MISSOURI DEALER AND BUSINESS OPERATING MANUAL

Revised: March 2023

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

Table of Contents

Section 1: Contact Information ............................................................................... 1-1

Section 2: General Information

Certificate of License ............................................................................................ 2-1

Access to Online Services .................................................................................... 2-1

Definitions ............................................................................................................. 2-2

Section 3: Dealer License Requirements

Who Is Required to Be Licensed As a Dealer? ..................................................... 3-1

How Do I Apply for a License? .............................................................................. 3-1

Completing the Online Application for a New Missouri Dealer License ................. 3-2

Organization Information ................................................................................. 3-2

Contact Information ......................................................................................... 3-2

License Operations .......................................................................................... 3-2

Administrative Fee ........................................................................................... 3-3

Plate Inventory ................................................................................................. 3-3

Fees ................................................................................................................ 3-4

Bond Policies ................................................................................................... 3-4

Franchise Agreement or letter of Appointment ................................................ 3-4

Owner Information ........................................................................................... 3-5

Background Check Information ....................................................................... 3-5

Signature ......................................................................................................... 3-6

Location Inspection .......................................................................................... 3-6

Garage Policies ............................................................................................... 3-8

Business Photo ................................................................................................ 3-8

Certificate of Dealer Seminar Completion ....................................................... 3-8

Affiliated Salvage Licenses .............................................................................. 3-9

Special Event Motor Vehicle Auction License ....................................................... 3-9

Limitations and Requirements for Special Event Motor Vehicle Auctions ........ 3-9

Section 4: Dealer License and Plate Fees

License Fees ........................................................................................................ 4-1

License Plate Fees ............................................................................................... 4-2

Additional Dealer Plates ........................................................................................ 4-3

Replacement Dealer Plate/Certificate of Number ................................................. 4-4

Driveaway Plates .................................................................................................. 4-4

Section 5: Use of Dealer License Plates

General Information .............................................................................................. 5-1

Temporary Plates for New Applicants ................................................................... 5-1

Section 6: Dealer Sales and Reporting Requirements

Minimum Sales Required ....................................................................................... 6-1

Monthly Sales Reporting ........................................................................................ 6-2

E-Filing Dealer Reports or Completing a Notice of Sale ........................................ 6-2

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

Monthly Reporting – Things to Remember ............................................................ 6-3

Penalty for False Statement or Omissions of Facts on Sales Reports ................... 6-4

Section 7: Dealer Advertising Practices ................................................................. 7-1

Section 8: Dealer Off-Premises and Sunday Sales

Off-Premises Show ................................................................................................ 8-1

Off-Premises Restrictions ...................................................................................... 8-1

Off-Premises Displays ........................................................................................... 8-2

Off-Premises Sale of Vehicle Used, Titled, and Registered by Dealership ............ 8-2

RV Shows – Requirements for Out-of-State Participants ....................................... 8-3

Sunday Sales ......................................................................................................... 8-3

Section 9: Dealer Financial Responsibility

Requirements to Maintain Financial Responsibility ................................................ 9-1

Penalties for Failure to Maintain Financial Responsibility ...................................... 9-1

Section 10: Salvage Business License Requirements

Who Is Required to Be Licensed As a Salvage Business? .................................. 10-1

How Do I Apply for a License? ............................................................................. 10-1

Completing the Online Application for a New or Renewal

Missouri Salvage Business .................................................................................. 10-1

Organization Information ................................................................................ 10-1

Contact Information ........................................................................................ 10-2

Physical Address ............................................................................................ 10-2

Fees ............................................................................................................... 10-2

License Operations ......................................................................................... 10-2

Current and Past Salvage History .................................................................. 10-3

Owner Information .......................................................................................... 10-3

Background Check Information ...................................................................... 10-3

Signature ........................................................................................................ 10-4

Location Inspection ......................................................................................... 10-4

Business Photo ............................................................................................... 10-4

Taxes on Parts ..................................................................................................... 10-4

Salvage Pools and Disposal Sales ...................................................................... 10-4

Responsibilities of a Body Shop........................................................................... 10-5

Responsibilities of a Scrap Metal Operator .......................................................... 10-5

Section 11: Changes Involving the Dealership or Salvage Business

Dealership ............................................................................................................ 11-1

Change in Dealership Location ....................................................................... 11-1

Change in Dealership Name........................................................................... 11-1

Partial Change in Dealership Owners ............................................................. 11-1

Complete Change in Dealership Owners ....................................................... 11-2

Dealership Buy-Out ........................................................................................ 11-2

Terminating, Selling, or Abandoning the Dealership ....................................... 11-2

Death or Incapacitation of an Owner .............................................................. 11-2

Salvage Business ................................................................................................ 11-2

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

Change in Business Location ......................................................................... 11-2

Change in Business Name ............................................................................. 11-3

Partial Change in Business Owners ............................................................... 11-3

Termination of a Salvage Business ................................................................ 11-3

Death or Incapacitation of an Owner .............................................................. 11-3

Section 12: Dealer and Salvage Business Record Keeping Requirements

Dealers ............................................................................................................... 12-1

Record Keeping Requirements ...................................................................... 12-1

Maintaining Records Digitally ........................................................................ 12-1

Temporary Permit Records............................................................................ 12-2

Business Records .......................................................................................... 12-2

Inspection of Records .................................................................................... 12-2

Salvage Business ............................................................................................... 12-3

Record Keeping Requirements ...................................................................... 12-3

Inspection of Records .................................................................................... 12-4

Section 13: Proof of Ownership for Dealers

General Information ............................................................................................ 13-1

Selling New Motor Vehicles ................................................................................ 13-1

Requirements ................................................................................................ 13-1

Restrictions .................................................................................................... 13-1

Transferring Ownership of a Motor Vehicle ......................................................... 13-2

Buying and Selling a Vehicle Without Title .......................................................... 13-2

Rescinded Sales ................................................................................................. 13-3

Duplicate Manufacturer’s Statement of Origin (MSO) ......................................... 13-4

Reassignment of Ownership by a Registered Dealer (RIDERS) ........................ 13-4

Consignment Sales ............................................................................................. 13-5

Information for Auctions and Dealers Selling at Auctions ................................... 13-5

Auctions – Records Required ........................................................................ 13-5

Section 14: Lease Rental License Requirements

Who is Required to Be Licensed As a Lease Rental Company? ........................ 14-1

How Do I Apply for a License? ............................................................................ 14-1

Completing the Online Application for Permit to Operate as

a Motor Vehicle/Marinecraft Leasing Company .................................................. 14-1

Organization Information ............................................................................... 14-1

Contact Information ....................................................................................... 14-2

License Operations ........................................................................................ 14-2

Affiliated Licenses .......................................................................................... 14-2

Physical Address ........................................................................................... 14-2

Mailing Address ............................................................................................. 14-2

Bond or ILC ................................................................................................... 14-2

Branches ....................................................................................................... 14-2

Owner Information ......................................................................................... 14-2

Corporate Structure ....................................................................................... 14-2

Signature ....................................................................................................... 14-3

Fees .............................................................................................................. 14-3

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

Additional Lease and Rental Fleet Plates ........................................................... 14-3

Cancellation or Denial of a Lease Rental License .............................................. 14-4

Termination of a Lease Rental Company ............................................................ 14-4

Dealers Licensed as a Lease Rental Company .................................................. 14-4

Section 15: Title Service Business License Requirements

Who is Required to Be Licensed as a Title Service? .......................................... 15-1

How Do I Apply for a License? ............................................................................ 15-1

Organization Information ..................................................................................... 15-1

Contact Information ............................................................................................. 15-1

Physical Address ................................................................................................ 15-2

Mailing Address .................................................................................................. 15-2

Bond or ILC ......................................................................................................... 15-2

Owner Information .............................................................................................. 15-2

Background Check Information ........................................................................... 15-2

Fees .................................................................................................................... 15-3

Record Keeping Requirements ........................................................................... 15-3

Disciplinary Action ............................................................................................... 15-3

Section 16: Transportation Network Company (TNC)

Who is Required to Be Licensed as a TNC? ....................................................... 16-1

How do I Apply for a License? ............................................................................ 16-1

How do I Renew my License? ............................................................................ 16-1

How to Report a Driver ....................................................................................... 16-1

Violation(s)/Assessment(s) ................................................................................. 16-1

Consumer Complaints ........................................................................................ 16-2

Definitions ........................................................................................................... 16-2

Section 17: Driveaway Company License Plates

Who is Allowed Driveaway Plates? ..................................................................... 17-1

Examples of Businesses Issued Driveaway License Plates ............................... 17-1

Required Documents .......................................................................................... 17-1

Fees .................................................................................................................... 17-1

Use of Plates ...................................................................................................... 17-1

Section 18: Repossessed Placards ...................................................................... 18-1

Section 19: Dealer Educational Seminar Provider

Who is Required to be a Licensed Dealer Educational Seminar Provider? ........ 19-1

How do I Apply for a License? ............................................................................ 19-1

Disciplinary Action ............................................................................................... 19-2

Refusal to Issue or Renew License ............................................................... 19-2

Section 20: Complaints/Disciplinary Action

Dealers ............................................................................................................... 20-1

Complaints..................................................................................................... 20-1

Disciplinary Action ......................................................................................... 20-1

Department Subpoenas ................................................................................. 20-3

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

Criminal Provisions ........................................................................................ 20-4

Salvage Business ............................................................................................... 20-4

Disciplinary Action ......................................................................................... 20-4

Section 21: Miscellaneous Information

Temporary Permits ............................................................................................. 21-1

General Permit Information ........................................................................... 21-1

Obtaining Temporary Permits ........................................................................ 21-1

Requirements for Issuing a 30-Day Permit .................................................... 21-1

Requirements for Issuing a 60-Day Permit .................................................... 21-1

Responsibility of the Dealer ........................................................................... 21-2

Responsibility of the Buyer ............................................................................ 21-2

Federal Trade Commission Used Car Rule ........................................................ 21-3

Lemon Law Refunds ........................................................................................... 21-3

Sales to Minors ................................................................................................... 21-3

Odometer Repair or Replacement ...................................................................... 21-3

Section 22: Code of State Regulations ................................................................. 22-1

Exhibits

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

Titling/Registration: Motor Vehicle Bureau

PO Box 100

Jefferson City, MO 65105-0100

General Information: 573-526-3669

Salvage Information: 573-526-3669

Dealer Title/Verification: 573-526-3669

Dealer Registration: Motor Vehicle Bureau

Dealer Licensing Section

PO Box 43

Jefferson City, MO 65105-0043

Dealer Registration: 573-526-3669, option 7

Salvage Business: 573-526-3669, option 7

Supply Requests: Motor Vehicle Bureau

Attention: Supply Request

PO Box 100

Jefferson City, MO 65105-0100

Phone: 573-526-3669, option 7

Online: https://dor.mo.gov/forms/

Buyers Guide form Federal Trade Commission (FTC)

(“As Is” sticker): 6

th

and Pennsylvania Ave, North West

Washington, DC 20580

Phone: 877-382-4357

Missouri Automobile Dealers Association (MADA)

3322 American Avenue

PO Box 1309

Jefferson City, MO 65109

Phone: 573-634-3011

Missouri Independent Automobile Dealers Association (MOIADA)

PO Box 481

Blue Springs, MO 64013

MIADA Phone: 800-889-1073

Section

1

CONTACT INFORMATION

1-1

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

CERTIFICATE OF LICENSE

The Department of Revenue issues a certificate of license to each dealer and businesses upon

approval of their application for registration. A dealer and salvage business license must be

prominently displayed in the business office at all times. If you have not received your Certificate of

License or the certificate is incorrect, contact the Department of Revenue, Dealer Licensing Section,

at 573-526-3669, option 7 or log into your MyDMV account to reprint the license.

A separate license and fee is required for each of the following categories of license at each

location where a licensee auctions, manufactures, sells, or displays motor vehicles, trailers, or boats:

Motor vehicle dealer;

Boat dealer (a motor vehicle dealer or trailer dealer may purchase and sell up to six boats or

vessels during each licensure period without licensing as a boat dealer);

Powersport dealer:

Wholesale motor vehicle dealer;

Trailer dealer;

Recreational vehicle dealer;

Motor vehicle, trailer, and boat manufacturer;

Wholesale motor vehicle auction;

Public motor vehicle auction;

Lease Rental company;

Salvage dealer or dismantler;

Body shop;

Scrap processor; and

Used parts dealer.

Storage Lot(s)

A dealer may store vehicles at a storage lot location other than at the licensed business location,

provided the Department is notified of the storage location, in writing, and no sales activity occurs on

the storage lot.

ACCESS TO ONLINE SERVICES

By accessing https://dor.mo.gov/motor-vehicle/dealers-lienholders/, lienholders and dealers who have

contracted with lienholders may file a notice of lien online by using the Department’s online Notice of

Lien Application. The fee is $2.50.

A notice of lien may only be filed online if the lien is a primary (first lien). If you are intending to file a

notice of lien on a unit where you are a secondary lienholder, you cannot file the notice of lien online;

you must file the notice of lien on paper with the following documentation:

Section

2

GENERAL INFORMATION

2-1

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

NO CHANGE

OF

OWNERSHIP

Application;

o Vehicle – Application for Missouri Title and License (Form 108) with “Title and

Notice of Lien” box checked; or

o Vessel/OBM – Application for Missouri Boat/Vessel or Outboard Motor and

Registration (Form 93) with “Title and Notice of Lien” box checked.

Certificate of title; and

Notice of Lien, Lien Release, Or Authorization to Add/Remove Name From Title

(Form 4809);

o Lien authorization or release of the existing lien is not required if the lienholder

is only updating a lien (same owners and same lienholder).

o A second lienholder must submit authorization from the primary lienholder

authorizing the second lien.

$20.50 ($8.50 title fee, $6 processing fee, and $6 NOL processing fee.)

