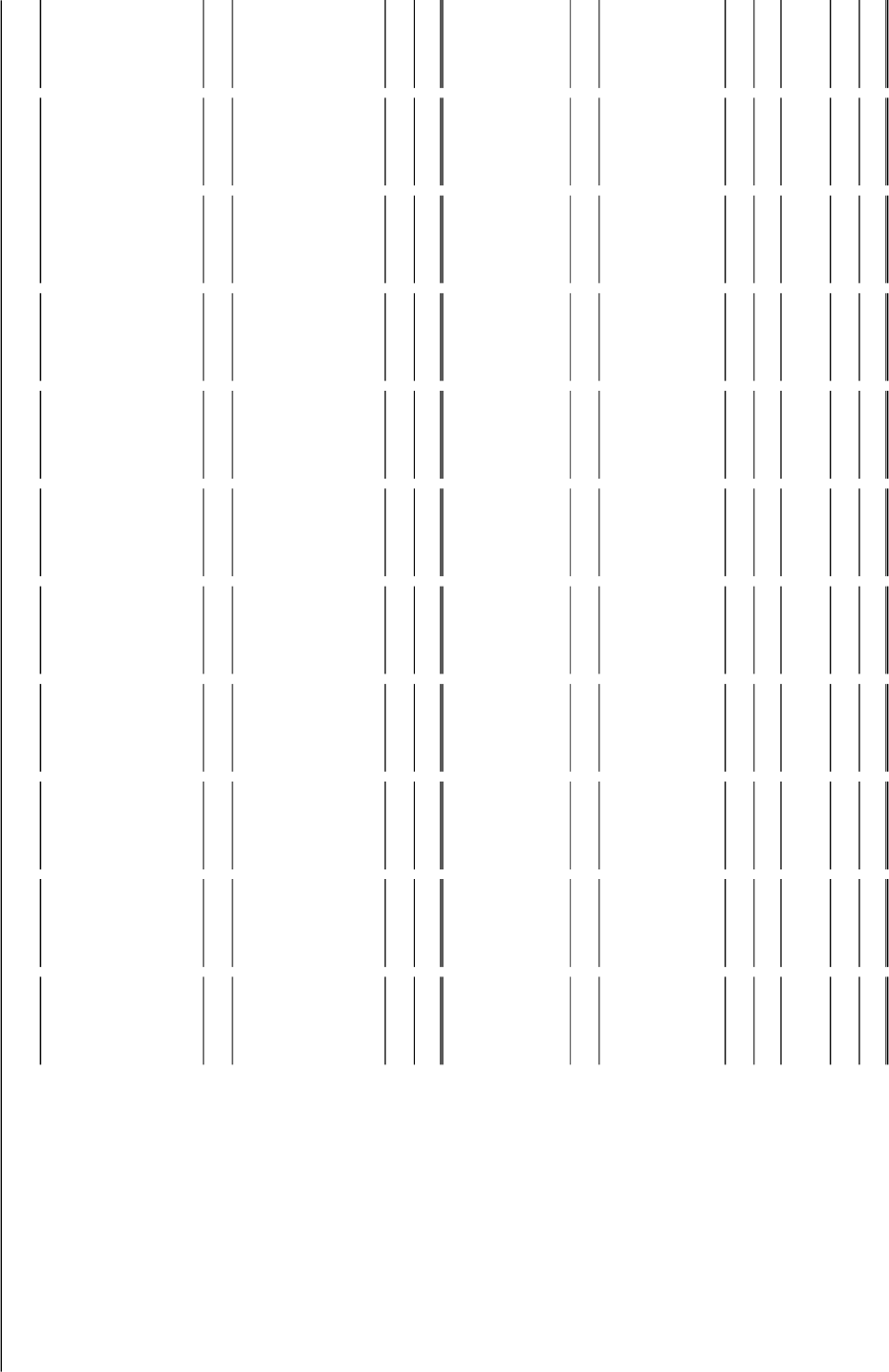

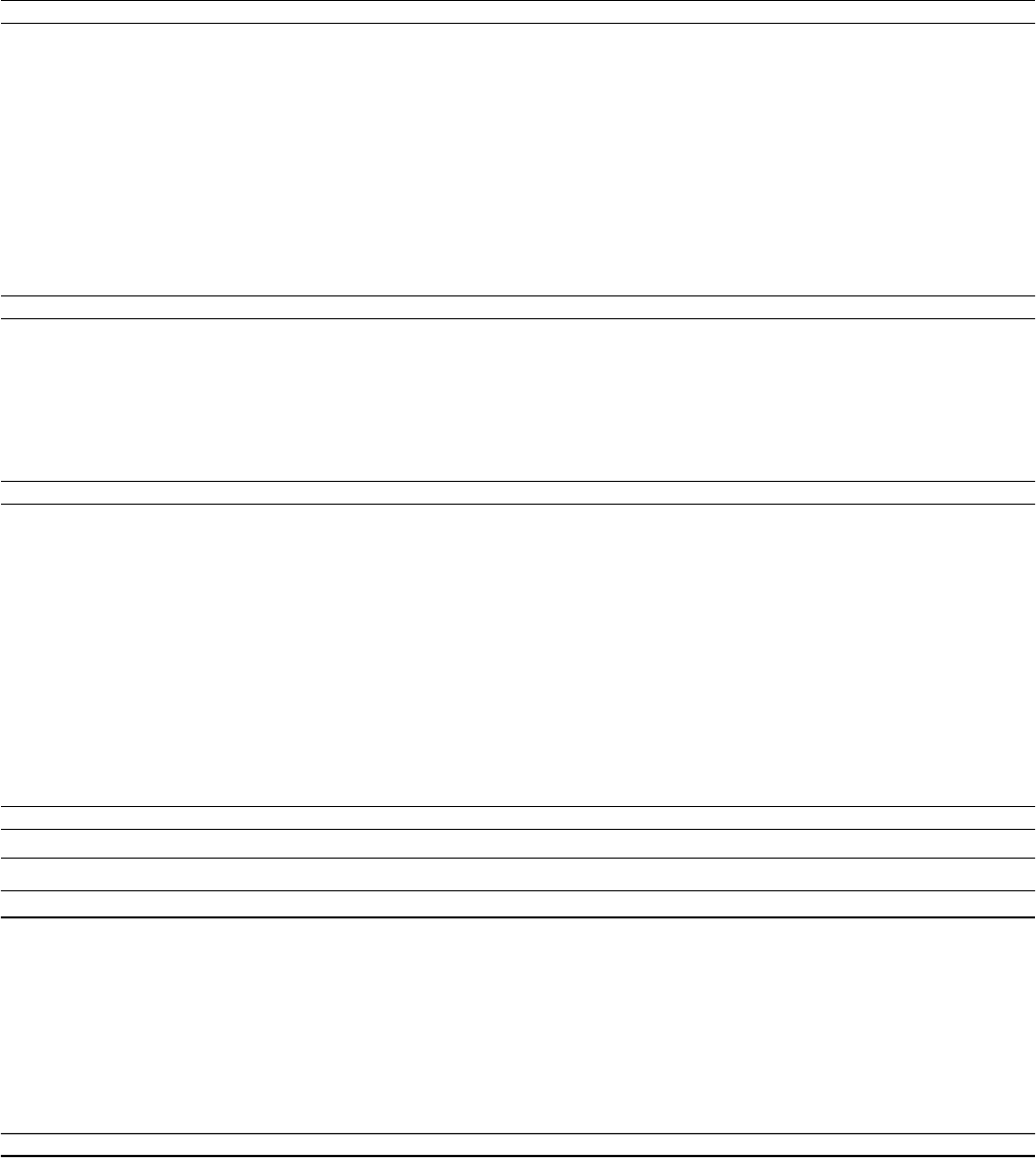

2023 2022

Revenues, gains and other support without donor restrictions:

74,866,988$ 70,475,317$

Amortization of advance fees 11,303,173 9,599,475

Net assets released from restrictions 507,997 703,837

Other 226,830 92,726

Interest and dividend income 4,262,978 3,679,989

Total revenues, gains and other support 91,167,966 84,551,344

Expenses:

Nursing services 22,725,837 20,461,059

Dietary and food services 13,989,657 12,184,286

Administration 12,882,601 12,973,682

Plant operations, maintenance and security 7,985,358 7,582,907

Laundry and housekeeping 4,372,621 4,228,726

Resident services - activities 2,779,061 2,620,070

Home care 2,802,557 3,054,319

Interest 3,448,221 4,134,114

Depreciation and amortization 14,346,183 14,284,564

Loss on disposal of property and equipment 6,904 -

Bad debt expense 927,265 374,718

Total expenses 86,266,265 81,898,445

Operating income 4,901,701 2,652,899

Non-operating gains (losses):

