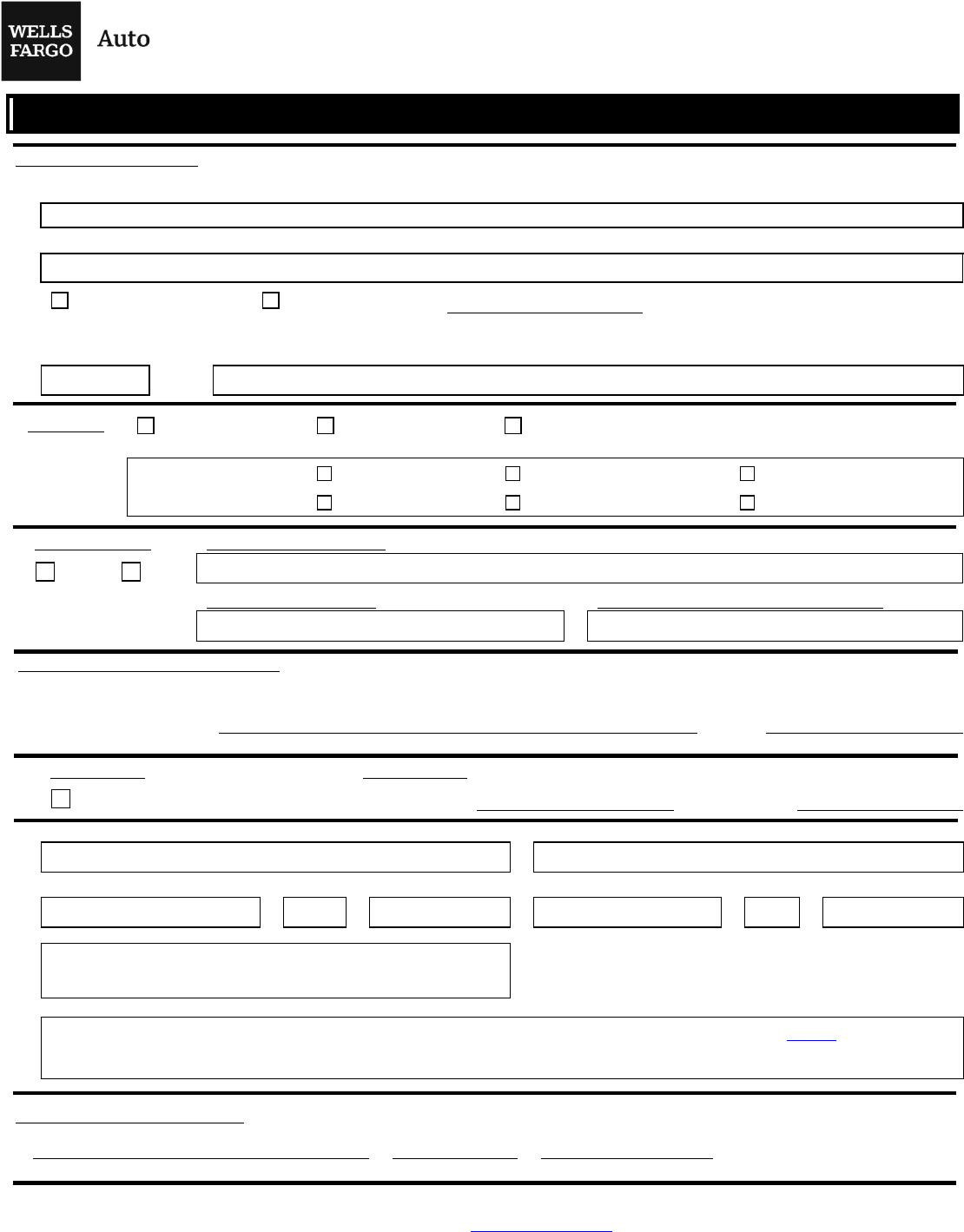

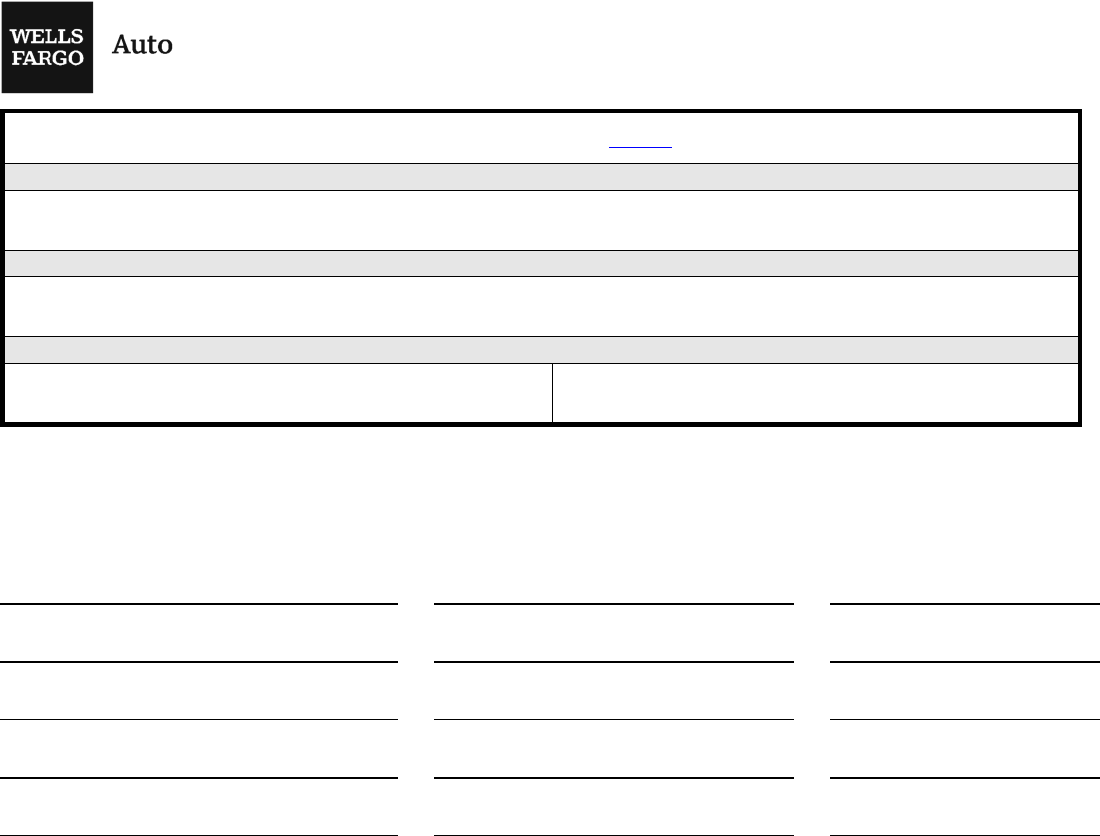

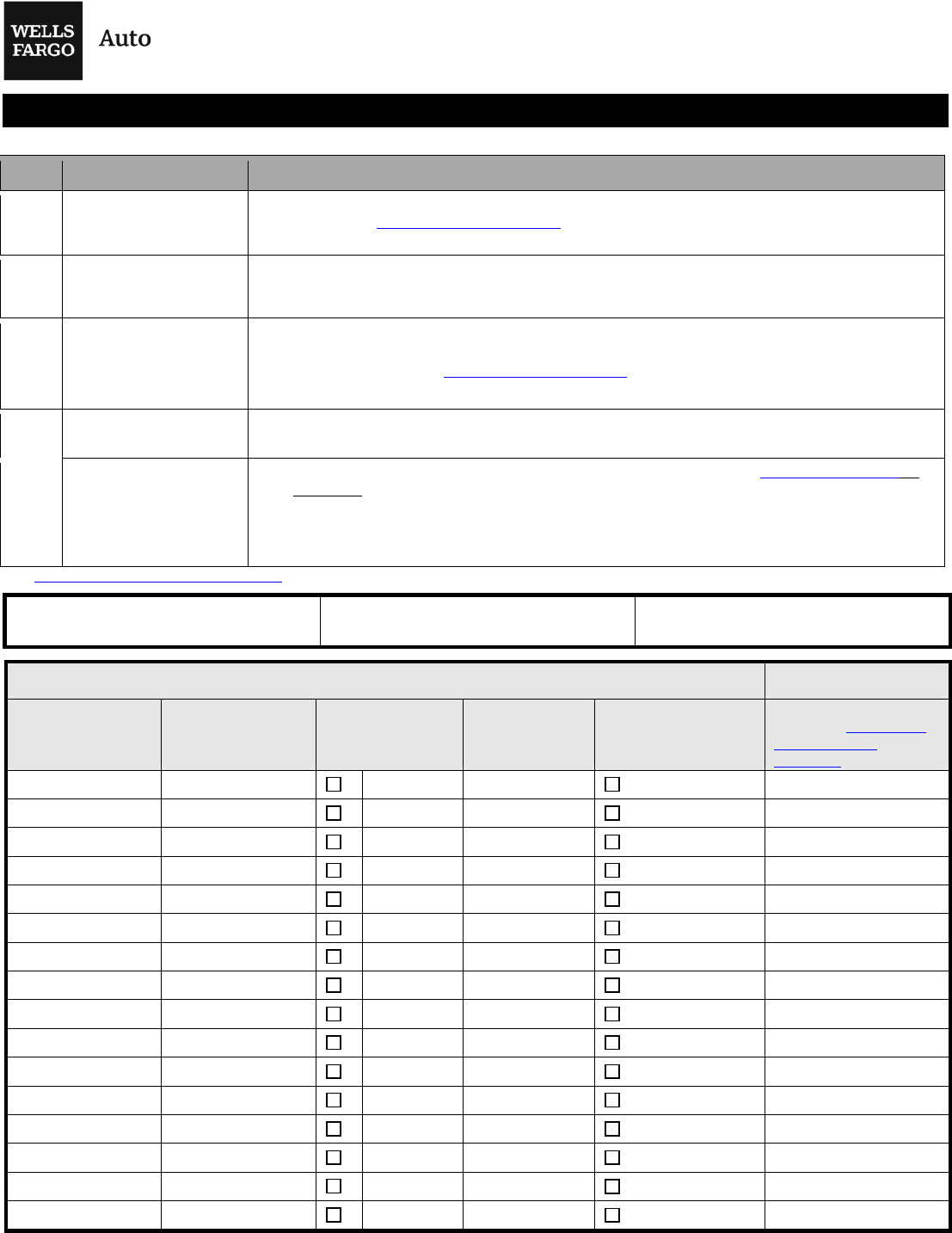

Dealer Information Sheet

Dealer Name and Address

Dealer Name (maximum 27 characters)

Corporate Legal Name (if different)

New Reactivate for DIS #

Reason for Inactivation:

Territory Number Territory Name

Dealer Type

Dealer National Account Commercial (Select Relationships Below)

Comm Relationships:

Deposits/Treasury

Interest Rate Mgmt.

Wells Fargo Floor Plan

Merchant Services

Insurance

Real Estate

Elected Official? Government Official Name

Yes No

Elected Official’s Position Elected Official’s Position at the Dealership

Corporate Master Dealer Agreement

For parent company, list the dealers to be added to the group (DIS Numbers).

DIS #

Parent Company Name

Dealer Options Electronic Vendor

eContracts

Dealertrack ID Route One ID

Physical Address Mailing Address

City State ZIP Code City State ZIP Code

Dealer Phone Number

F&I Fax Business Office Fax Net Monthly Code (refer to Dealer Participation Matrix OF-365; ACH Mandatory)

Wells Fargo Auto Contact Name (person to call for questions; print clearly)

Print ARM Name BDT Mobile Phone

Use to gather information from the Dealer.

Submit online with the Dealer File Activation

form.