CHANGE OF

OWNERSHIP

Notice of Lien, Lien Release, Or Authorization to Add/Remove Name From Title

(Form 4809); and

$6 NOL processing fee.

A dealer or lienholder may apply for a security access code which authorizes access, under the

Driver’s Privacy Protection Act (DPPA), to the Department’s motor vehicle and marine title and lien

records using the online system. The online record search will check the Department’s title, lien,

notice of sale, and reject files, and provide the most recent record(s) in each file. The base fee is

$0.0382 per record. If there is no record on file with the Department the $0.0382 is waived.

To apply for an online account number and security access code, go to https://dor.mo.gov/motor-

vehicle/dealers-lienholders/.

DEFINITIONS

Antique Motor Vehicle: Any motor vehicle at least 25 years of age.

Boat Dealer: Any person, partnership, or corporation who, for a commission or with an intent to make

a profit or gain of money or other thing of value, sells, barters, exchanges, leases or rents with the

option to purchase, offers, attempts to sell, or negotiates the sale of any vessel or vessel trailer,

whether or not the vessel or vessel trailer is owned by such person. Any person, partnership, or

corporation who sells six or more boats, vessels or vessel trailers (or combination of either) in any

calendar year. If dealer is both a boat dealer and a licensed boat manufacturer, refer to Section

301.559, RSMo for sales requirements.

Boat Manufacturer: Any person engaged in the manufacturing, assembling, or modification of new

vessels or vessel trailers as a regular business, including a person, partnership, or corporation which

acts for and is under the control of a manufacturer or assembly in connection with the distribution of

boats, vessels or vessel trailers. A manufacturer can only sell to dealers. If dealer is both a boat

dealer and a licensed boat manufacturer, refer to Section 301.559, RSMo for sales requirements.

Body Shop: A business that repairs physical damage on motor vehicles that are not owned by the

shop or its officers or employees by mending, straightening, replacing body parts, or painting.

2-2

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

Classic Motor Vehicle: A dealer of motor vehicles at least five years of age, which were produced in

limited numbers or otherwise have special value unrelated to basic transportation, excluding

recreational motor vehicles (RVs), historic motor vehicles, motorcycles, motor-tricycles, and all-terrain

vehicles (ATVs).

Dealer Educational Seminar Provider: A recognized business or school with a lawful presence in

the state of Missouri who is licensed with the Department of Revenue to provide professional

education, including consumer protection laws, to motor vehicle dealers.

Driveaway Operation:

The movement of a motor vehicle or trailer by any person or motor carrier other than a dealer over

any public highway, under its own power singly, or in a fixed combination of two or more vehicles,

for the purpose of delivery for sale or for delivery either before or after sale;

The movement of any vehicle or vehicles, not owned by the transporter, constituting the

commodity being transported, by a person engaged in the business of furnishing drivers and

operators for the purpose of transporting vehicles in transit from one place to another by the

driveaway or towaway methods; or

The movement of a motor vehicle by any person who is lawfully engaged in the business of

transporting or delivering vehicles that are not the person's own and vehicles of a type otherwise

required to be registered, by the driveaway or towaway methods, from a point of manufacture,

assembly or distribution or from the owner of the vehicles to a dealer or sales agent of a

manufacturer or to any consignee designated by the shipper or consignor.

Emergency Vehicle: Motor vehicles used as ambulances, law enforcement vehicles, and fire fighting

vehicles and assistance vehicles.

Franchisor: A person who grants a franchise to another person and complies with the franchisor’s

licensing requirement of the Motor Vehicle Franchise Practices (MVFP) Act.

The Department of Revenue does not license franchisors.

Franchised New Motor Vehicle Dealer: Any motor vehicle dealer who has been franchised to deal a

certain make of motor vehicle by the manufacturer or distributor of that make and motor vehicle and

who may, in line with conducting his business as a franchise dealer, sell, barter, or exchange used

motor vehicles.

A licensed dealer in the state cannot control, be controlled by, or share a common parent entity or

sibling entity with a manufacturer, except as permitted by sections 301.550 to 301.575, RSMo, and the

MVFP act. Dealers or manufacturers licensed in this state have standing to seek civil action against

such dealers or manufacturers if found to be in violation.

Lease and Rental Company: Any person, company, or corporation engaged in the business of

renting or leasing motor vehicles, trailers, boats, or outboard motors used exclusively for rental or

lease purposes and not for resale.

2-3

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

Manufacturer: Any person engaged in the manufacturing, assembling, or modification of new motor

vehicles or trailers as a regular business, including a person, partnership, or corporation which acts

for and is under the control of a manufacturer or assembly in connection with the distribution of motor

vehicles or accessories for motor vehicles. Manufacturers can only sell to dealers. If you are a

manufacturer and sell other vehicles in addition to what is manufactured, or sell more than eight new

motor vehicles, five boats that you manufacture on a retail basis you must obtain a license as a

“Manufacturer” and a “Motor Vehicle Dealer”. A “Manufacturer” alone is authorized to sell only the

new vehicles or boats it manufactures. If you are a manufacturer and sell to the public, you are

required to be licensed as a dealer. If you install “special bodies” (e.g., dump, hoist, lime spreaders),

on an incomplete chassis, you must register as a manufacturer. You can obtain information for

issuing Vehicle Identification Numbers (VIN) for units manufactured by contacting the National

Highway Traffic Safety Administration (NHTSA) at:

US DOT/NHTSA

NSA-32, Room 6111

1200 New Jersey Ave

SE West Building

Washington, DC 20590

Phone: 202-366-5210 or 888-327-4236

Online: http://www.nhtsa.dot.gov/cars/rules/maninfo/ or

https://vpic.nhtsa.dot.gov/

Mobility Motor Vehicle Dealer: Any person who is licensed as a new or used motor vehicle dealer

under this chapter who is engaged in the business of buying, selling, or exchanging mobility motor

vehicle and servicing or repairing mobility motor vehicles at an established and permanent place of

business.

Motor Vehicle Broker: A dealer license is not needed for a person who holds himself or herself out

through solicitation or advertisement as an individual who offers to arrange a transaction involving the

retail sale of a motor vehicle, and who is not:

A dealer, agent, or employee of a dealer acting on behalf of a dealer;

A manufacturer, agent, or employee of a manufacturer acting on behalf of a manufacturer;

The owner of a vehicle involved in the transaction; and

A public motor vehicle auction or wholesale motor vehicle auction where buyers are licensed

dealers.

Motor Vehicle Dealer: Any person who, for commission or with an intent to make a profit or gain of

money or other thing of value, sells, barters, exchanges, leases, or rents with the option to purchase,

or who offers or attempts to sell or negotiates the sale of motor vehicles or trailers whether or not the

motor vehicles or trailers are owned by such person; provided, however, an individual auctioneer or

auction conducted by an auctioneer licensed under Chapter 343, RSMo, shall not be included within

the definition of a motor vehicle dealer. The sale of eight or more motor vehicles or trailers in any

calendar year are required as evidence that such person is engaged in the motor vehicle business

and is eligible for licensure as a motor vehicle dealer under Sections 301.550 to 301.573, RSMo.

A motor vehicle dealer may sell five or fewer vessels each year without being required to be

licensed as a boat dealer.

2-4

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

Powersport Dealer: Any motor vehicle dealer who sells, either pursuant to a franchise agreement or

otherwise, primarily motor vehicles including, but not limited to, motorcycles, autocycles, all-terrain

vehicles, and personal watercraft, as those terms are defined in Chapter 306, RSMo.

Public Garage: A place of business where motor vehicles are housed, stored, repaired,

reconstructed or repainted for persons other than the owners or operators of such place of business.

Public Motor Vehicle Auction: Any person, firm, or corporation who takes possession of a motor

vehicle whether by consignment, bailment, or any other arrangement, except by title, for the purpose

of selling motor vehicles at a public auction by a licensed auctioneer.

Rebuilder: A business that rebuilds or repairs four or more motor vehicles in a calendar year that are

owned by the rebuilder, but does not include common or contract carriers of persons or property.

Recreational Motor Vehicle (RV) Dealer: A dealer of new or used motor vehicles designed,

constructed or substantially modified for use as temporary housing quarters, including sleeping and

eating facilities which are either permanently attached to a motor vehicle or attached to a unit which is

securely attached to a motor vehicle.

RV dealers are motor vehicle dealers and subject to motor vehicle dealer requirements, but

are issued RV plates.

Repossession Business: Any business that repossesses motor vehicles or trailers and sells or

otherwise disposes of them shall be issued a placard displaying the word "Repossessed", provided

such business pays the license fees presently required of a manufacturer, distributor, or dealer in

Section 301.560, RSMo.

Salvage Dealer or Dismantler: A business that dismantles used motor vehicles for the sale of

the parts thereof, and buys and sells used motor vehicle parts and accessories.

Scrap Processor: A business that, through the use of fixed or mobile equipment, flattens,

crushes, or otherwise accepts motor vehicles and vehicle parts for processing or transportation

to a shredder or scrap metal operator for recycling.

Special Event Motor Vehicle Auction: An auction in which:

Ninety percent of the vehicles being auctioned are at least ten years old or older;

No more than three percent of the total vehicles being auctioned are owned and titled in the

name of the licensed auction or its owners; and

The duration of the auction is no more than three consecutive calendar days and is held no

more than three times in a calendar year by a licensee.

Storage Lot: An area within the same city or county where a dealer may store excess vehicle

inventory.

Title Service Agent: Is any person who acts as an agent for a fee in obtaining a certificate of

ownership of a motor vehicle.

Trailer: Any vehicle without motive power designed for carrying property or passengers on its own

structure and for being drawn by a self-propelled vehicle, except those running exclusively on tracks,

including a semi-trailer or vehicle of the trailer type so designed and used in conjunction with a self-

propelled vehicle that a considerable part of its own weight rests upon and is carried by the towing

vehicle.

2-5

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

Trailer Dealer: Any person selling, either exclusively or otherwise, trailers as defined above. A trailer

dealer may acquire a motor vehicle for resale only as a trade-in for a trailer. A trailer dealer may

purchase one driveaway license plate to display such motor vehicle for demonstration purposes. The

sale of six or more trailers in any calendar year is required as evidence that such person is engaged

in the trailer business and is eligible for licensure as a trailer dealer. A trailer dealer:

Sells only trailers;

Is not required to obtain a motor vehicle dealer license for the purpose of selling a motor

vehicle acquired as trade-in (regardless of the number);

Requesting to sell motor vehicles acquired by any means other than trade-in is required to

obtain a motor vehicle dealer license when selling eight or more motor vehicles per license

year; and

Must obtain a boat dealer license if selling six or more boats acquired as trade-in.

See Section 4 for fees.

Transportation Network Company (TNC): a corporation, partnership, sole proprietorship, or other

entity that is licensed pursuant to Sections 387.400 to 387.440, RSMo, and operating in the state of

Missouri that uses a digital network to connect TNC riders to TNC drivers who provide prearranged

rides. A TNC shall not be deemed to own, control, direct, operate, or manage the TNC vehicles or

TNC drivers that connect to its digital network, except where agreed to by written contract.

Used Motor Vehicle Dealer: Any motor vehicle dealer, as defined by Section 301.550, RSMo, who is

not a new motor vehicle franchised dealer.

Used Parts Dealer: A business that buys and sells used motor vehicle parts or accessories. This

definition does not include businesses that sell only new, remanufactured, or rebuilt parts or those

who make isolated sales of used parts at a swap meet lasting less than three days.

Vessel: Every boat and watercraft defined as a vessel in Section 306.010, RSMo.

Vessel Trailer: Any trailer, which is designed and manufactured for the purposes of transporting

boats or vessels.

Wholesale Motor Vehicle Auction: Any person, firm, or corporation in the business of providing

auction services solely in wholesale transactions at its established place of business in which the

purchasers are motor vehicle dealers licensed by this or any other jurisdiction, and which neither

buys, sells, nor owns the motor vehicles it auctions in the ordinary course of its business. Except as

required by law with regard to the auction sale of a government owned motor vehicle, a wholesale

motor vehicle auction shall not provide auction services in connection with the retail sale of a motor

vehicle.

Wholesale Motor Vehicle Dealer: A motor vehicle dealer who sells motor vehicles only to other new

motor franchise dealers or used motor vehicle dealers or via auctions limited to other dealers of any

class. A wholesale dealer cannot make retail sales.

2-6

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

WHO IS REQUIRED TO BE LICENSED AS A DEALER?

You must be licensed as a Motor Vehicle dealer if you sell eight or more vehicles in a calendar year.

You must be licensed as a Trailer, Powersport or Boat dealer if you sell six or more trailers,

powersports, or boats in a calendar year , unless you are:

A financial institution or selling repossessed motor vehicles;

Disposing of vehicles used and titled solely in your ordinary course of business; or

A collector of antique motor vehicles.

For the purposes of Sections 301.550 to 301.573, RSMo, the sale, barter exchange, lease, or rental

with option to purchase of six or more motor vehicles in a calendar year by any person, partnership,

corporation, company, or association, whether or not the motor vehicles are owned by them, shall be

prima facie evidence of intent to make a profit or gain of money and such person, partnership,

corporation, company, or association shall be deemed to be acting as a motor vehicle dealer. Any

person, partnership, corporation, company, or association who is in violation is guilty of a Class A

misdemeanor.

HOW DO I APPLY FOR A LICENSE?

All dealer licenses and license plates expire the 31

st

of December of the license expiration year.

Missouri law provides for no “grace period”. You must title and pay tax on all motor vehicles, trailers,

or boats that you buy and sell during the time you are not a licensed Missouri dealer.

To apply for a license as a new Missouri dealer, manufacturer, or auction go to MyDMV.mo.gov/mv

and click on “Businesses”.