Net investment gains, realized 2,092,460 933,264

Net investment gains (losses), unrealized 1,925,979 (21,617,264)

Provider relief funding - 484,919

Loss on disposal of property and equipment - (115,890)

Contributions 74,141 71,614

Construction related marketing costs (64,458) (8,971)

Loss on early extinguishment of debt - (2,076,605)

Change in fair value of interest rate swap agreement 1,123,353 10,632,953

Other (84,936) 7,999

Net non-operating gains (losses) 5,066,539 (11,687,981)

Excess (deficit) of revenues, gains and other support over expenses 9,968,240 (9,035,082)

Net assets released from restrictions for

purchase of property and equipment 242,697 265,224

Change in net assets without donor restrictions 10,210,937$ (8,769,858)$

Net resident and patient service revenue

The United Methodist Retirement Homes, Incorporated, Its Affiliate, and Subsidiary

Consolidated Statements of Operations and Changes in Net Assets

Years Ended September 30, 2023 and 2022

See accompanying notes to the consolidated financial statements. 5

Years Ended September 30, 2023 and 2022 (Continued)

2023 2022

Change in net assets with donor restrictions:

Contributions 721,569$ 2,914,469$

Interest and dividend income 328,028 484,549

Net investment gains, realized 193,142 134,008

Net investment gains (losses), unrealized 693,319 (2,521,556)

Change in split interest agreements 106,993 (487,187)

Maturity of split interest agreement 40,640 247,684

Change in value of pledges 26,154 (24,898)

Bad debt expense (recovery of bad debt) (2,720) 2,589

Net assets released from restrictions (750,694) (969,061)

Change in net assets with donor restrictions 1,356,431 (219,403)

Change in net assets 11,567,368 (8,989,261)

Net assets, beginning of year 101,646,154 110,635,415

Net assets, end of year 113,213,522$ 101,646,154$

The United Methodist Retirement Homes, Incorporated, Its Affiliate, and Subsidiary