OF-30 (01/15/20)

Wells Fargo Auto is a division of Wells Fargo Bank, N.A. © 2020 Wells Fargo Bank, N.A. All rights reserved.

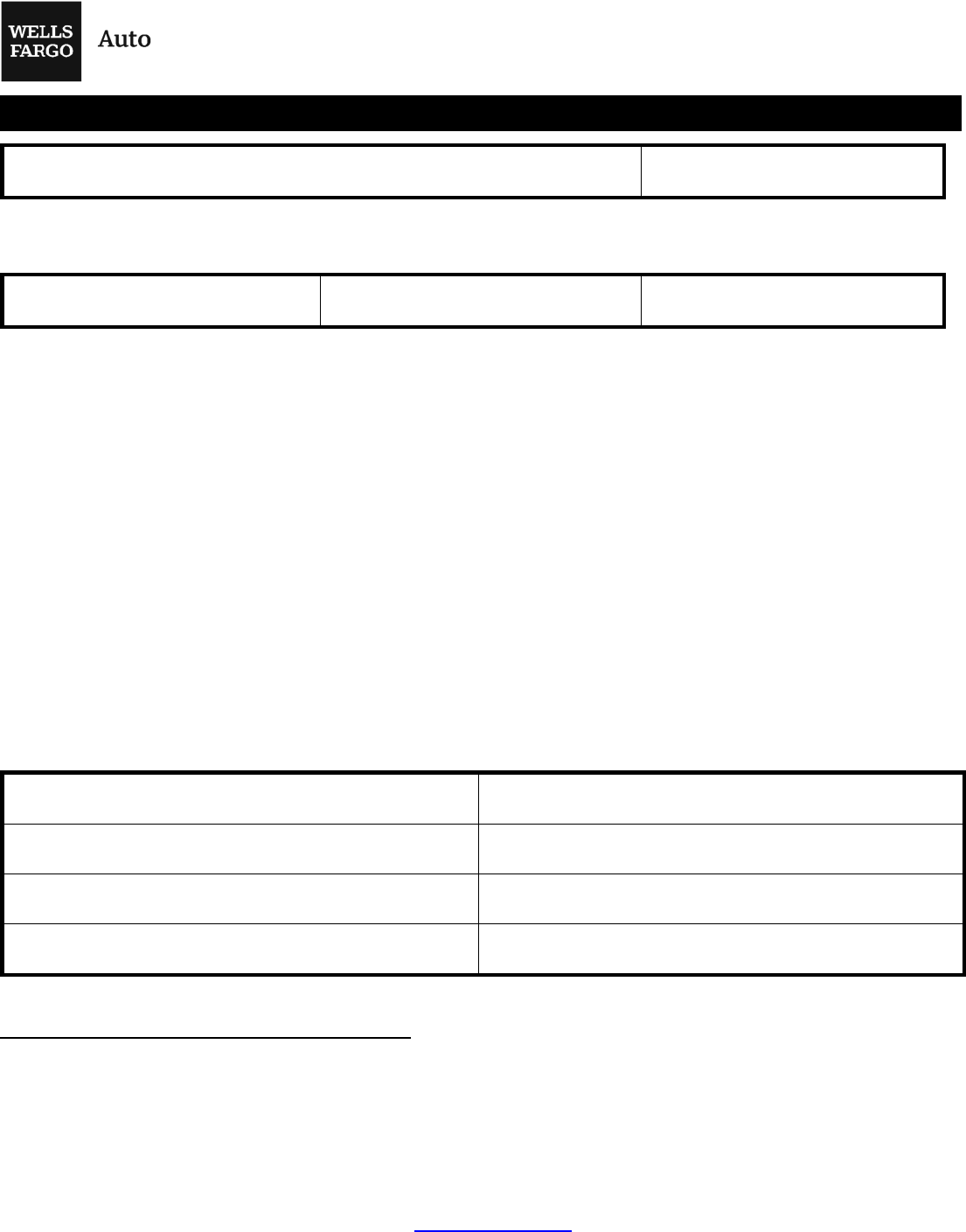

ACH Profile Authorization Form

Dealer Name* DIS Number (if applicable)

Pursuant to the Dealer Agreement and for the purpose of funding motor vehicle financing to Dealer's account, by signing

this authorization, the above referenced Dealer is granting Wells Fargo Bank, N. A. DBA Wells Fargo Auto permission and

authority to credit, via Electronic Funds Transfer (EFT), to:

Dealer Bank Account Number/Type* Bank Name* Bank Transit / Routing Number *

By signing this authorization, Dealer is also agreeing that:

Dealer will guarantee vehicle title on purchased contracts funded by EFT. Each contract shall be deemed purchased

upon receipt of transferred funds from Wells Fargo Auto.

The bank account number and transfer instructions provided are true and correct for Dealer. If during the term of this

authorization Wells Fargo Auto receives a Notice of Change (NOC) from a financial institution related to a change in

Dealer’s account, bank, or transit/routing number, Wells Fargo Auto is authorized to update its records accordingly as

required by National Automated Clearing House Association (NACHA) guidelines.

Dealer agrees to indemnify and hold Wells Fargo Auto harmless from any and all claims, actions, and liability and from

any loss suffered by Wells Fargo Auto as a result of any EFT. Wells Fargo Auto will not be responsible for any loss

suffered by Dealer as a result of any EFT.

Payment of fees charged by Dealer's bank in connection with processing of EFTs shall be the sole responsibility of

Dealer, and Wells Fargo Auto will not be held responsible for such fees.

If the bank account information provided does not match the corporate name on the Dealer Agreement, Dealer

authorizes Wells Fargo Auto to deposit funds into the account for which information has been provided.

In the event there is a negative balance due to Wells Fargo Auto, caused by non-sufficient funds, a change in ACH

bank account information, or a block on the account, Dealer must contact Wells Fargo Auto immediately and provide

new bank account information. Due to system limitations, Dealer will have to replace the funds with a certified check

directly to Wells Fargo Auto while Wells Fargo Auto processes the new ACH information. This includes and is not

limited to dealer participation and deal proceeds.