Be prepared to upload the following documents:

Photograph of the applicant’s building, lot, and sign, (new applicants only);

Inspection and Certification for Dealer, Auction, or Manufacturer Business License (Form

5748)

Certificate of Dealer Educational Seminar Completion (used motor vehicle dealers only);

Franchise Agreement or Letter of Appointment, if applicable;

Corporate Surety Bond (Exhibit A) or Irrevocable Letter of Credit (Exhibit B) (does not apply to

auctions or manufacturers);

Garage liability policy (does not apply to trailer, auction, or manufacturers);

Mail-to letter signed by the post office, if your mailing address is different than your physical

address;

Appropriate fees; and

A completed criminal record, which the dealer obtains from the Missouri State Highway Patrol

or the agency responsible for criminal records in the dealer’s state of residency.

The above requirements are further explained in the pages that follow.

Section

3

DEALER LICENSE REQUIREMENTS

3-1

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

You may also submit the above requirements, along with an Application for Dealer, Auction, or

Manufacturer License and Number Plate(s) (Form 4682), to the address listed on Form 4682.

COMPLETING THE ONLINE APPLICATION FOR A NEW OR RENEWAL MISSOURI

DEALER LICENSE

All incorrect or incomplete applications will be rejected. If you are renewing, please verify the

following information is still accurate.

ORGANIZATION INFORMATION

Business name – List the name(s) to be used by the business (e.g., John Doe Enterprises,

Inc., DBA John Doe Auto Sales). The DBA should be registered with the Secretary of State as

a fictitious name. A corporate surety bond (Exhibit A) or irrevocable letter of credit (Exhibit B)

must be in the same name listed on application. If your dealer license is approved and a title

application is submitted under a name other than the licensed name, the title transaction will

be rejected.

Registration with Secretary of State – The license applicant must be properly registered with

the Secretary of State as required by Missouri law. For more information, please contact the

Secretary of State’s Office by calling 573-751-3827 or at sos.mo.gov. A copy of this

registration is not required to be submitted with your dealer application, except as noted in item

3 for signage.

PHYSICAL ADDRESS

Enter complete business address. A mailing address may be added by clicking the blue plus sign (+)

only if the United States Postal Service will not deliver mail to your business location address

because of security reasons such as theft or vandalism. You must provide a copy of the letter from

the postal authorities to confirm that mail cannot or will not be delivered to your business address with

your application before a “Mail To” will be considered for approval. Lack of a proper mail receptacle is

not justification for the use of a “Mail To” address.

REGULAR BUSINESS HOURS OF OPERATION

A bona fide established place of business must be open at regular business hours when the owner or

operator may be contacted by the public at the business address. “Regular” business hours are

considered to be a minimum of 20 hours per week. You may satisfy these requirements by being

open at least four days (Monday through Saturday) each week. Only hours between 6 a.m. and 10

p.m. will be considered by the Department in determining whether a place of business is open the

minimum 20 hours per week. You must post the business hours at the business location and must

have the records accessible for inspection during the posted times.

Sunday sales are prohibited unless conducting an off-premises show or sale or as otherwise

described in Section 8.

CONTACT INFORMATION

Business telephone number and email address – Provide your business telephone number

and email address. Also include a contact person and their telephone number.

LICENSE OPERATIONS

Operation Type – Refer to definitions in Section 2 to determine the appropriate type of

business operations. A new application is required for each type of operation.

3-2

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

o Public or Wholesale Auctions: When registering as an auction, check “Public Motor

Vehicle Auction” or “Wholesale Motor Vehicle Auction” in Section 4. Auction records

must be kept separate from dealership records, and you must maintain a display area or

lot separate from the dealership lot for auction vehicles.

o Manufacturers: When requesting a manufacturer’s license, you must submit a letter that

lists the makes of all motor vehicles, trailers, or boats that you manufacture. If you are a

“final state” manufacturer or converter, you must list the makes of the vehicle bodies

(e.g., dump, hoist, coach) that you manufacture, and provide a brief description of

operation. A separate sheet of paper may be used if necessary. Indicate if you are the

manufacturer of the vehicle bodies, or if you perform the conversion work. Also, indicate

if you sell directly to the general public, or if you sell units to another dealer for resale to

the general public. If so, you must apply for the appropriate dealer license.

Unit Type – If your application indicates that you will be selling new or used power sports, and

other types of units (motor vehicle, cycles and/or trailers), the dealer licensing section will

assign one dealer license number for selling and/or demonstrating all unit types specified.

ADMINISTRATIVE FEE

Each motor vehicle, boat, and powersport dealer must declare if an administrative fee is

charged and, if so, must declare how much is charged and must provide banking information.

An electronic notification is generated and sent to each motor vehicle, boat, and/or powersport

licensee charging administrative fees based upon the total number of sales reported in the

previous month, as well as any additional sales amended to prior months, and based upon ten

percent of each administrative fee charged by the licensee. The electronic notification indicates

the amount due and payable to the fund and specifies that the licensee must authorize the

Department of Revenue to initiate an automated clearing house (ACH) transaction with the

licensee’s financial institution to credit the amount due and payable to the fund.

NOTE: Administrative fees will be charged for all reported sales unless a sale is reported as

exempt.

Reference Section 301.558, RSMo, and 12 CSR 10-26.230 through 12 CSR 10-26.231.

PLATE INVENTORY

Plate quantity – Dealers may receive up to two plates initially and may request additional

plates based on the following:

o Dealers may purchase a third plate after 15 sales and one plate per every ten sales

thereafter, except for RV dealers who may purchase two plates for every ten sales for

the first 50 sales and then one plate for every additional ten sales over 50.

For new businesses, additional plates are based off the number of estimated

sales; and

For renewing businesses, additional plates are based off the number of sales

made between July 1 of the previous licensure year through June 30 of the

current licensure year.

o The maximum number of dealer plates you may purchase is based on the number of

sales that you estimate you will make during your first licensure year and the above

criteria for renewing dealers. Once you determine your sales estimate and the quantity

of plates you want to purchase, enter the number of plates you want and the plate type

(e.g., motor vehicle, motorcycle, boat).

o Motor vehicle dealers who also have a salvage business license will be entitled to one

additional plate for every 50 vehicles purchased from July 1 of previous year through

June 30 of the current year. Dealers who request to purchase additional plates must

supply a list of the salvage vehicles purchased reflecting the year, make, and VIN.

3-3

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

o Manufacturers may purchase up to 350 plates.