Consolidated Statements of Operations and Changes in Net Assets

See accompanying notes to the consolidated financial statements. 6

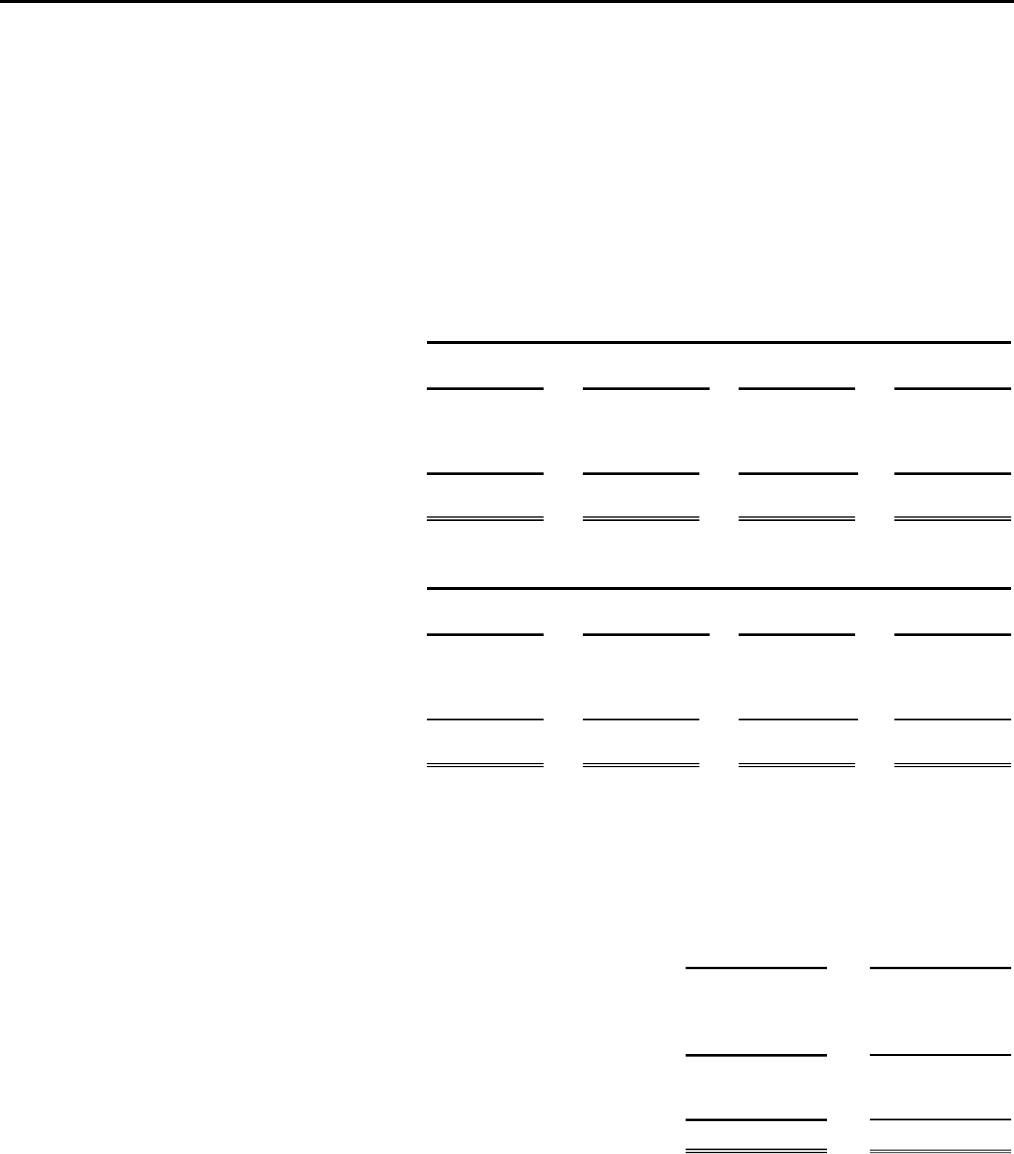

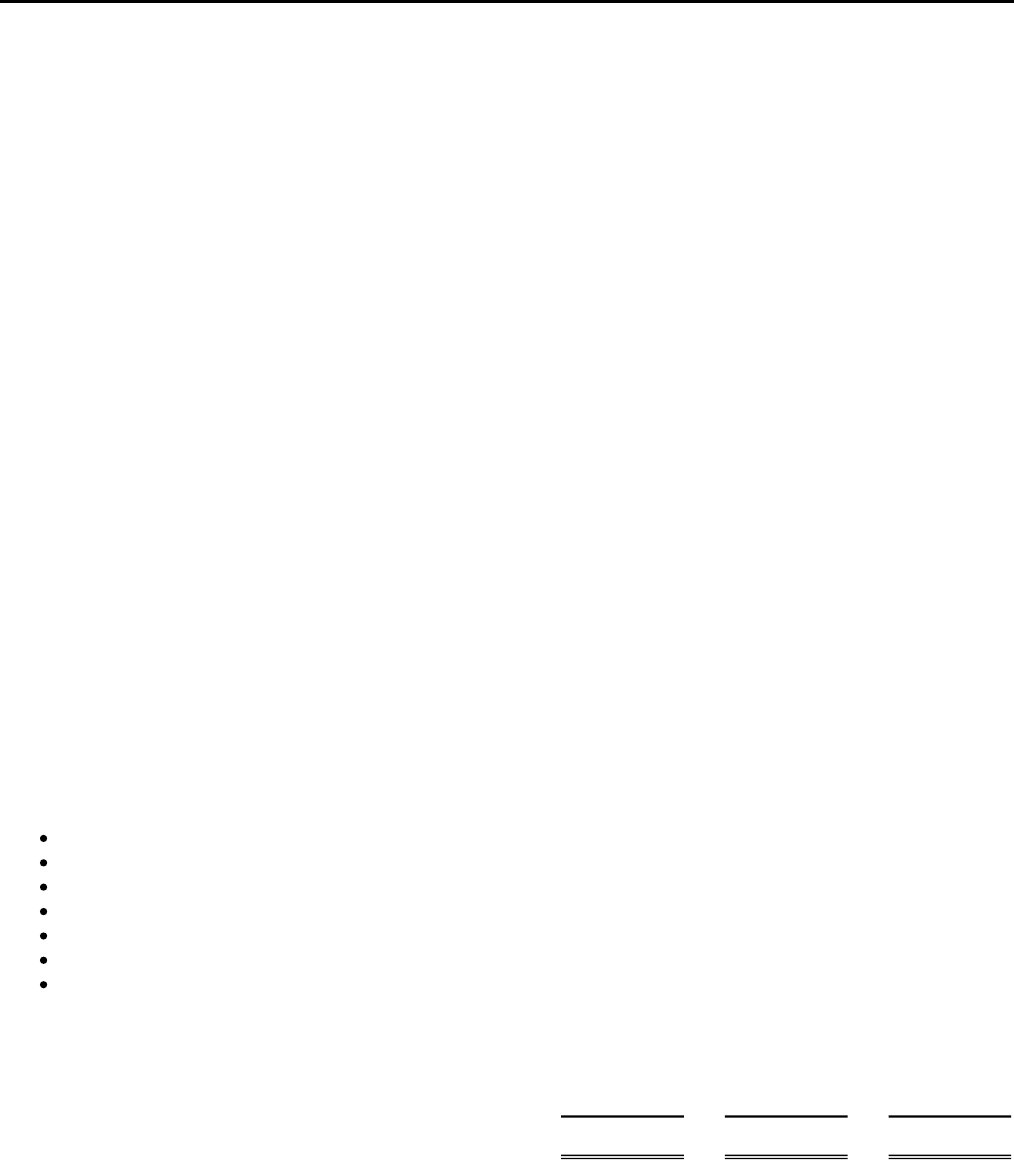

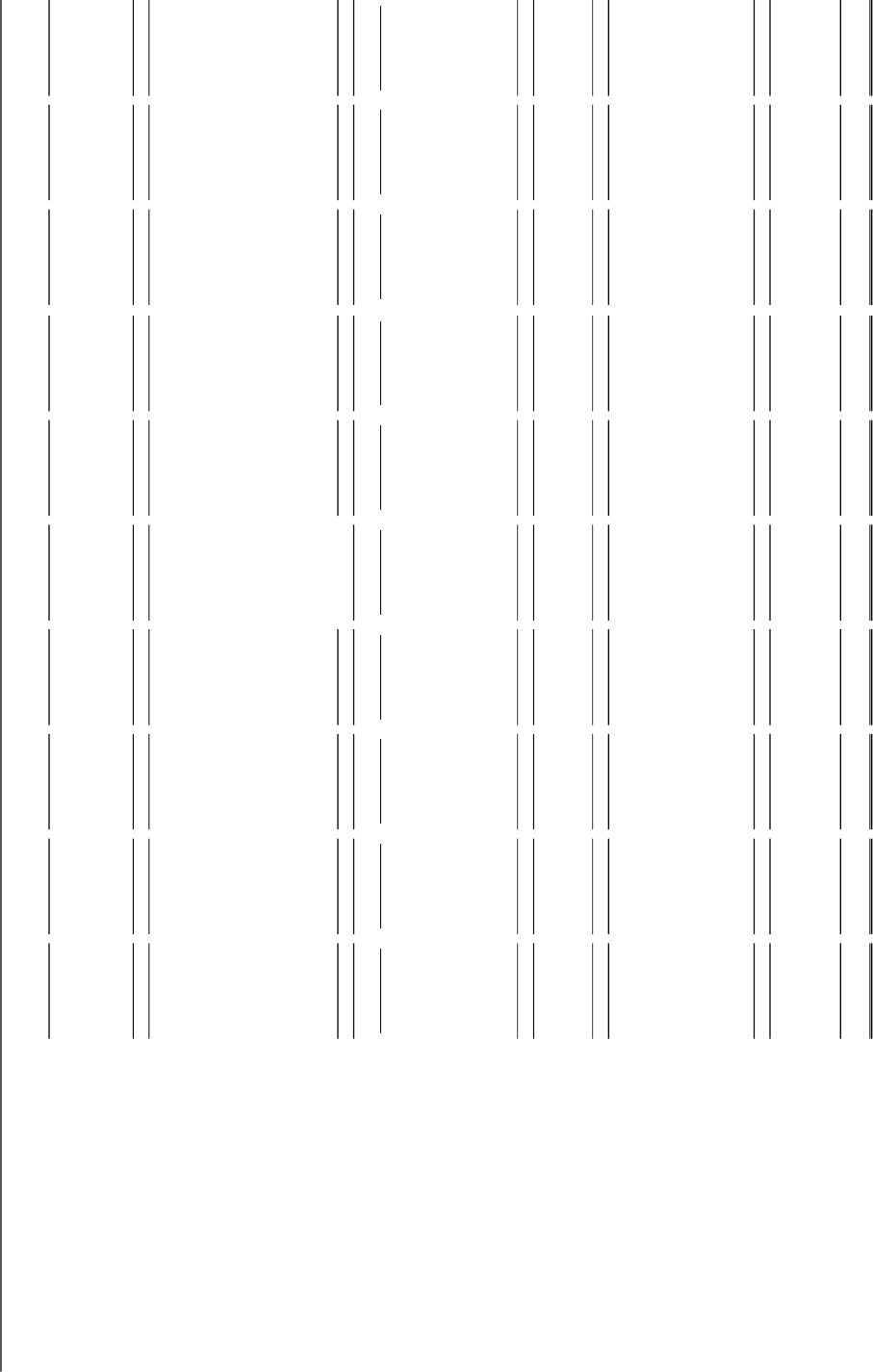

2023 2022

Cash flows from operating activities:

11,567,368$ (8,989,261)$

cash provided by operating activities:

Depreciation and amortization 14,331,625 14,270,007

Amortization of deferred financing costs 65,365 70,512

Amortization of bond premium (153,105) (187,410)

Amortization of deferred marketing costs 14,558 14,557

Amortization of deferred revenue from advance fees (11,303,173) (9,599,475)

Non-refundable entrance fees received 16,623,104 14,560,528

Bad debt expense 927,265 374,718

Loss on disposal of property and equipment 6,904 115,890

Unrealized (gains) losses on investments and (2,619,298) 24,138,820

assets limited as to use

Realized gains on investments and assets limited as to use (2,285,602) (1,067,272)

Loss on early extinguishment of debt - 2,076,605

Change in fair value of interest rate swap agreement (1,123,353) (10,632,953)

Net change in:

Accounts receivable - residents and patients (1,690,382) 150,801

Accounts receivable - other (1,477,097) (525,674)

Trusts receivable (5,530) 36,712

Contributions receivable (23,434) 22,309

Due from/to related parties (71,377) 71,377

Inventories (54,088) (45,536)

Prepaid expenses and other current assets (81,398) (23,681)

Accounts payable 152,684 10,410

Accrued salaries and related expenses 104,748 (221,474)

Provider relief advanced funding (120,181) (485,419)

Deferred revenue - other 6,500 -

Liability to other foundations - (8,732)

Accrued interest payable 44,810 (993,742)

Funds held for others (61,242) (39,081)

Net cash provided by operating activities 22,775,671 23,093,536

Change in net assets

Adjustments to reconcile change in net assets to net

The United Methodist Retirement Homes, Incorporated, Its Affiliate, and Subsidiary

Consolidated Statements of Cash Flows

Years Ended September 30, 2023 and 2022

The accompanying notes are an integral part of these consolidated financial statements. 7

Years Ended September 30, 2023 and 2022 (Continued)

2023 2022

Cash flows from investing activities:

Purchase of property and equipment (22,176,900)$ (24,737,794)$

Net change in investments and assets limited as to use (4,811,812) (11,259,465)

Change in assets held for resale 197,103 18,724

Net cash used by investing activities (26,791,609) (35,978,535)

Cash flows from financing activities:

Refunds of deposits and refundable fees (2,216,678) (1,437,176)

Refundable entrance fees received 1,389,493 1,333,726

Payments on bonds and note payable (5,785,000) (115,125,979)

Deferred costs, net - (1,718,255)

Proceeds from issuance of bonds - 136,445,228

Net change in annuity obligations (62,422) (210,002)

Net cash provided (used) by financing activities (6,674,607) 19,287,542

Change in cash (10,690,545) 6,402,543

Cash, cash equivalents, and restricted cash, beginning of year 29,928,446 23,525,903

Cash, cash equivalent, and restricted cash, end of yea

r

19,237,901$ 29,928,446$

Supplemental cash flow information:

Cash paid during the year for interes

t

3,610,731$ 5,577,701$

Additions of property and equipment included

in accounts payabl

e

1,536,424$ 1,336,149$

Consolidated Statements of Cash Flows

The United Methodist Retirement Homes, Incorporated, Its Affiliate, and Subsidiary