Dealer Authorized Signer Name* Address*

Dealer Authorized Signature* City, State, ZIP*

Phone Number* Title*

Date* Loan Administration Manager (LAM) 5 / National Account Manager / Call Center

Sales Manager/ Retail Sales Manager Signature*

*Required Fields (Signature from LAM 5 or equivalent is required for Dealer information changes)

Attach a deposit slip or voided check (or a copy) with Dealer’s name imprinted. Dealer’s bank account number, bank

name, and bank transit/routing number entered above must match the voided check or deposit slip. If a deposit slip or

voided check is not available, a letter from Dealer’s bank with the account information is acceptable.

By signing this form, Dealer authorizes Wells Fargo Auto to initiate credit entries to the above-identified account, confirms

that Dealer must comply with the applicable provisions of U.S. law, and agrees to abide by NACHA rules.

In the event of a conflict between any term in this form and any term in the Dealer Agreement, the term of the Dealer

Agreement shall control.

Submit documents via Dealer Maintenance request form

OF-99 (06/12/19)

Wells Fargo Auto is a division of Wells Fargo Bank, N.A. © 2019 Wells Fargo Bank, N.A. All rights reserved.

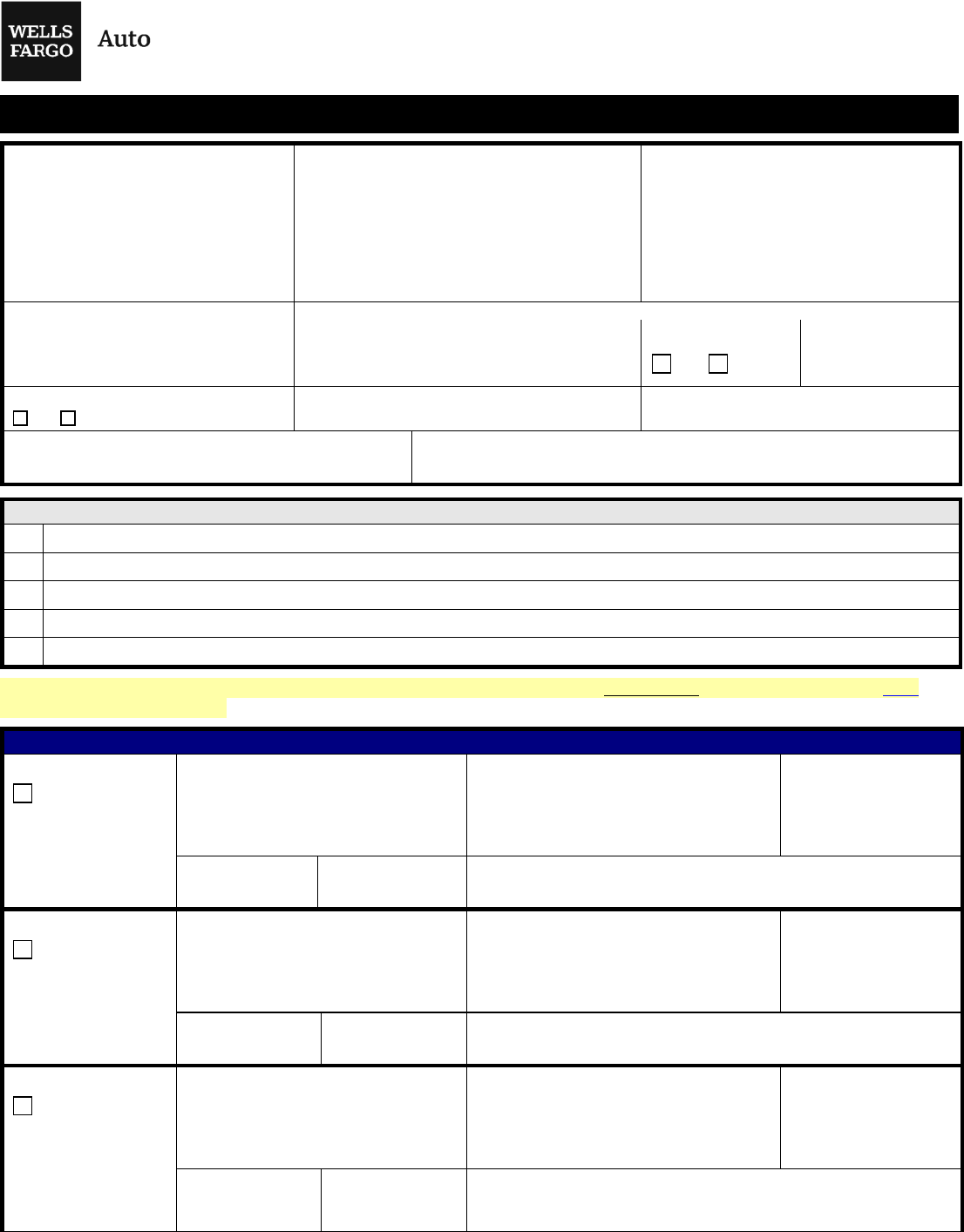

Franchise Dealer Profile

Dealership Legal Name

Dealership DBA name

Dealership Name (as it appears in Retail

Installment Contract)

Address Main Phone

Dealership Website Electronic Vendor

Dealertrack ID

RouteOne

YES NO

Route One ID

Primary Collateral Evaluation Software:

KBB NADA

F & I FAX

f

Business Office Fax

Federal Tax Identification Number (TIN)

The state in which Dealership filed Articles of Incorporation (or LLC):

Only New Car Manufacturers that Dealer Represents

1

2

3

4

5

*If the authorized signer has a preferred name or nickname, identify these names in the Dealer Profile, to be updated in DIS. See Sales

P&P for variations and examples.