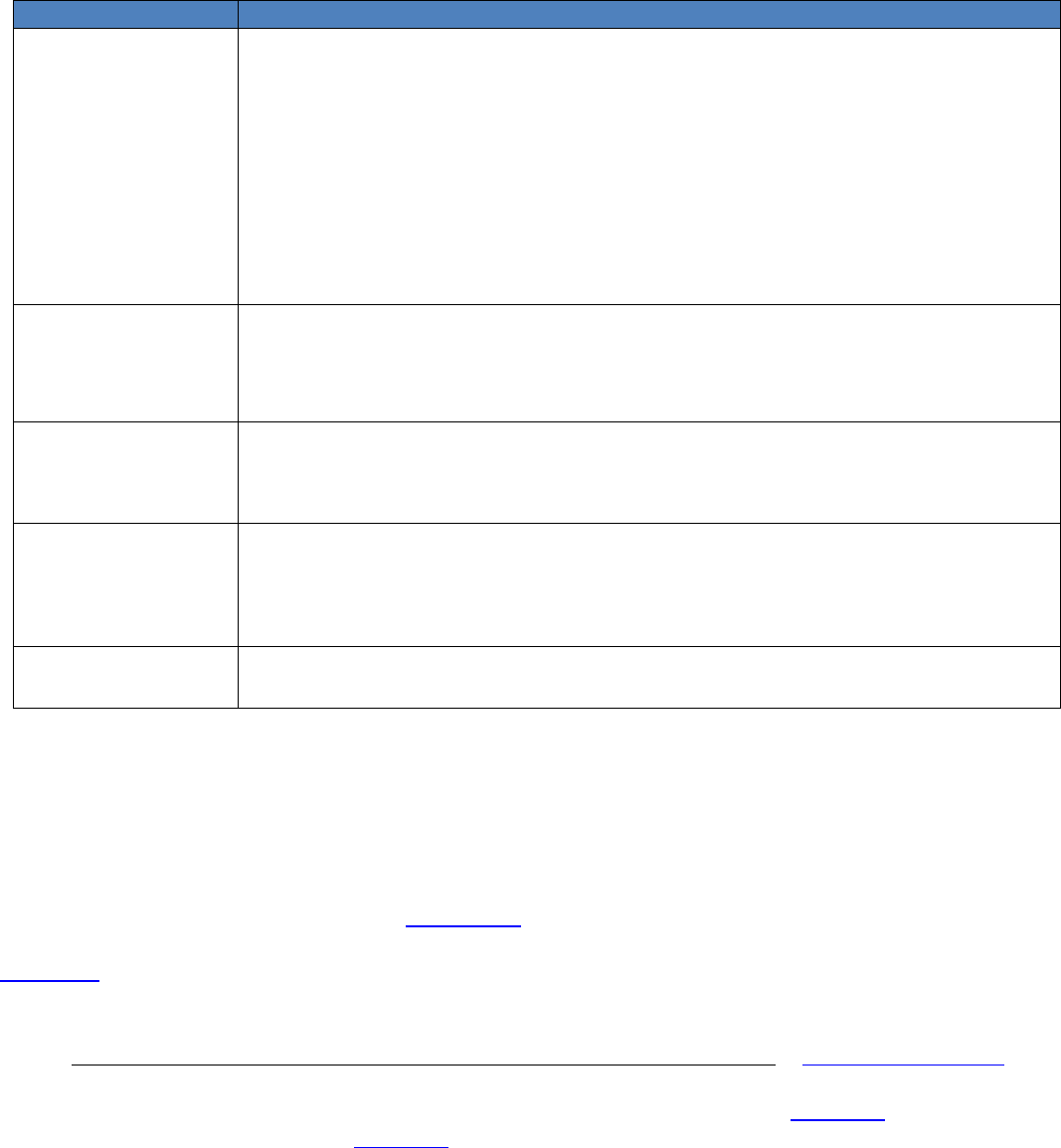

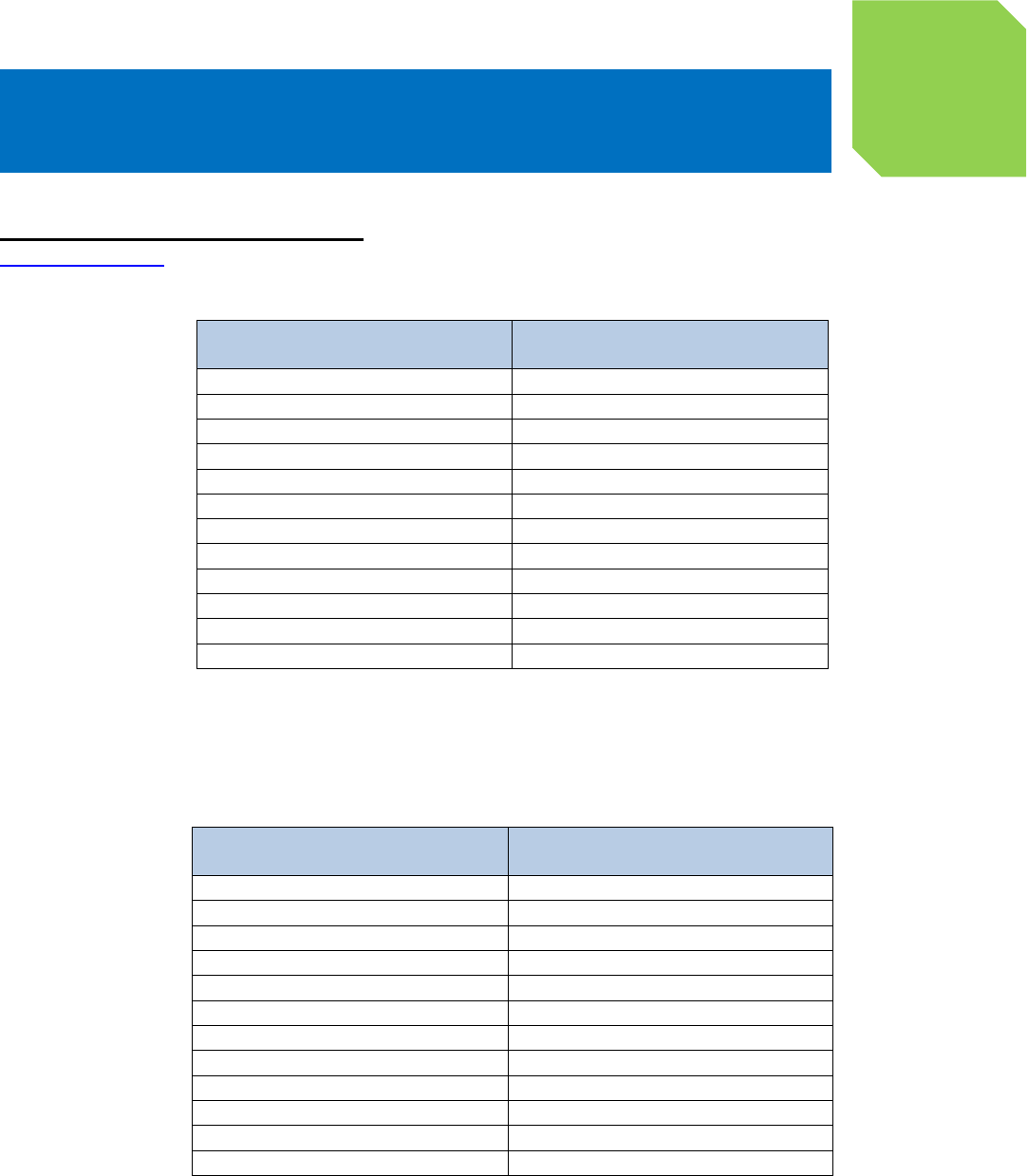

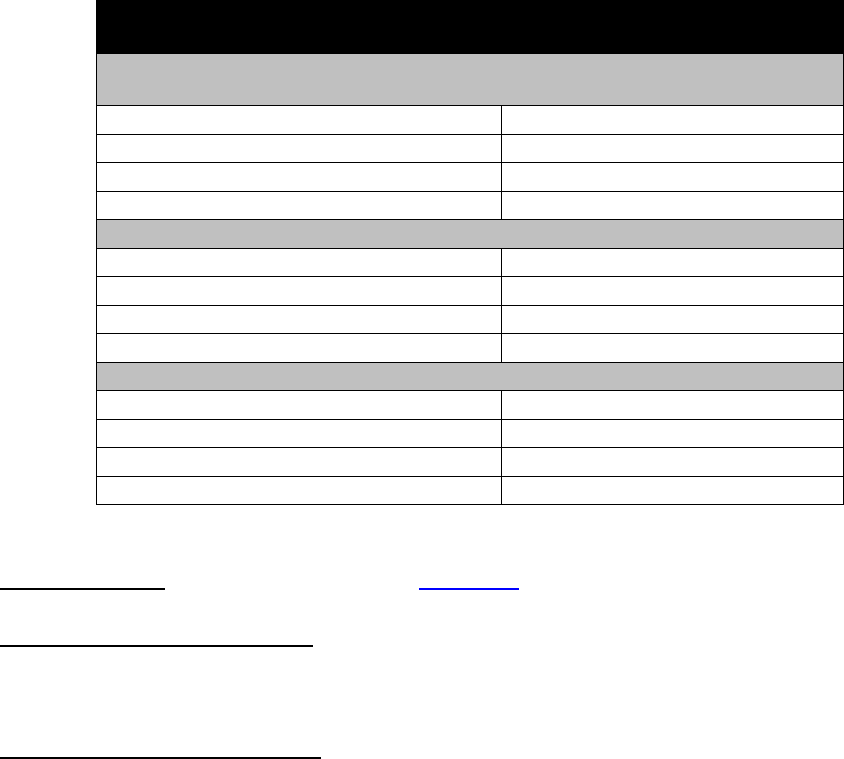

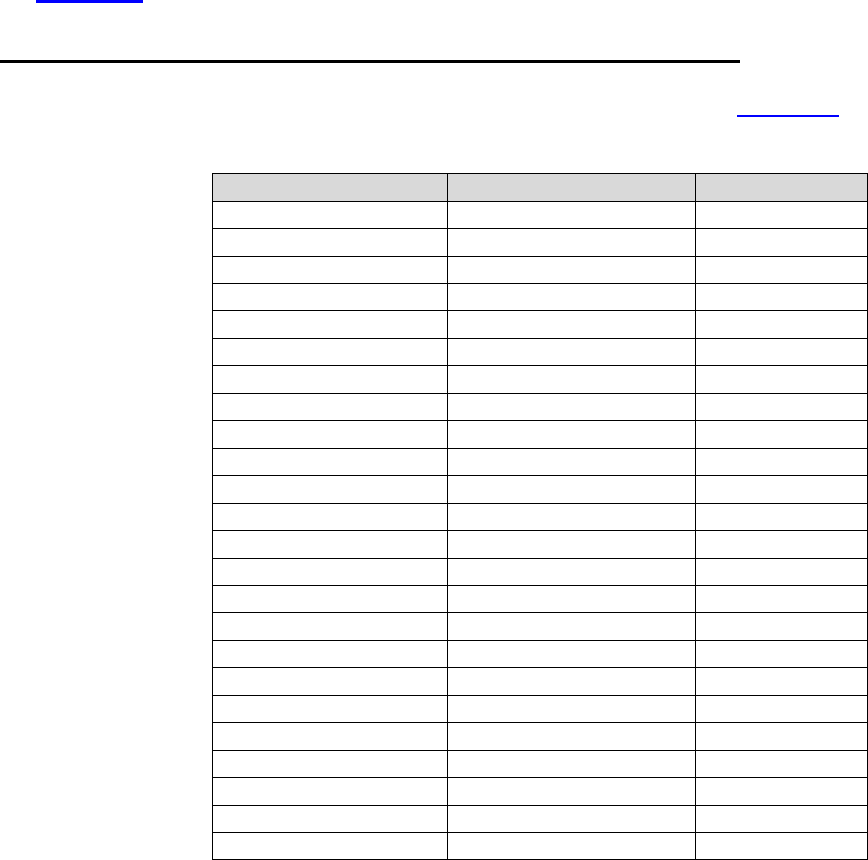

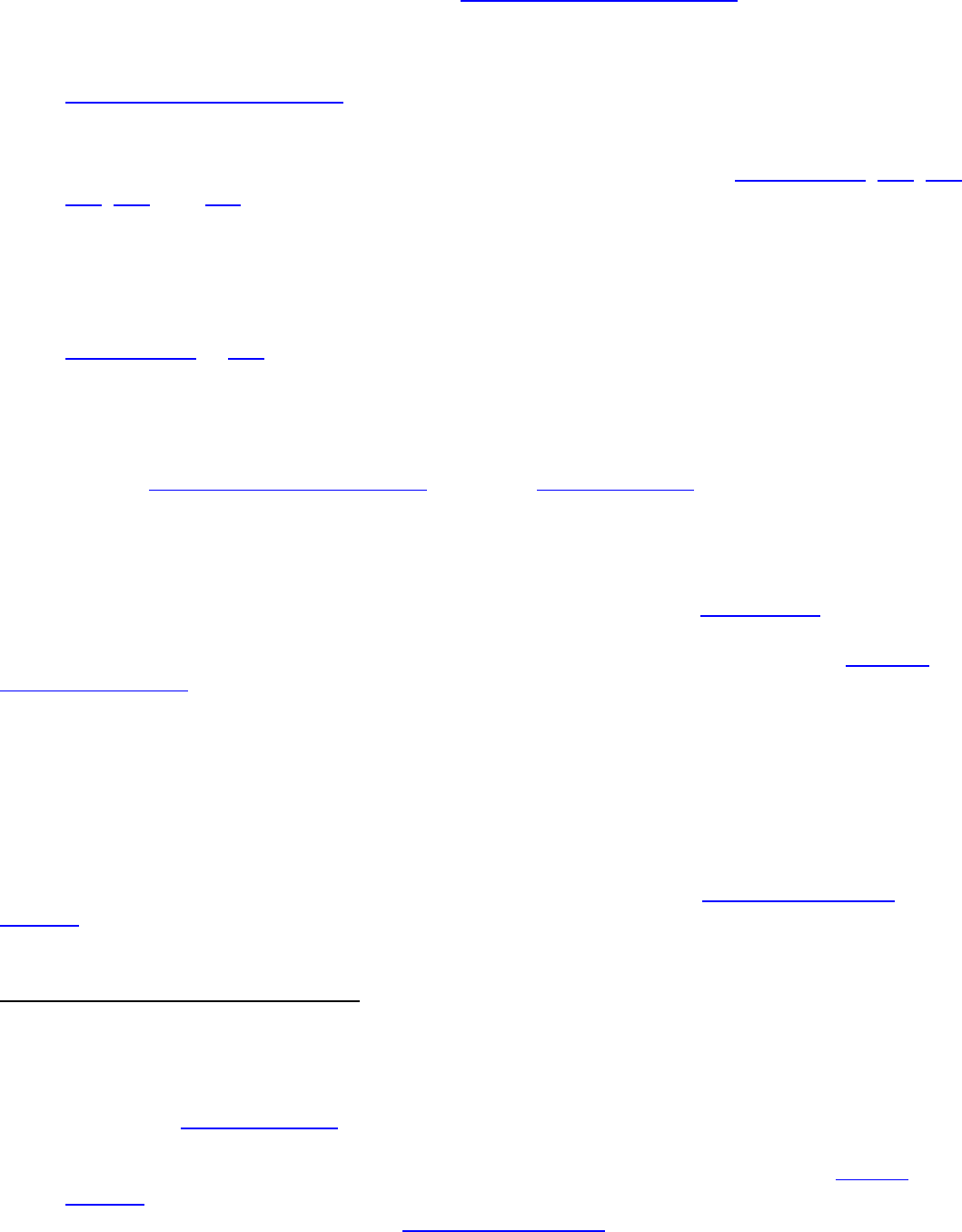

o See the following chart for plate types and descriptions.

NOTE: Public and wholesale auctions are not eligible for dealer plates because they do not

own the vehicles being sold.

NOTE: Dealer plates shall not be issued to franchisors.

FEES

If applying for licensure by completing Form 4682, you must submit one check or money order for the

license and plate fees. If you are applying using MyDMV, fees will be systematically calculated. See

Section 4 for detailed fee information.

BOND POLICIES

Corporate Surety Bond Requirement or Irrevocable Letter of Credit – Section 301.560(3),

RSMo, requires motor vehicle dealers, powersport dealers, boat dealers, emergency vehicle

dealers and trailer dealers to submit either a corporate surety bond (Exhibit A) or an

irrevocable letter of credit (Exhibit B) issued by any state or federal financial institution, in the

penal sum of $50,000, with their application for dealer registration. The bond or irrevocable

letter of credit must be on a form approved by the dealer licensing section. The dealer must be

bonded for the entire licensure year. Any bond that is submitted must be in effect through

December 31 of the licensure year, or is a “non-expiring” bond. If the bond or letter of credit on

file expires or is cancelled, a new bond or letter of credit must be submitted to the Department

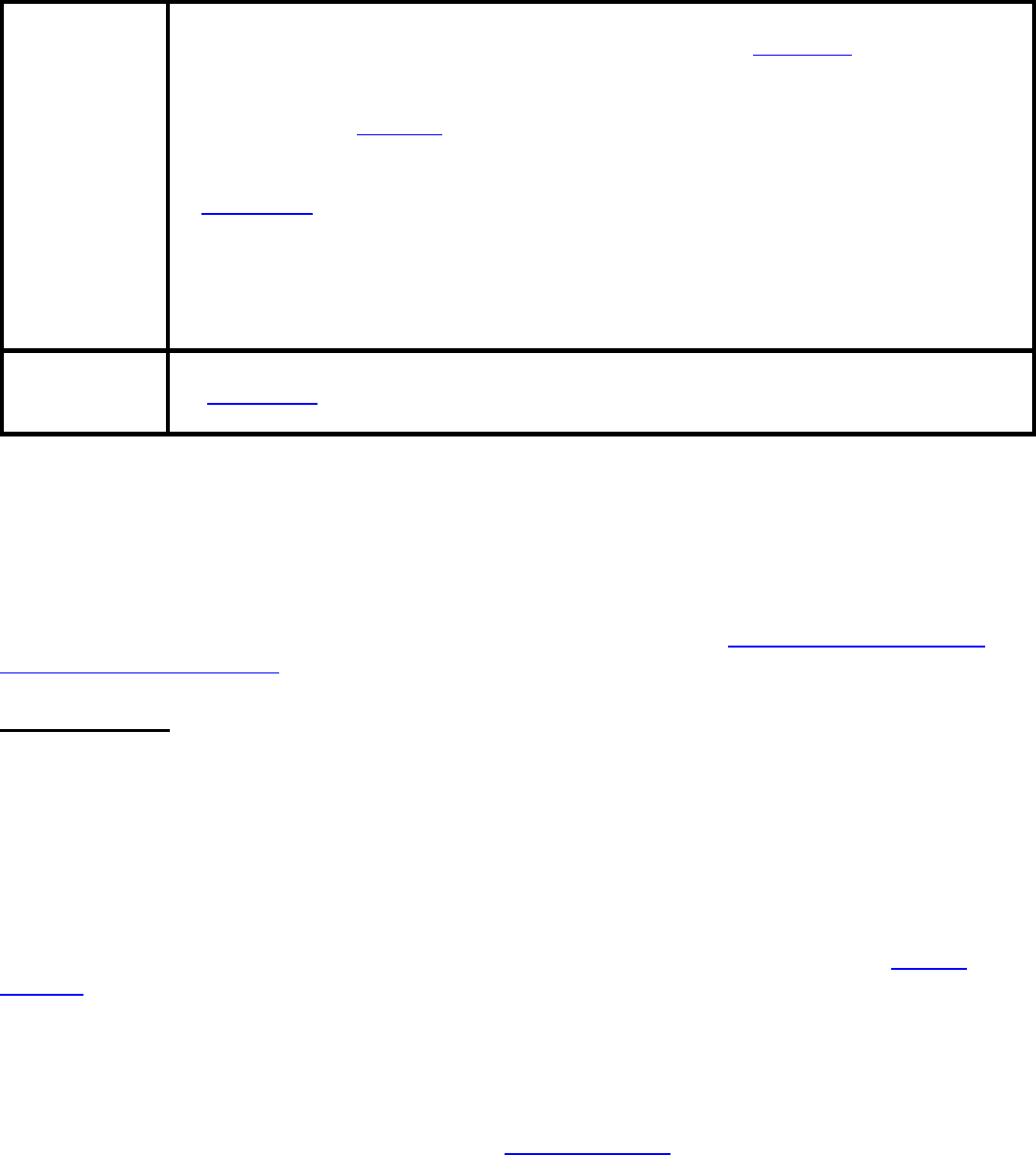

PLATE TYPE

DESCRIPTION

Motor Vehicle,

Manufacturer, and

Recreational

Dealer Plate

Standard (6” x 12”) license plates that may only be displayed on a motor

vehicle, trailer, or motorcycle, motortricycle or autocycle held for resale by

a motor vehicle dealer or manufacturer.

These plates may also be displayed on a boat or vessel held for resale by

a dealer provided the dealer sells no more than five boats/vessels and

vessel trailers per calendar year.

For use by any

customer while the customer's vehicle is being serviced or

repaired by the motor vehicle dealer

Plates with the “RV Dealer” logo allow the dealer to demonstrate only RVs,

camper trailers, and any motor vehicle accepted as trade-in.

Cycle or

Powersport Dealer

Plate

A motorcycle license plate (4” x 7”) that may only be displayed on a

motorcycle, motortricycle, autocycle, and personal watercraft, owned and

being held for resale by a motor vehicle or powersport dealer, or

manufacturer.

Trailer Dealer

Plate

Standard (6” x 12”) license plates that may only be displayed on trailers.

A trailer dealer may purchase one driveaway plate to demonstrate motor

vehicles accepted as trade-in.

Boat Dealer Plate/

Certificate of

Number

A certificate of number (6” x 12”) that may only be displayed on a boat,

vessel, or vessel trailer being held for resale by a licensed boat dealer.

The certificate of number must be carried in or displayed on the boat

during a demonstration on the water.

Boat Trailer

Dealer Plates

Standard (6” x 12”) license plates that may only be displayed on a boat

trailer being held for resale by a license boat dealer.

3-4

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

on or before the date of expiration or cancellation. The bond or irrevocable letter of credit

does not apply to auctions or manufacturers.

FRANCHISE AGREEMENT OR LETTER OF APPOINTMENT

The document must include the name and address of the franchisee, effective date of the franchise

agreement, expiration date (or show non-expiring), and make(s) of vehicle(s) the franchisee is

authorized to sell. The document must state that the dealer licensing section will be notified in case of

cancellation by either party. The document must provide notification to the Department at least 30

days prior to cancellation of the franchise (Exhibit C).

A “Manufacturer’s Certification of a Dealer” is acceptable for franchise authorization only if the

corresponding franchise agreement is on file with the Dealer Licensing Section. A manufacturer’s

letter of intent will not suffice as proof of franchise. A dealer wanting to sell new vehicles for

which they do not have a franchise agreement must apply for a title in the dealership’s name.

Certificates of Origin for any given make of vehicle may only be assigned by dealers who are

franchised to sell that make of motor vehicle. If you are requesting licensure as a manufacturer, you

must issue franchise agreements to the dealers whom you authorize to sell those vehicle makes or

vehicle bodies that you manufacture. You must supply a Manufacturer’s Certificate of Origin for each

vehicle or vehicle body manufactured.

OWNER INFORMATION

Enter complete owner information. When renewing online, click on the plus sign (+) in the right corner

of the green banner to add additional owners, if applicable.

BACKGROUND CHECK INFORMATION

A criminal record is required for each owner listed on the dealer license application and must have

been issued within six months of the issuance or renewal of the dealer license. When renewing

online, click the plus sign (+) to upload additional background check records.

When renewing or obtaining your initial Missouri dealer license, you must obtain a criminal

record utilizing the Missouri State Highway Patrol’s Missouri Automated Criminal History Site

(MACHS). This site can be accessed at https://www.machs.mo.gov/MACHSFP/home.html or via link

on the Department of Revenue’s website at

https://mydmv.mo.gov/businesslicensing/BusinessLicense/AppStatus.

Upon registering with MACHS, you will be prompted to create a personal account. Following the

submission of your record check request, the response will be returned directly to your MACHS

account that you created. Your response may be returned almost instantaneously, however, some

results may take several days depending on processing workloads. NOTE: A Dealer may set up one

account and request multiple record checks under this one account.

To avoid a delay in obtaining a dealer license, it is very important that dealers begin this process as

soon as possible in order to have the criminal record when sending in license renewal documentation

or initial licensing documentation.

Be sure to check your MACHS account frequently as MACHS will only retain the criminal record

results for 30 days. After 30 days, MACHS will archive the results and a new criminal record request

must be submitted with additional payment.

3-5

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

Record check results should be retrieved from your account and provided with your renewal

application.

Points to remember:

A name-based criminal history record is required for each owner listed on the dealer license

application and must have been issued within six months of the issuance or renewal of the

dealer license.

The web address for the MACHS system is https://www.machs.mo.gov/MACHSFP/home.html.

Choose the option “Log-in to the Name Search Portal”.

If any of the owners, partners, or principal officers is a resident of a state other than Missouri, you

must submit a current background check from the Highway Patrol or Background Investigation

Bureau in the state in which they reside.

SIGNATURE

An owner, partner, or corporate officer listed on the application must provide an electronic signature.

By signing the application, the applicant certifies that the information is true and accurate and

that the business has, and will maintain, during the entire period of registration, financial

responsibility (liability insurance) with respect to each motor vehicle that is owned, licensed, or

operated on the streets or highways. This includes motor vehicles held for resale.

For more information regarding financial responsibility, contact the Missouri Department of Revenue,

Driver License Bureau, PO Box 200, Jefferson City, MO 65105-0200, or your insurance agent. You

may call the Driver License Bureau at 573-751-4600.

LOCATION INSPECTION

Inspection and certification – An authorized law enforcement officer or designee must

complete the Inspection and Certification for Dealer, Auction, or Manufacturer Business

License (Form 5748) to certify that the applicant has a bona fide established place of

business as set forth in Section 301.560, RSMo.

o Dealers selling only emergency vehicles are exempt from this requirement.

o A motor vehicle dealer’s business must be inspected by the Missouri State Highway

Patrol or authorized designee prior to submitting the application to the dealer licensing

section.

o A boat dealer or boat manufacturer’s business may be inspected by the Missouri State

Highway Patrol.

o If the business is located in a first class county (Boone, Buchanan, Camden, Callaway,

Cape Girardeau, Cass, Clay, Cole, Franklin, Greene, Jackson, Jasper, Jefferson, Platte,

St. Charles, St. Louis, St. Louis City, and Taney), authorized metropolitan police who

are employed in the same city in which the business is located may complete the

inspection.

o Certification may not be completed by a sheriff or marshal.

An applicant who is licensed within two months of the license expiration date shall not be required to

have the renewal application certified by a law enforcement agency or officer provided the renewal

application is filed before the present license expires. Certification of Renewal applications for all

dealers, except franchise dealers and emergency vehicle dealers must be completed every year for

the first three years and every other year thereafter.

3-6

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

The following is considered when determining the existence of a bona fide established place of

business for motor vehicle manufacturers, new motor vehicle franchise dealers, used motor vehicle

dealers, wholesale dealers, powers sport dealers, boat dealers, boat manufacturers, trailer dealers,

trailer manufacturers, and public and wholesale auctions. You must maintain a bona fide place of

business for the entire registration period. The director of revenue retains the right to determine the

existence of a bona fide place of business at any time.

Permanently Enclosed Building – A bona fide established place of business must have a

permanently enclosed building or structure either owned in free or leased and actually

occupied and primarily used in whole, or in clearly designated and segregated part, as a place

of business by the applicant for the selling, bartering, trading, servicing, or exchanging of motor

vehicles, trailers, all-terrain vehicles, personal watercraft or boats, and where the public may

contact the owner or operator at any reasonable time and where books, records, files, and

other matters required and necessary to conduct business are kept. A working telephone

number shall be maintained during the entire registration year, which will allow the public, the

department, and law enforcement to contact the applicant during regular business hours.

o If a travel trailer or a manufactured home is being used as the office, it must be

anchored to the ground and the wheels removed.

o If a dealer is also licensed as an auction, the auction records must be kept separately

from the dealership records.

Example: An applicant for a motor vehicle dealer license maintains a building or structure

primarily used in the operation of a business other than the sale or exchange of motor

vehicles. As a sideline the applicant wants to engage in the business of selling motor vehicles.

The building or structure used primarily for business other than the selling or exchanging of

motor vehicles does not qualify as a bona fide established place of business for the selling of

motor vehicles unless an area is clearly designated and records are separately maintained for

the purpose of selling, bartering, trading, servicing, or exchanging motor vehicles, powersports,

boats, or trailers.

Display Area – A bona fide established place of business must contain an area or lot that is not

a public street upon which multiple vehicles, boats, personal watercraft, or trailers may be

displayed. The display area of the principal place of business and each branch location of the

business must be of sufficient size to physically accommodate vehicles of the type which the

business is licensed to sell. The display area must:

o Be clearly for the exclusive use of the dealer, auction, or manufacturer for display

purposes as to prevent confusion or uncertainty concerning its relationship to the

business.

o Provide unencumbered visibility from the nearest public street of the vehicles being sold

by the dealer, auction, or motor vehicle manufacturer.

An auction must maintain a display area or lot separate from the dealer’s lot for auction vehicles.

An enclosed garage does not qualify as a proper display area.

A licensee in more than one class of business may use the same building and display area for all

classes so long as each use is separately and clearly marked. Records must be maintained

separately and separate signs as specified below must be displayed.

Signage – The sign must:

o Contain the name of the dealership by which it is known to the public through

3-7

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

advertising or otherwise. The name on the sign is not required to be identical to the

name appearing on the dealership's license, provided such name is registered as a

fictitious name with the Secretary of State and has been approved by the dealer’s line-

make manufacturer, in writing, in the case of a new motor vehicle franchise dealer. A

copy of the fictitious name registration must accompany the application for

dealer licensure in this case.

o Have letters at least six inches in height and be clearly visible to the public. The sign

shall be of a permanent nature, erected on the exterior of the office or on the display

area, and be constructed or painted and maintained so as to withstand reasonable

climatic effects and be readable.

o A banner is not acceptable as a permanent sign. A temporary sign or device may be

used while you are obtaining a permanent sign or device, provided an order for

construction, purchase, or painting has in fact been placed. A copy of the sign work

order and a picture of the temporary sign must be submitted with the application.

o If a franchise dealer purchases a currently licensed new motor vehicle franchise

dealership, the dealer may submit a photo of the existing dealership sign until a new

sign is acquired.

o A public motor vehicle auction licensee shall display, in a conspicuous manner, two

additional signs, each of which shall bear the following warning in letters at least six

inches high: “Attention Buyers: Vehicles sold at this auction may not have had a

safety inspection.” The dimensions of each sign shall be at least two feet by two

feet.

NOTE: Bona fide established place of business of all applicants must be maintained for the

entire licensure year. If the bona fide established place of business is not maintained, the

licensee must notify the dealer licensing Section within 10 days and surrender, at that time,

all temporary permits, license, and license plates or certificates of number. If the licensee

intends to relocate prior to the expiration of the license, the Department must be informed

of such intent at the time the license is surrendered. If the business is then certified at a

new location, the Department will return the temporary permits, license plates, or

certificates of number and issue a new license reflecting the new location for no additional

fee. The Department or its representative reserves the right to determine the existence of a

bona fide established place of business at any time.

GARAGE POLICIES

Garage Liability Policy – Every applicant, as a new motor vehicle franchise dealer,

manufacturer, a used motor vehicle dealer, a power sport dealer, a wholesale motor vehicle

dealer, or boat dealer must furnish with the application a copy of a current dealer garage policy

bearing the policy number, effective and expiration date, name and address of the insurer and

the insured. Emergency vehicle dealers are required to provide policy prior to licensing. Trailer

dealers are exempt.

BUSINESS PHOTO

A current photograph, not exceeding eight inches by ten inches but no less than five inches by

seven inches of the applicant’s place of business must be submitted.

The initial application for licensure must include a photograph which must show the business

building, lot, and sign. If more than one photograph is necessary to show all three, a

statement must be submitted that clearly explains that all photos were taken at the same

address. Digitized photos are acceptable.

3-8

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

A dealer who sells only emergency vehicles is exempt.

CERTIFICATE OF DEALER EDUCATIONAL SEMINAR COMPLETION

All used motor vehicle dealers (excluding wholesale dealers, powersport, trailer, public auctions,

franchise, boat, RV and dealer applicants who currently own a separately licensed dealership)

applying for a motor vehicle dealer’s license for the first time, must provide proof of attendance at a

Dealer Educational Seminar approved by the Department. For more information regarding the dealer

education seminars, see https://dor.mo.gov/motor-vehicle/dealers-lienholders/seminar-

requirements.html.

AFFILIATED SALVAGE LICENSES

If registering as a Used Motor Vehicle and Used Powersport Dealer, make the appropriate selection.

If yes, enter the requested information.

SPECIAL EVENT MOTOR VEHICLE AUCTION LICENSE

Special event motor vehicle auction licenses are issued under Section 301.580, RSMo.

A special event motor vehicle auction is an auction which:

Ninety percent of the vehicles being auctioned are at least ten years old or older;

No more than three percent of the total vehicles being auctioned are owned and titled in the

name of the licensed auction or its owners; and

The duration of the auction is no more than three consecutive calendar days and is held no

more than three times in a calendar year by a licensee.

LIMITATIONS AND REQUIREMENTS FOR SPECIAL EVENT MOTOR VEHICLE AUCTIONS:

A completed Special Event Motor Vehicle Auction Application (Form 5432)

o The completed application must be received by the Department 90 days prior to the

event;

$1,000 license fee;

The special event motor vehicle auction licensee must furnish the Department with a corporate

surety bond or an irrevocable letter of credit in the amount of one hundred thousand dollars

($100,000).

A licensee may obtain only three special event motor vehicle auctions within a calendar year.

The special event motor vehicle licensee is responsible for ensuring a required sales tax or

special event tax license has been acquired.

The special event motor vehicle auction licensee must be registered to conduct business in

this state.

No dealer, driveaway, auction or wholesale plates or temporary permits shall be issued to a

special event motor vehicle auction licensee.

The special event motor vehicle auction licensee shall provide the purchaser of a motor vehicle

at such auction the current contact information including, but not limited to, name, address, and

telephone number of the licensee.

The completed Special Event Motor Vehicle Auction Application (Form 5432), $1,000 license fee,

and the $100,000 bond or irrevocable letter of credit must be mailed to:

Motor Vehicle Bureau

Dealer Licensing Section

PO Box 43

Jefferson City, MO 65105-0043

3-9

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

Within 10 days of the conclusion of the special event motor vehicle auction, the licensee shall report

of each vehicle included in the auction. The report shall include information indicating if the listed

vehicles were sold at the auction or not sold at the auction. The license must provide the following

details of each vehicle on the report:

Make;

Model;

Year; and

Vehicle identification number.