Dealer Principal Information

Dealer Principal # 1

Checked GSMOS

(DCaRS Only)

Name*

Preferred Name/Nickname

Email Address Date of Birth

Last 4 digit of SSN % of ownership Residential Address

Dealer Principal # 2

Checked GSMOS

(DCaRS Only)

Name*

Preferred Name/Nickname

Email Address Date of Birth

Last 4 digit of SSN % of ownership Residential Address

Dealer Principal # 3

Checked GSMOS

(DCaRS Only)

Name*

Preferred Name/Nickname

Email Address Date of Birth

Last 4 digit of SSN % of ownership Residential Address

OF-149 (01/10/20)

Wells Fargo Auto is a division of Wells Fargo Bank, N.A. © 2020 Wells Fargo Bank, N.A. All rights reserved. Page 3 of 10

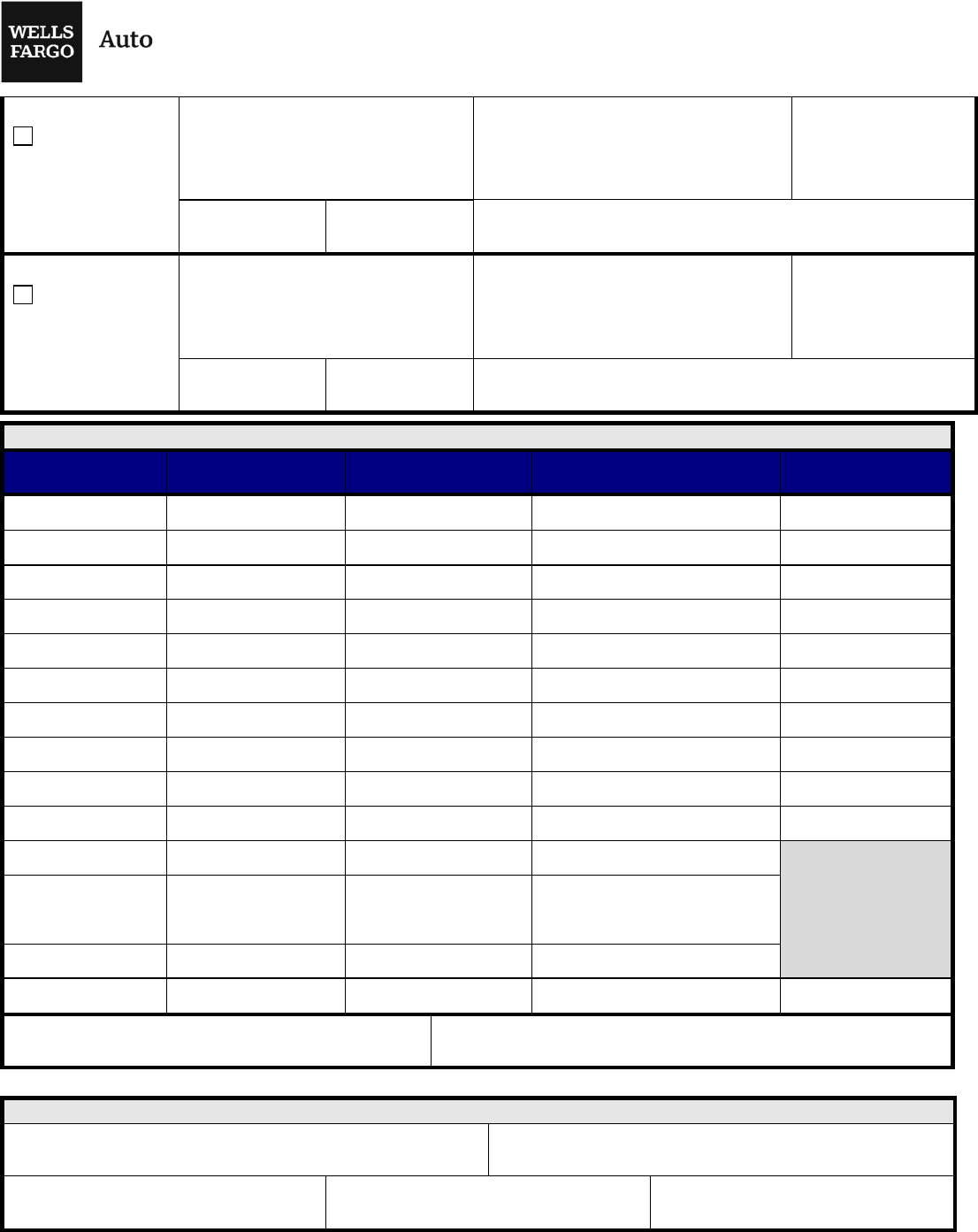

Dealer Principal # 4

Checked GSMOS

(DCaRS Only)

Name*

Preferred Name/Nickname

Email Address Date of Birth

Last 4 digit of SSN % of ownership Residential Address

Dealer Principal # 5

Checked GSMOS

(DCaRS Only)

Name*

Preferred Name/Nickname

Email Address Date of Birth

Last 4 digit of SSN % of ownership Residential Address

Dealership Staff Information

Title Name Preferred Name or

Nickname

Email Address Preferred Method of

Communication

Corporate Officer

Corporate Officer

Corporate Officer

Controller

F&I Director

F&I Manager(s)

GM

GSM

Office Manager

Title Clerk

Parts Manager

Aftermarket

Recovery

Contract

Service Manager

Post Sale Contact

Aftermarket Cancellation Contact Phone Aftermarket Cancellation Contact Fax

Note: Proof of Corporate officer required (include copies of documentation in dealer signup package).

Production Information

Average Sales per Month - New Cars Average Sales per Month - Used Cars

Life Accident and Health Provider

GAP Provider Service Contract Provider

OF-149 (01/10/20)

Wells Fargo Auto is a division of Wells Fargo Bank, N.A. © 2020 Wells Fargo Bank, N.A. All rights reserved. Page 4 of 10

Reminder: List the aftermarket products sold at the dealership using form (OF-611)

Present Financial Institution

Name

Landlord or Mortgage Holder

Name

Floor Plan

Company Name Contact Name and Phone

I understand that by providing the fax number(s) above or any other fax number(s) that I provide in the future, on behalf of

the dealership, that said dealership consents to receive advertising faxes (including rate sheets) sent by or on behalf of

Wells Fargo Auto.