The completed report must be mailed to:

Motor Vehicle Bureau

Dealer Licensing Section

PO Box 43

Jefferson City, MO 65105-0043

3-10

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

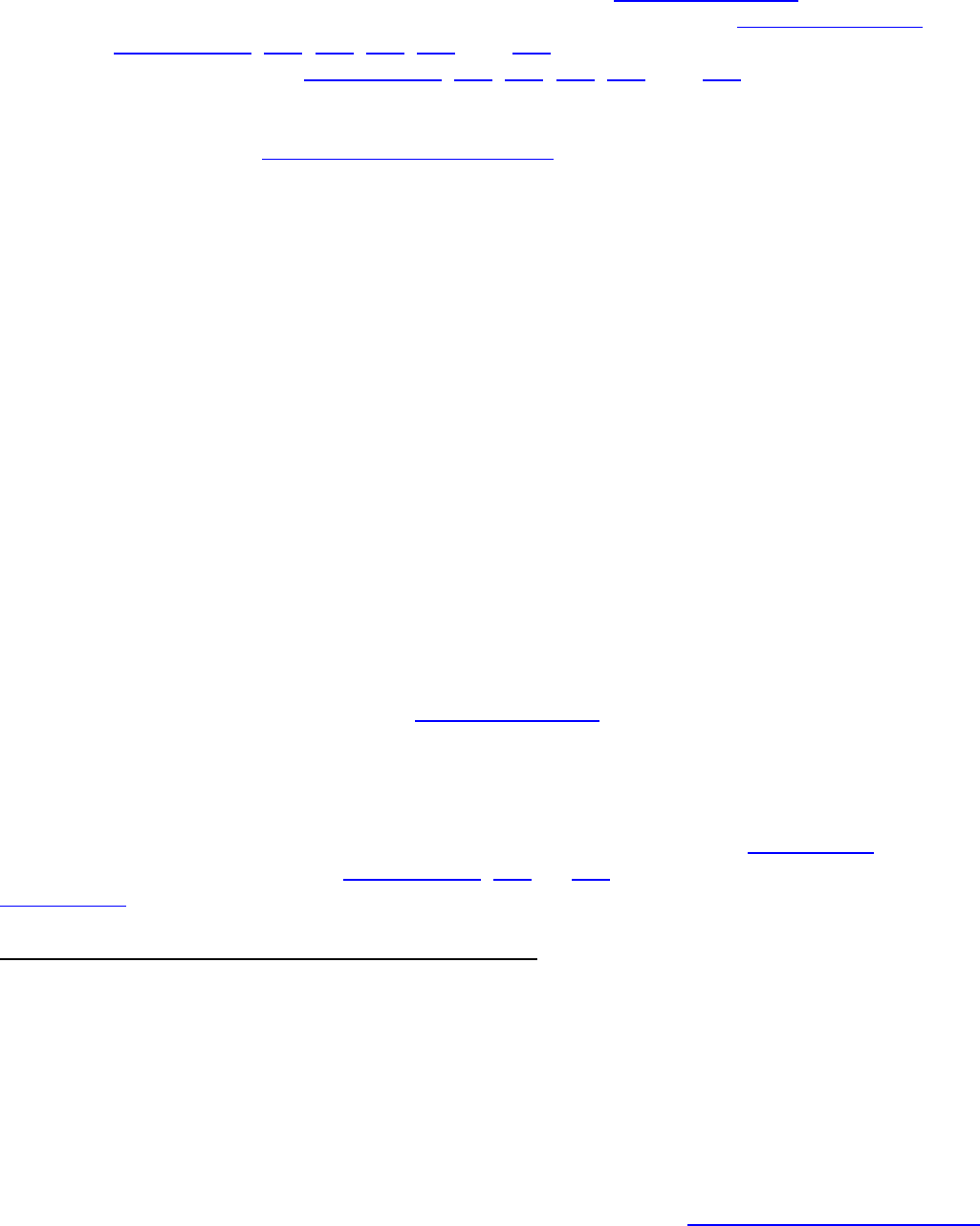

LICENSE FEES

The following fees are payable to the Missouri Department of Revenue. Payment may be made by

check or money order. A separate license fee is required each year.

When applying for a license as a motor vehicle dealer and an auction, two separate

applications must be submitted along with $150 license fee for each application (total of $300)

plus $50 license fee for auctions (Auctions do not receive plates).

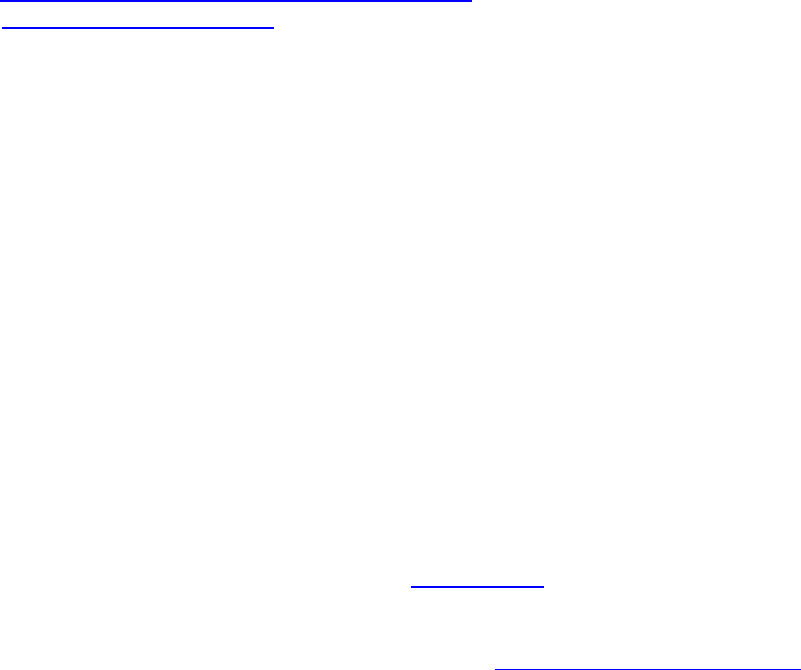

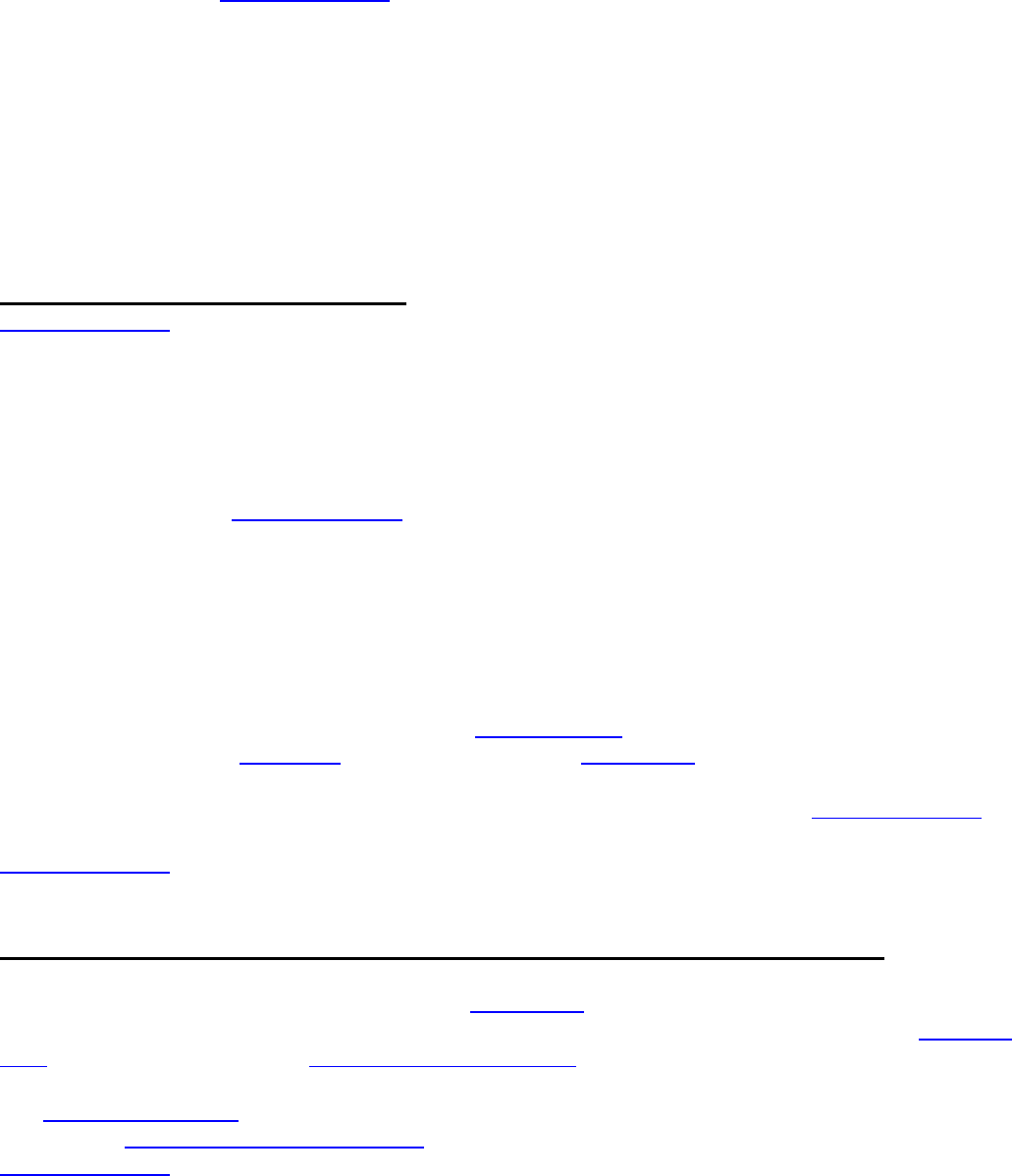

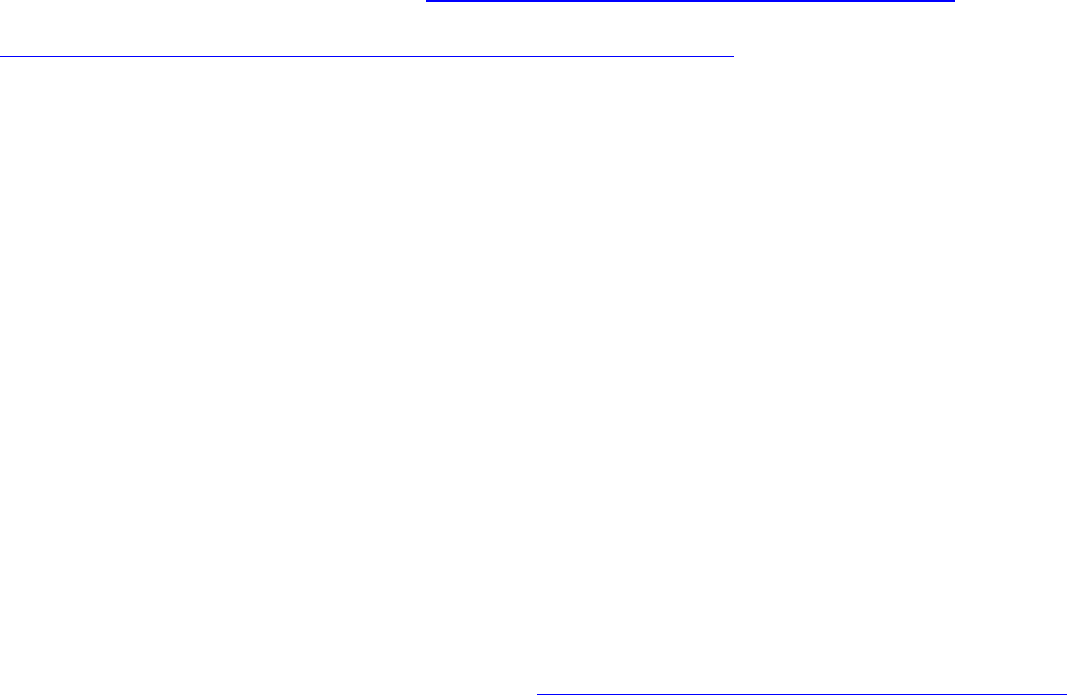

Licensure fee(s) (original and first two years of license):

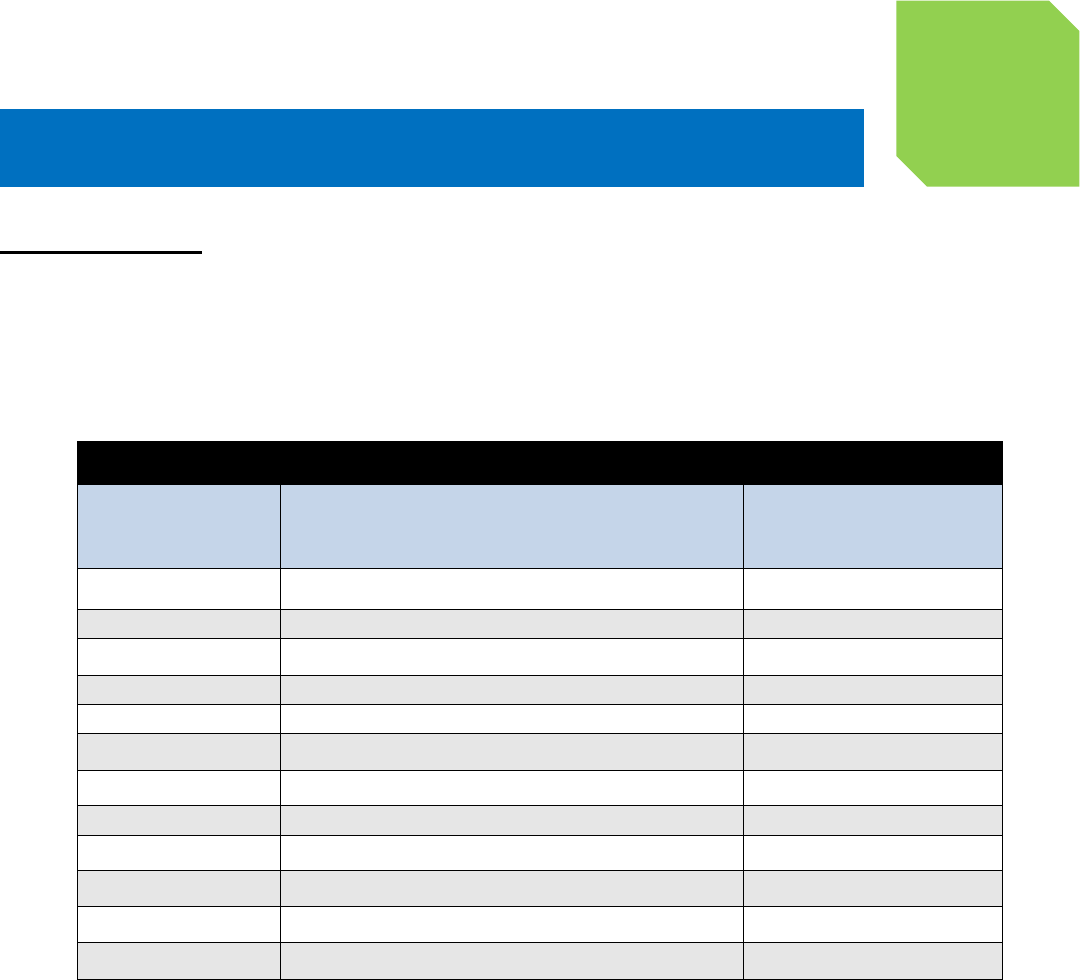

FEE FOR A ONE YEAR LICENSE

MONTH OF

APPLICATION

MOTOR VEHICLE/ TRAILER/

POWERSPORT DEALER,

MANUFACTURER OR AUCTION

BOAT DEALER OR

MANUFACTURER

JANUARY

$150

$80

FEBRUARY

$137.50

$73.33

MARCH

$125

$66.67

APRIL

$112.50

$60

MAY

$100

$53.30

JUNE

$87.50

$46.67

JULY

$75

$40

AUGUST

$62.50

$33.33

SEPTEMBER

$50

$26.67

OCTOBER

$37.50

$20

NOVEMBER

$25

$13.33

DECEMBER

$12.50

$6.67

A dealer who has been in business for three years will be issued a two-year license

when they renew at the end of their third year.

DEALER LICENSE AND PLATE FEES

Section

4

4-1

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

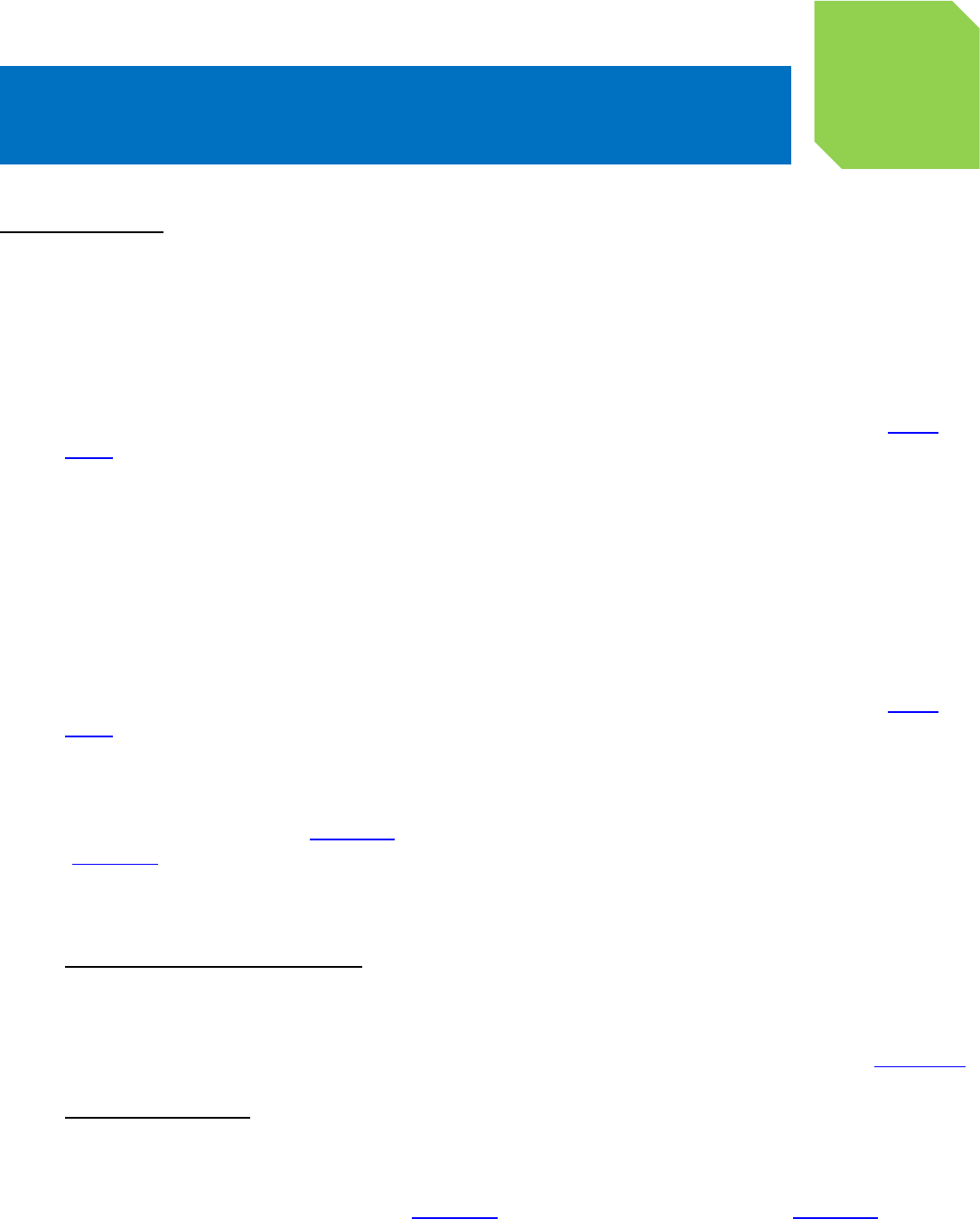

FEE FOR A TWO YEAR LICENSE

MONTH OF

APPLICATION

MOTOR VEHICLE/ TRAILER/

POWERSPORT DEALER,

MANUFACTURER OR AUCTION

BOAT DEALER OR

MANUFACTURER

JANUARY

$300

$160

FEBRUARY

$287.50

$153.33

MARCH

$275

$146.67

APRIL

$262.50

$140

MAY

$250

$133.33

JUNE

$237.50

$126.67

JULY

$225

$120

AUGUST

$212.50

$113.33

SEPTEMBER

$200

$106.67

OCTOBER

$187.50

$100

NOVEMBER

$175

$93.33

DECEMBER

$162.50

$86.67

Late Renewal Penalties – Applications received:

On or after November 3, but prior to December 31 = $25; and

After December 31 = $50.

Replacement License Certificate – $8.50;

Dealer System Record Print – $8.50;

Copy of Dealer Records/Sales Report – $3 per month (no fee if dealer is requesting own report).

Security access code is required if report is requested by someone other than the owner; and

Copy of Dealer Application (and supporting documents) for one-year license – $1.50 per license

year.