Dealer Principal or Corporate Officer Print Name Dealer Principal or Corporate Officer Signature Date

Dealer Principal or Corporate Officer Print Name Dealer Principal or Corporate Officer Signature Date

Dealer Principal or Corporate Officer Print Name Dealer Principal or Corporate Officer Signature Date

Dealer Principal or Corporate Officer Print Name Dealer Principal or Corporate Officer Signature Date

Dealer Principal or Corporate Officer Print Name Dealer Principal or Corporate Officer Signature Date

OF-149 (01/10/20)

Wells Fargo Auto is a division of Wells Fargo Bank, N.A. © 2020 Wells Fargo Bank, N.A. All rights reserved. Page 5 of 10

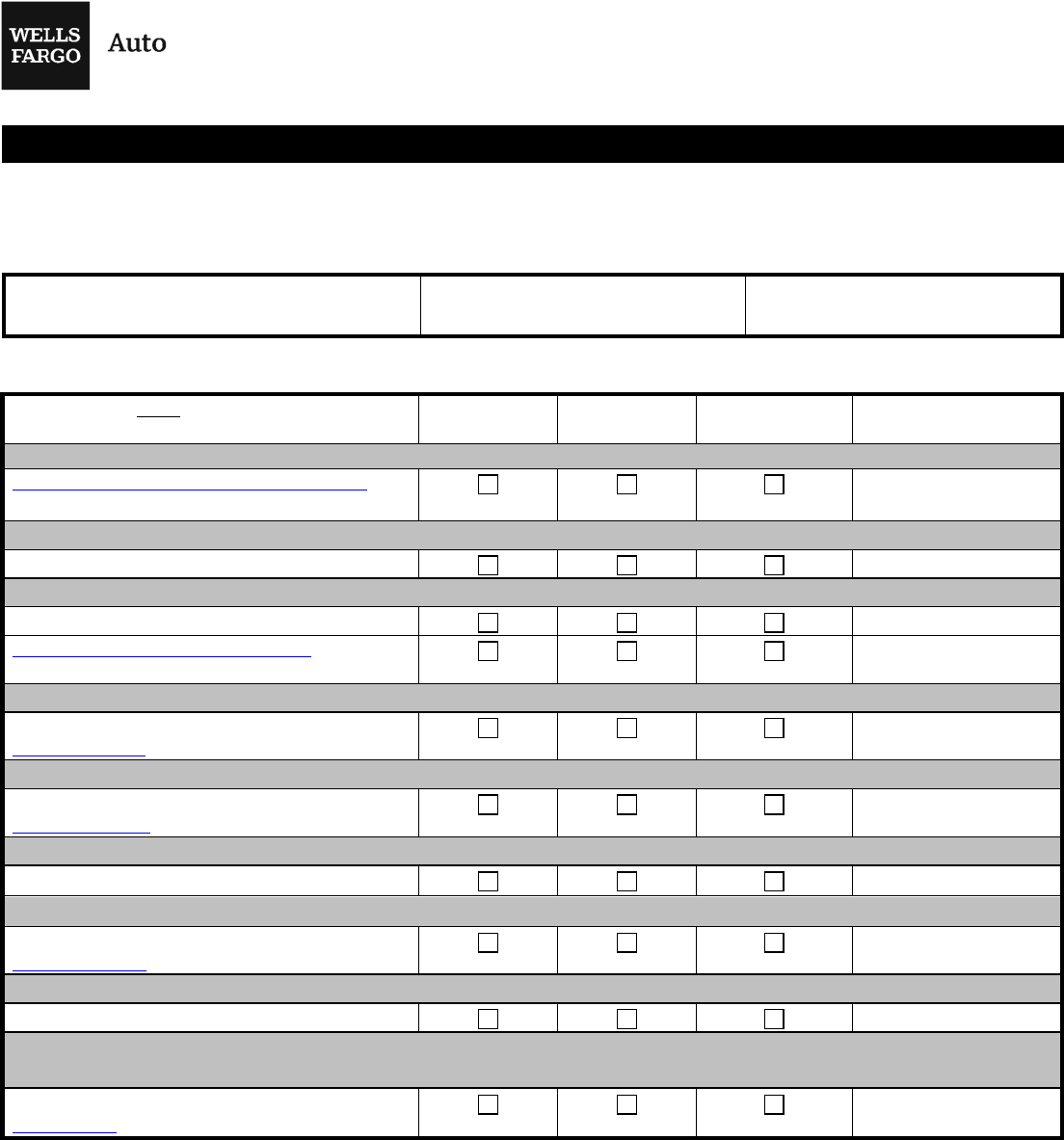

Franchise Dealer Qualification Checklist

• All pages must be completed.

• For additional items required by states, refer to Section A below.

• A complete dealer file, including this checklist, must be sent to DCaRS for approval before purchasing contracts from a

prospective dealer.

Dealer Name Territory Name Territory Number

Section A

All documents must be reviewed and

completed prior to submission to DCaRS.

ARM

RSM DCaRS

Representative

Comments

California Only

Agreement for Entitlement to Refund (OF-180) –

signed by Dealer and Wells Fargo Auto

Florida Only

Florida Banking Finance Business License

Michigan Only

Michigan Banking Finance Business License

Michigan Tax Refund Form (OF-482) – signed by

Dealer and Wells Fargo Auto

New Jersey Only

Early Contract Payoff GAP Refund Dealer Letter:

OF/LTR-563_NJ

Oklahoma Only

Early Contract Payoff GAP Refund Dealer Letter:

OF/LTR-563_OK

Pennsylvania Only

Pennsylvania Banking Finance Business License

South Carolina Only

Early Contract Payoff GAP Refund Dealer Letter:

OF/LTR-563_SC

Texas Only

Texas Banking Finance Business License

Alabama Indiana Maryland Nebraska

Colorado Iowa Massachusetts Nevada

Oregon

Texas

Vermont

Wisconsin

Early Contract Payoff GAP Refund Dealer Letter:

OF/LTR-563

OF-116 (12/13/19)

Wells Fargo Auto is a division of Wells Fargo Bank, N.A. © 2019 Wells Fargo Bank, N.A. All rights reserved.

Section B

All documents must be reviewed and

completed prior to submission. DCaRS

request must match documentation and

forms.

ARM

RSM

DCaRS

Representative

Comments

Affiliated Dealer Search – Search for any

affiliated dealer using DIS and Salesforce.

Is affiliated dealer listed?

Yes No

If yes, list dealer name

and parent number:

Franchise Dealer Qualification Checklist

(OF-116)

IRS Form W-9 from IRS website

Franchise Dealer Profile (OF-149) with

signatures and dates

ACH Profile Authorization (OF-99) – signed by

Dealer and Wells Fargo Auto

Deposit slip or copy of voided check with

dealer's name imprinted. If deposit slip or

voided check is not available, a letter from the

bank or dealership with the account information

is acceptable.

Dealer Agreement (OF-24)

Must be signed by Dealer Principal or Corporate

Officer and Wells Fargo Auto VP or higher.

Dealer Agreement Schedule 1 (OF-24d)*

*Used in combination with OF-24 when dealer

identifies subsidiaries, affiliates, and fictitious

names.

Must be signed by Dealer Principal or Corporate

Officer and Wells Fargo Auto VP or higher.

Proof of Legal Name (if applicable) – see

Documentation for Franchise Dealers for

acceptable documentation

DBA proof (if applicable) - see Documentation

for Franchise Dealers for acceptable

documentation

Current Dealer License

OF-116 (12/13/19)

Wells Fargo Auto is a division of Wells Fargo Bank, N.A. © 2019 Wells Fargo Bank, N.A. All rights reserved.

Aftermarket Products Sold at Dealership (OF-

611)

• Complete form with products reviewed by

Aftermarket Product Management (AMP)

team.

• Include “okay to proceed” email from AMP

team.

See Aftermarket Products Sold at Dealership

Negative News Search Request (OF-712)

Yes No

If yes, attach to dealer

signup file.

Provide copy of the document to the dealer. ARM

Fair Lending Statement (OF-593)

Approvals (All items listed above are in the file and in the correct order.)*Required Signatures

Auto Relationship Manager Signature * Auto Retail Credit National Account Manager/ Auto Retail Credit

National Account Management Manager/ Retail Sales Manager/

Commercial/Retail Market Manager or Designated Approver

Signature*

OF-116 (12/13/19)

Wells Fargo Auto is a division of Wells Fargo Bank, N.A. © 2019 Wells Fargo Bank, N.A. All rights reserved.

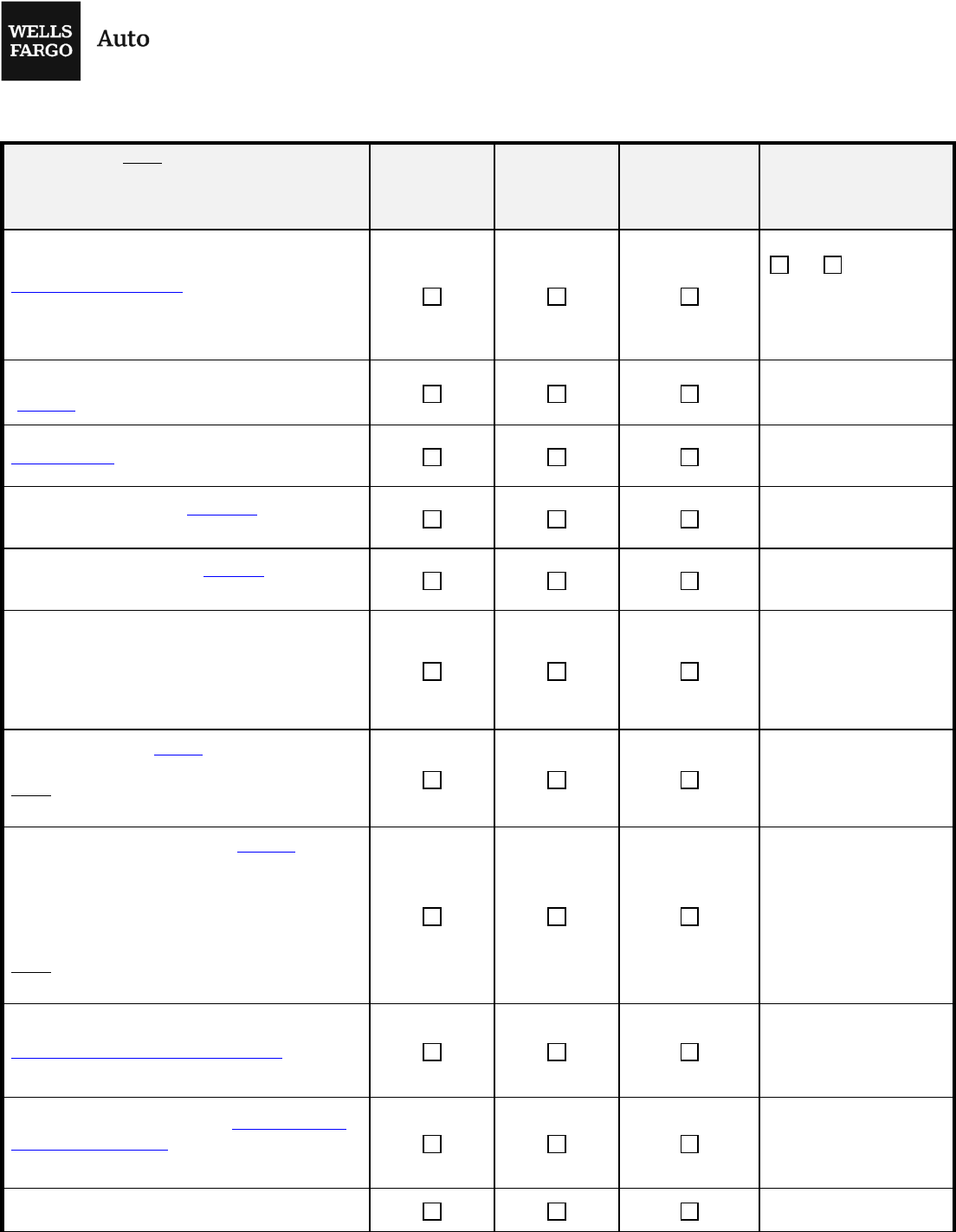

Aftermarket Products Sold at Dealership

When prospecting a new dealer or updating an IDA, perform these steps prior to submission to DCaRs.