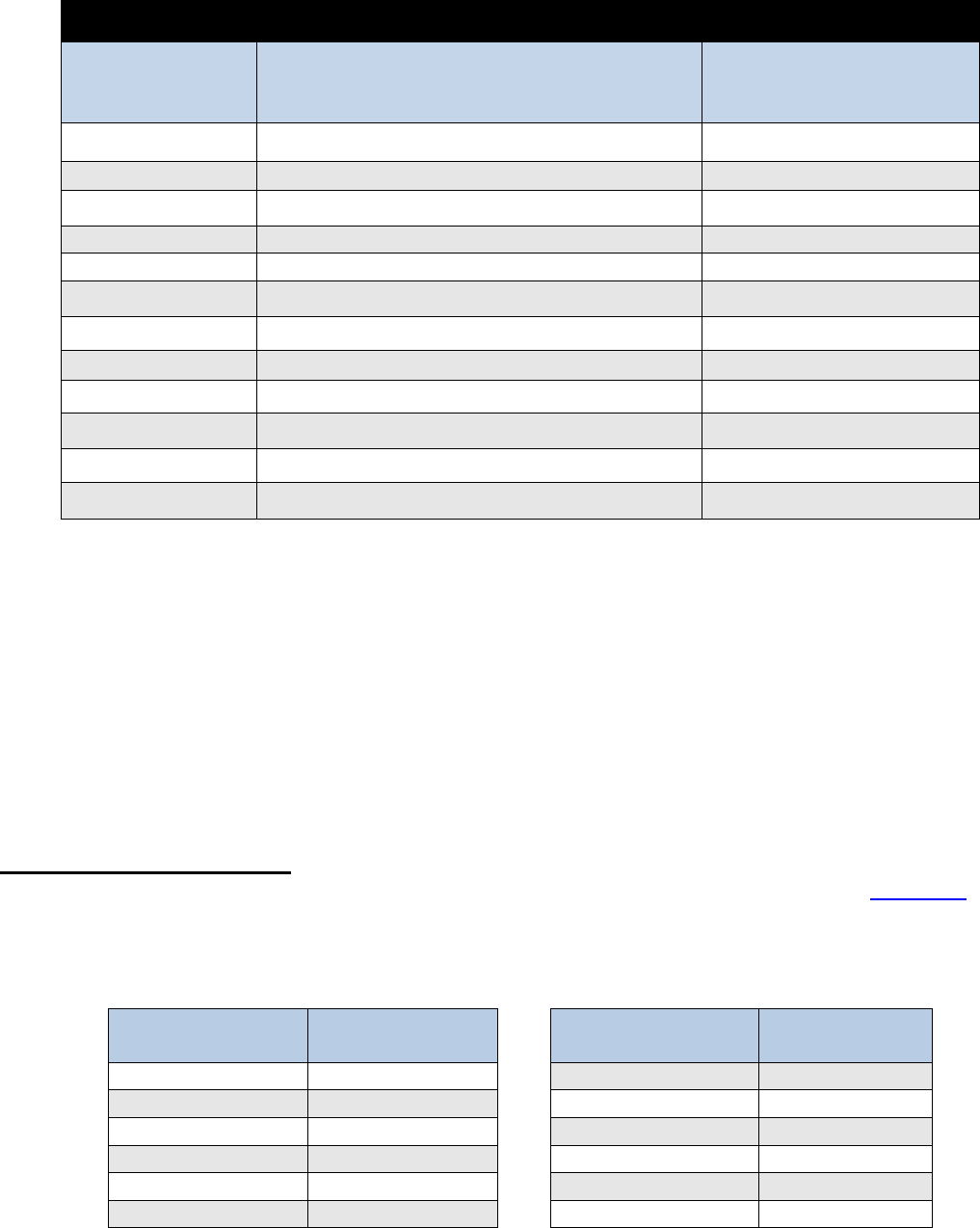

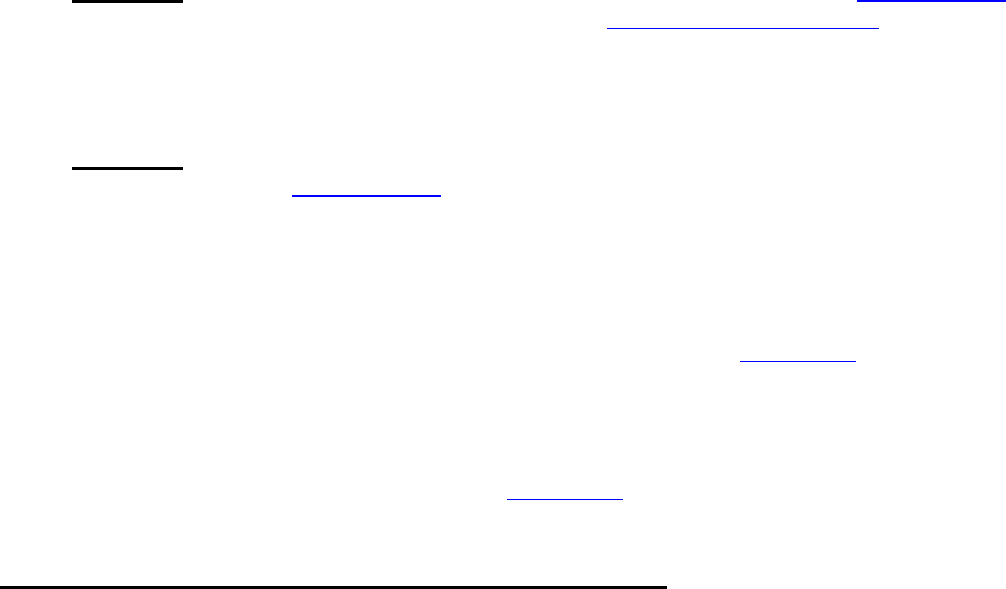

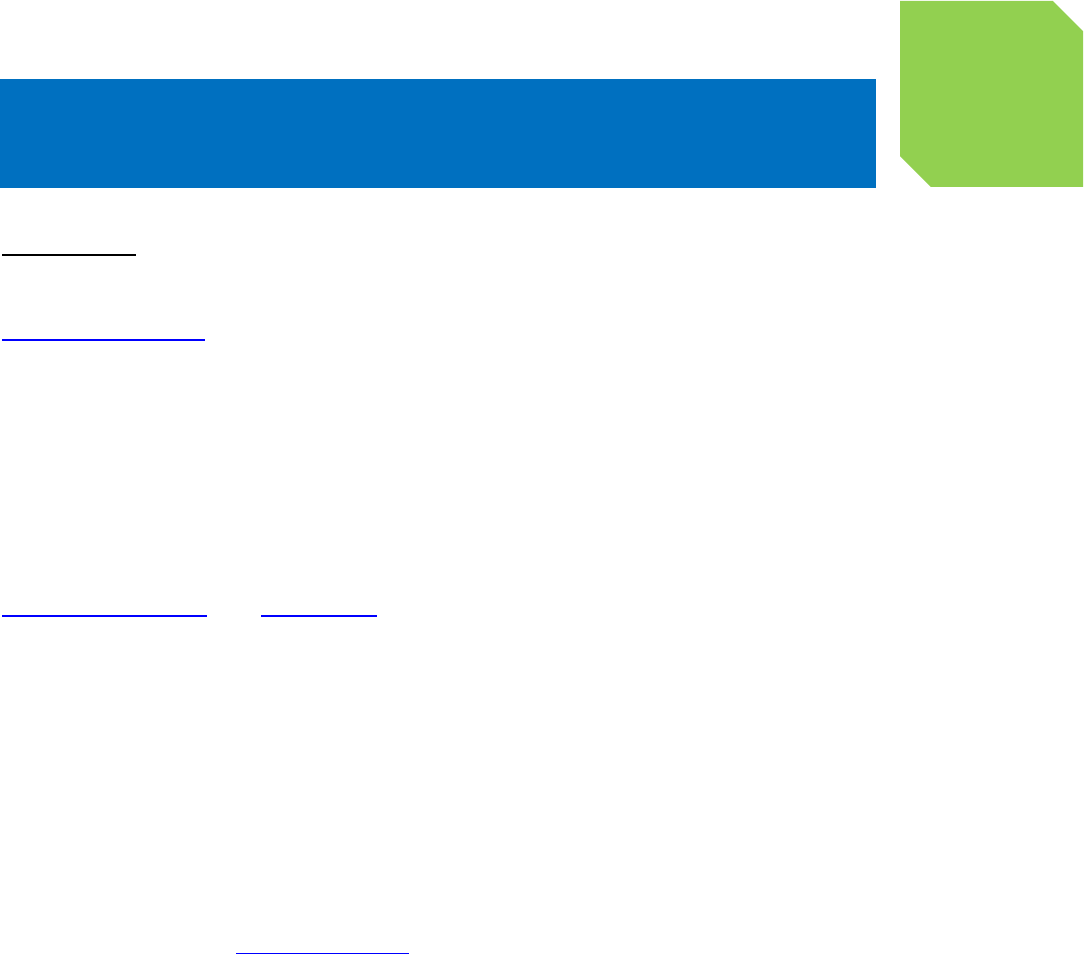

LICENSE PLATE FEES

Fees are $50 for the initial plate or certificate for each license type of license listed in Section 2.

Fees are prorated for dealers applying for licensure after January 31

st

, as shown in the following

chart:

MONTH OF

APPLICATION

INITIAL

PLATE FEE

MONTH OF

APPLICATION

INITIAL

PLATE FEE

JANUARY

$50

JULY

$25

FEBRUARY

$45.83

AUGUST

$20.83

MARCH

$41.67

SEPTEMBER

$16.67

APRIL

$37.50

OCTOBER

$12.50

MAY

$33.33

NOVEMBER

$8.33

JUNE

$29.17

DECEMBER

$4.17

4-2

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

First plate fees for a two year license:

MONTH OF

APPLICATION

INITIAL

PLATE FEE

MONTH OF

APPLICATION

INITIAL

PLATE FEE

JANUARY

$100

JULY

$75

FEBRUARY

$95.83

AUGUST

$70.83

MARCH

$91.67

SEPTEMBER

$66.67

APRIL

$87.50

OCTOBER

$62.50

MAY

$83.33

NOVEMBER

$58.33

JUNE

$79.17

DECEMBER

$54.17

A dealer may request up to two dealer plates or certificates of number. Additional plates may be

requested based on the number of sales as outlined in Section 3.

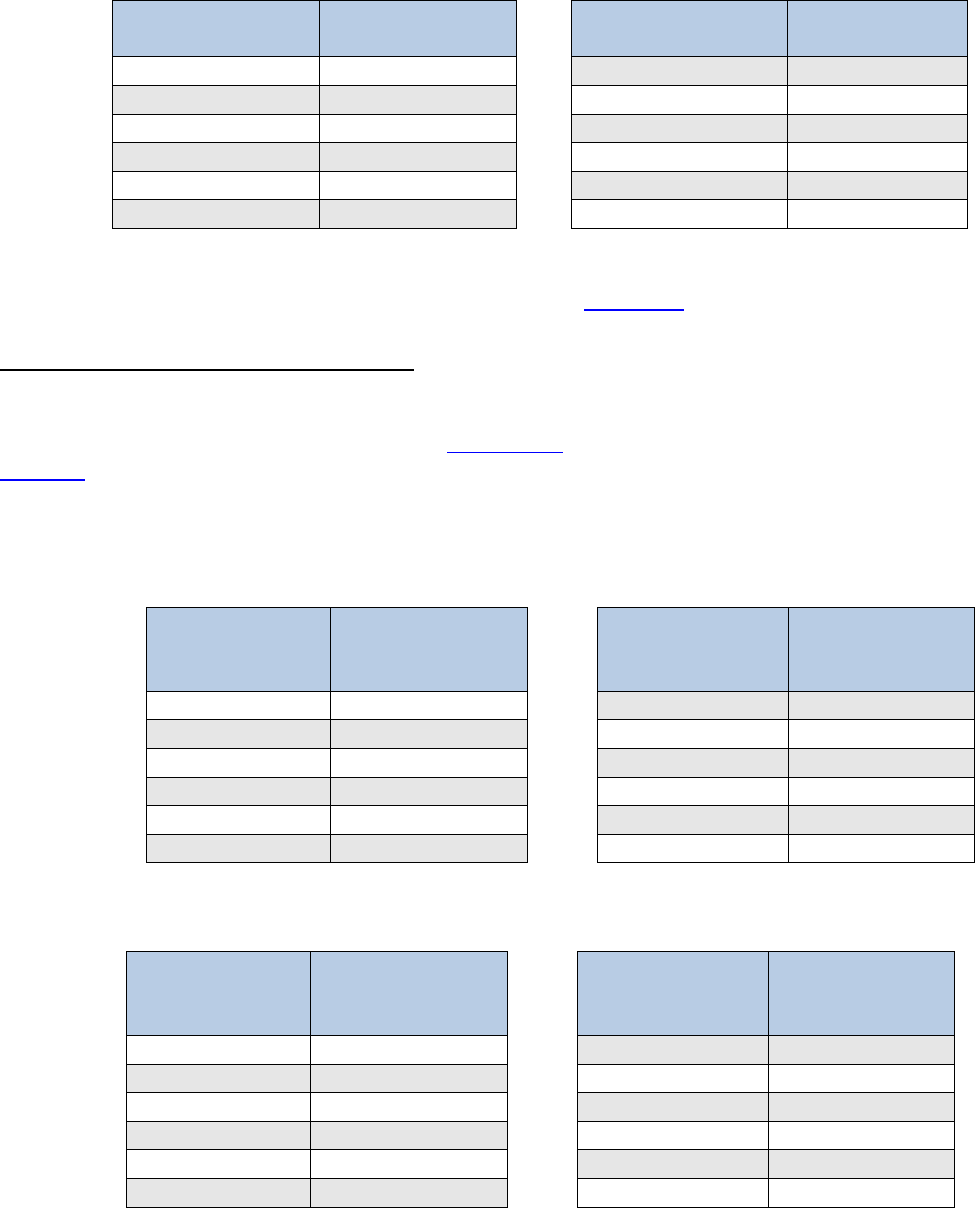

ADDITIONAL DEALER PLATES

If you wish to obtain additional dealer license plates or certificates of number, and have not obtained

the maximum number of plates allowed based on your sales, you must submit an Application for

Replacement or Additional Dealer Plates (Form 5690), or request additional plates through your

MyDMV account.

Additional plates and certificates of number are $10.50, when purchased for a full year. If

purchased after January 31, the fees are prorated. Payment must be submitted with your

application.

Additional plate and certificates of number for a two-year license:

MONTH OF

APPLICATION

EACH

ADDITIONAL

PLATE

MONTH OF

APPLICATION

EACH

ADDITIONAL

PLATE

JANUARY

$21

JULY

$15.75

FEBRUARY

$20.13

AUGUST

$14.88

MARCH

$19.25

SEPTEMBER

$14

APRIL

$18.38

OCTOBER

$13.12

MAY

$17.50

NOVEMBER

$12.25

JUNE

$16.62

DECEMBER

$11.38

MONTH OF

APPLICATION

EACH

ADDITIONAL

PLATE

MONTH OF

APPLICATION

EACH

ADDITIONAL

PLATE

JANUARY

$10.50

JULY

$5.25

FEBRUARY

$9.63

AUGUST

$4.38

MARCH

$8.75

SEPTEMBER

$3.50

APRIL

$7.88

OCTOBER

$2.63

MAY

$7

NOVEMBER

$1.75

JUNE

$6.13

DECEMBER

$0.88

4-3

MISSOURI DEALER AND BUSINESS OPERATING MANUAL

Enclose a check or money order made payable to the Missouri Department of Revenue and mail

to:

Motor Vehicle Bureau

Dealer Licensing Section

PO Box 43

Jefferson City, Missouri 65105-0043

The Missouri Department of Revenue may electronically resubmit checks returned for insufficient or

uncollected funds.

REPLACEMENT DEALER PLATE/CERTIFICATE OF NUMBER

To obtain a replacement dealer plate or certificate of number, you must complete, sign, and notarize

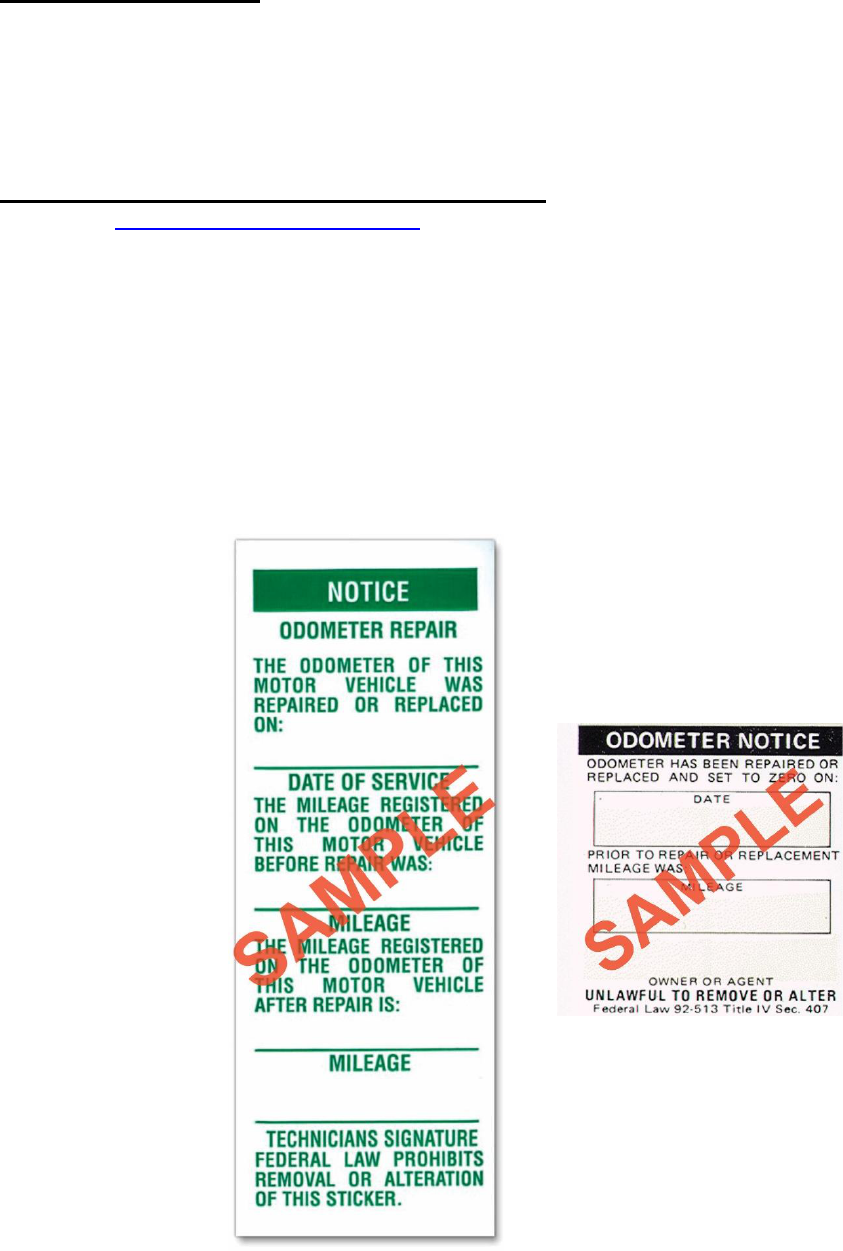

Application for Replacement or Additional Dealer Plates (Form 5690). Submit the application with

$8.50 replacement fee and $6 processing for each replacement requested. If the plate was stolen

and a police report is submitted, the replacement plate fee of $8.50 is not required but you still must

submit $6 processing fee for each plate (do not send cash).

Make check or money order payable to Missouri Department of Revenue. The above items must be

sent to:

Motor Vehicle Bureau

Dealer Licensing Section

PO Box 43

Jefferson City, MO 65105-0043

You must file a report with the local law enforcement authorities or Missouri State Highway Patrol.

DRIVEAWAY PLATES