Step Team member Action(s)

1. Sales (ARM/RSM/ARR/Call

Center Sales Manager) team

member

a. *Complete all sections below.

b. Send form to [email protected].

2.

Aftermarket Product

Management Team

a. *Review form and select your response.

b. Send form back to Sales team member with responses. If none of the product(s) require(s) further review,

include an “okay to proceed” email confirmation.

3.

Sales team member

a. For products identified as “Need review”, collect copies of all product forms and re-attach the completed

OF-611.

c. If none of the product(s) are identified as “Need review”, proceed to step 5.

4.

Aftermarket Product

Management Team

a. Send response to Sales team member to confirm receipt of the product forms and confirmation to

proceed.

5.

Sales team member

a. Upload the dealer onboarding package or IDA along with the following to the DCaRS SharePoint site for

processing:

• Completed OF-611

• Copy of email confirmation from Aftermarket Products team to proceed with onboarding or IDA

process

*See Aftermarket Products Sold at Dealership for details.

Dealership Name Address Main Phone

Aftermarket Products

For Aftermarket team use

only

Product Type Provider Name

Direct Sale or Agent

Info

Form(s) Name

and Number

Dealer Owned

*For products that require

review, see Aftermarket

Products Sold at

Dealership.

Yes [Loss rate] [Select]

Yes [Loss rate]

[Select]

Yes [Loss rate]

[Select]

Yes [Loss rate]

[Select]

Yes [Loss rate]

[Select]

Yes [Loss rate]

[Select]

Yes [Loss rate]

[Select]

Yes [Loss rate]

[Select]

Yes [Loss rate]

[Select]

Yes [Loss rate]

[Select]

Yes [Loss rate]

[Select]

Yes [Loss rate]

[Select]

Yes [Loss rate]

[Select]

Yes [Loss rate]

[Select]

Yes [Loss rate]

[Select]

Yes [Loss rate]

[Select]

OF-611 (01/10/20)

Wells Fargo Auto is a division of Wells Fargo Bank, N.A. © 2020 Wells Fargo Bank, N.A. All rights reserved.

WELLS

FARGO

Auto

Fair

lending

—

our

shared

commitment

Helping

customers

succeed

financially

is

our

ultimate

and

enduring

mission.

Making

financial

services

available

to

everyone

on

a

fair

and

consistent

basis

and

providing

all

applicants

an

equal

opportunity

to

obtain

automobile

financing

is

essential

to

this

success.

It

’

s

a

commitment

we

expect

from

our

team

members,

and

every

dealership

we

do

business

with.

Because

we

believe

in

fair

and

equal

access

to

credit,

we

ensure

that

all

credit

applicants

and

prospective

credit

applicants

are

treated

fairly

and

consistently

throughout

the

entire

lending

process.

We

strive

to

comply

with

both

the

spirit

and

letter

of

the

law,

including

the

Equal

Credit

Opportunity

Act

(ECOA)

and

the

various

state

and

local

laws

that

prohibit

discrimination

in

lending.

Our

commitment

to

fair

lending

includes:

•

Advertising

products

and

services

in

a

non-

discriminatory

manner

that

is

designed

to

inform

and

attract

a

diverse

customer

base.

•

Adhering

to

responsible

lending

practices

that

fully

disclose

costs

and

conditions

of

credit

to

the

customer

and

allow

the

customer

to

make

an

informed

decision.

•

Promoting

credit

and

pricing

decisions

that

are

based

on

prudent

underwriting

standards

that

are

valid

for

predicting

risk

and

avoiding

bias

on

any

prohibited

basis.

•

Training

team

members

on

fair

lending

laws

and

on

customer

service

techniques

designed

to

help

our

team

members

treat

all

applicants

fairly

and

consistently.

•

Hiring

and

promotional

policies

that

support

fair

lending

by

fostering

diversity

and

creating

an

inclusive

environment

in

which

all

team

members

and

customers

feel

welcome.

•

Monitoring

customer

complaints

and

the

contracts

we

purchase

to

help

detect

potential

fair

lending

risk

and

taking

corrective

action,

including

those

that

may

require

your

cooperation.

We

expect

that

you,

and

all

third

parties

that

you

may

contract

with

in

support

of

your

business

activities,

share

our

fair

lending

commitment

in

both

words

and

actions

by

ensuring

that

all

customers

seeking

vehicle

financing

are

treated

fairly

and

consistently

without

regard

to

any

basis

prohibited

by

law.

Furthermore,

your

agreement(s)

with

Wells

Fargo

requires

compliance

with

all

applicable

laws

with

regard

to

the

extension

of

credit,

including

those

covering

fair

lending.

Thank

you

for

doing

business

with

us

and

for

your

shared

commitment

to

fair

lending.

We

look

forward

to

our

continued

relationship.

If

you

have

any

questions

about

our

Fair

Lending

Program,

please

contact

your

auto

relationship

manager.

Wells

Fargo

Auto

is

a

division

of

WeIIs

Fargo

Bank,

N.A.

Member

FDIC

and

Equal

Credit

Opportunity

Lender.

©

2019

Wells

Fargo

Bank,

N.A.

All

rights

reserved.

6579178

9/19